The US Personal Consumption Expenditure (PCE) Index, the preferred inflation gauge of the US Federal Reserve, rose 2.9% annually and 0.2% monthly last December. So-called Core PCE increased by 0.1% monthly but declined by 3.2% yearly, making for an interesting year ahead for Bitcoin.

Stock futures were slightly lower at the start of the US trading day, while cryptos and Bitcoin remained mostly flat. Before the US inflation news, Bitcoin traded at $41,122.08 and declined marginally before recovering to $41,831.43 at press time.

Why US Inflation is Important to Bitcoin

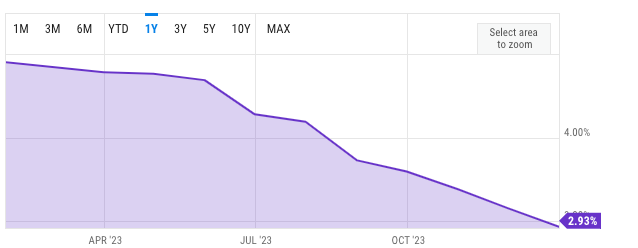

The PCE is still above the 2% target the US Federal Reserve is using to benchmark tightening effects. The central bank has brought the Federal Funds rate to between 5.25 and 5.5% since March 2022, which has seen prices in most sectors cool off significantly, except for shelter.

People sell risky assets when they feel the central bank may induce a recession by tightening fiat currency policies too aggressively. Investors then move to more stable investments like government bonds, which are backed by the government’s full faith. When the bank starts cutting rates, the prices of risky assets like Bitcoin can rise as risk appetite grows.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

The US Treasury plans to announce its borrowing plans for 2024 on Jan. 31, 2024. Higher government borrowing can signal that the government is willing to take on more risk and lower the appeal of government bonds since more debt increases the chances of a default. As a result, some investors could choose Bitcoin.

Why People Will Invest in Bitcoin

The approval of certain exchange-traded funds (ETFs) that track the price of Bitcoin directly means that the asset has a chance to establish itself as a mature investment vehicle. An ETF allows an investor to get direct exposure to BTC price changes without the need to buy Bitcoin directly.

A co-founder of the first gold ETF, Hector McNeil, says a Bitcoin ETF vehicle will increase adoption. He likens it to how a gold ETF removed the hassle of digital asset management but encouraged more people to invest in the asset.

“ETFs are at their most powerful when they give market access to difficult-to-trade asset classes. [ETFs] democratize ownership. Having asset managers like BlackRock and Invesco and Fidelity, that’s a massive stamp of approval.”

Read more: Bitcoin Price Prediction 2024/2025/2030

McNeil expects BTC’s supply constraints to push up the price gradually. Even though most investors do not use it as a currency, Bitcoin is still regarded as a store of value and has technological properties that make it well-suited to function as a currency, he believes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.