- There was a sharp jump in the number of institutional investors.

- Fees collected by miners dropped 32% in the week.

In what was a sign of clear bullish sentiment, Bitcoin [BTC] worth nearly $540 million was pulled out of centralized exchanges over the last week. This, according to on-chain analytics firm IntoTheBlock, was the largest weekly net outflow since June 2023.

Typically, spikes in exchange outflows imply a short-term accumulation trend, likely motivated by expectations of higher returns in the future.

The trend also reflected investors’ preference to HODL rather than liquidate their holdings for gains. This was interesting considering that more than 94% of all Bitcoin entities were in profit as of this writing, according to AMBCrypto’s analysis of Glassnode’s data.

What the traders are up to

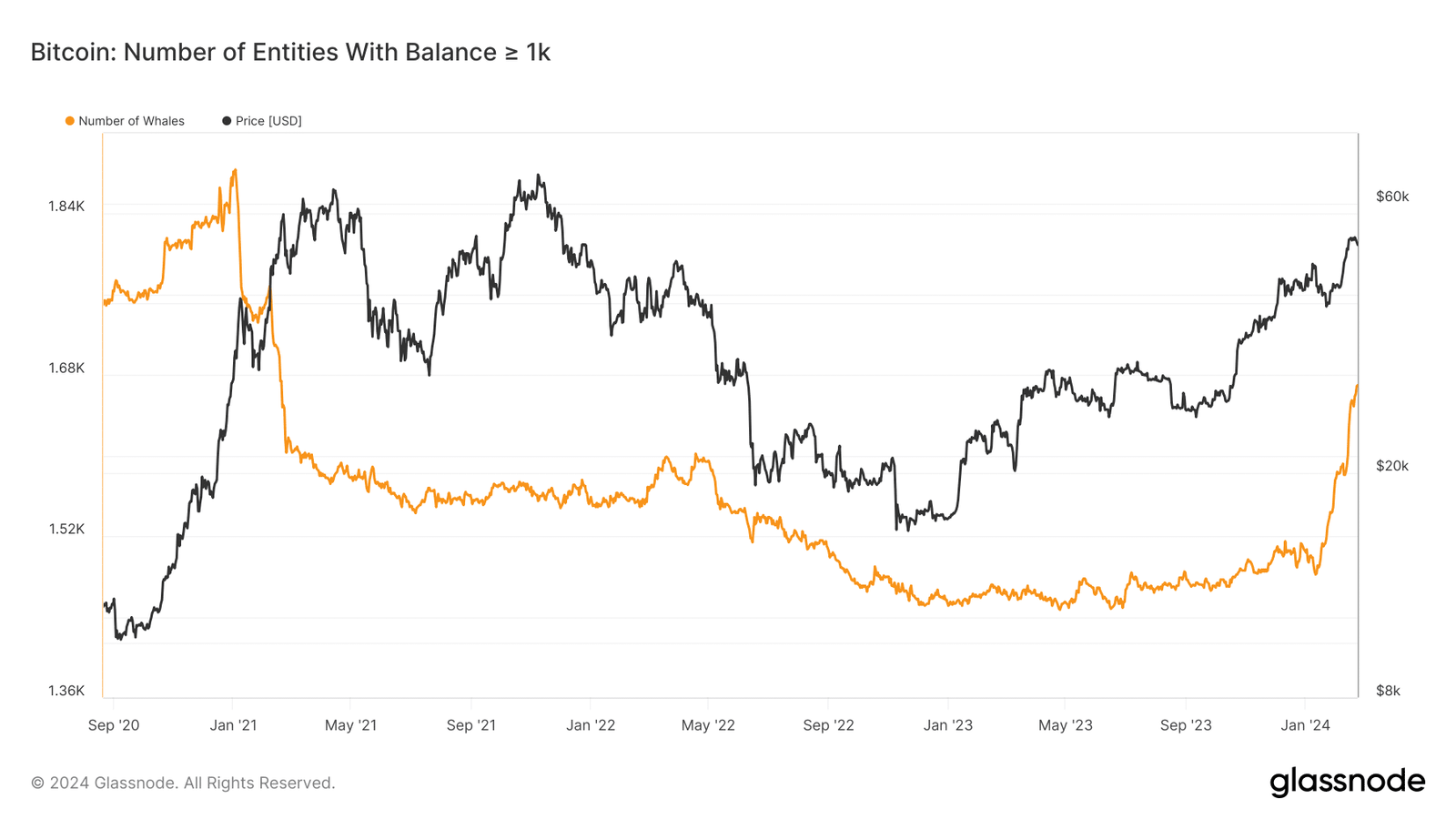

Another telling indicator of a broader market accumulation was the jump in the number of institutional investors.

The number of unique entities holding at least 1k coins reached 1,670 at press time, an increase of 12% over the last month. This figure was also reminiscent of the early bull market period of 2021.

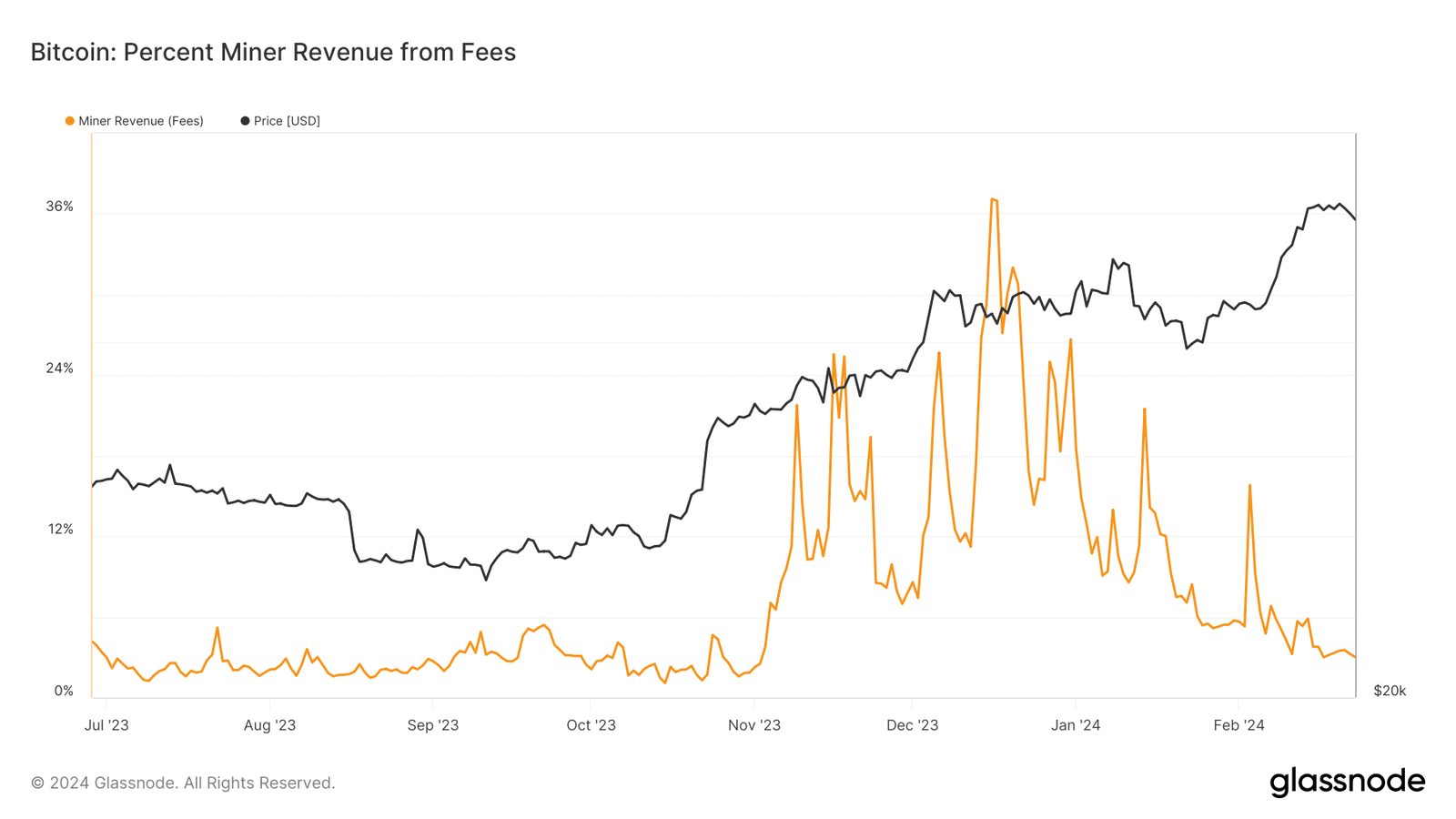

As users focused on accumulation, transaction activity on the network declined. Bitcoin miners collected a little over $11 million in network usage charges in the last week, marking a 32% plunge.

In fact, a closer examination revealed a sharp decline in percentage of miner revenue derived from fees, dropping from 26% at the beginning of the year to 3.23% at press time.

This might not be a happy reading for miners guarding the first-generation blockchain, who will have to deal with a drop in block rewards following next month’s halving.

The king coin has been range bound in the last week, oscillating in a narrow zone between $51k and $52k, according to CoinMarketCap. The sideways movement was another sign that Bitcoin was getting accumulated.

Read BTC’s Price Prediction 2024-25

The market was “extremely greedy” at press time, as per AMBCrypto’s scrutiny of Hyblock Capital movement.

This suggested that more investors were bound to enter the market, eventually leading to an upward breakout.