-

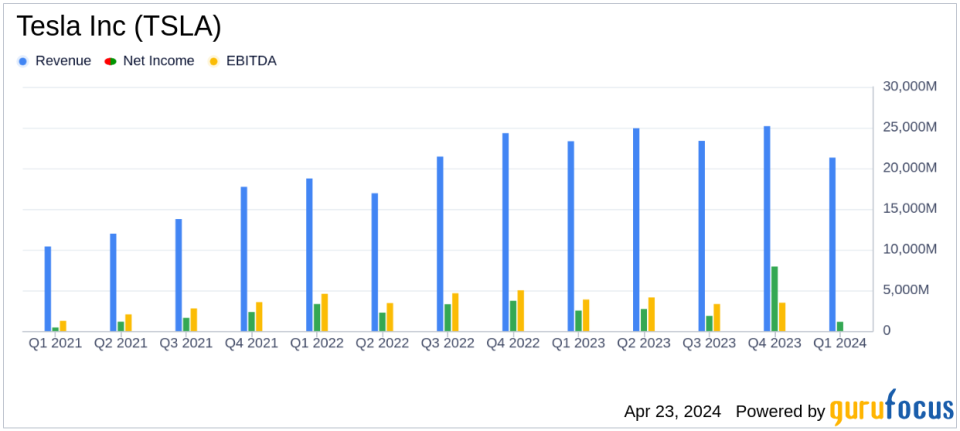

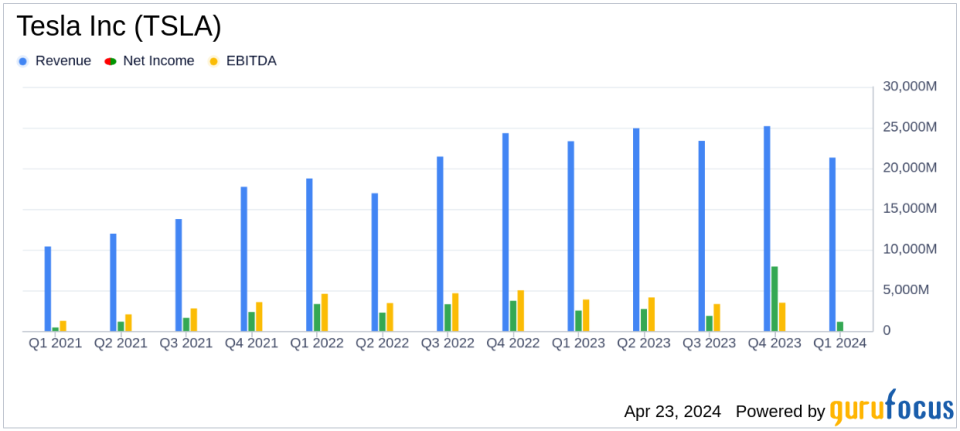

Revenue: Reported at $21.3 billion for Q1 2024, marking a 9% decrease year-over-year, falling short of the estimated $22.34 billion.

-

Net Income: GAAP net income stood at $1.1 billion, below the estimated $1.81 billion, reflecting a 55% decrease from the previous year.

-

Earnings Per Share (EPS): Diluted GAAP EPS was $0.34, significantly below the estimated $0.51.

-

Free Cash Flow: Recorded a negative $2.5 billion, driven by an inventory increase and significant AI infrastructure capital expenditures.

-

Operating Cash Flow: Plummeted by 90% year-over-year to $242 million, indicating a sharp decline in operational efficiency.

-

Gross Margin: Decreased by 199 basis points to 17.4%, impacted by reduced vehicle average selling prices and increased operating expenses.

-

Capital Expenditures: Rose by 34% to $2.77 billion, underscoring continued investment in growth despite financial pressures.

On April 23, 2024, Tesla Inc (NASDAQ:TSLA) released its 8-K filing, detailing the financial outcomes for the first quarter of 2024. The company reported a significant downturn in key financial metrics, notably underperforming against analyst expectations for both earnings per share and revenue. Tesla’s reported earnings per share (EPS) of $0.34 sharply contrasted with the estimated $0.51, while revenue for the quarter stood at $21.3 billion, falling short of the anticipated $22.34 billion.

Company Overview

Founded in 2003 and headquartered in Palo Alto, California, Tesla Inc is a pioneer in the electric vehicle (EV) and sustainable energy industry. The company designs, manufactures, and sells electric vehicles and energy generation and storage systems. In 2023, Tesla’s global vehicle deliveries exceeded 1.8 million units, underscoring its significant role in promoting electric mobility and renewable energy solutions.

Operational and Financial Challenges

During Q1 2024, Tesla faced multiple operational challenges, including geopolitical tensions and production disruptions at its Gigafactory Berlin due to an arson attack. These issues contributed to a 13% year-over-year decrease in total automotive revenues, which stood at $17.38 billion. The company also experienced a decline in vehicle deliveries, exacerbated by production adjustments for the Model 3 at the Fremont factory.

Financial Highlights and Strategic Initiatives

Despite the revenue decline, Tesla continues to invest in growth and innovation, with capital expenditures reaching $2.8 billion in the quarter. The company is focusing on enhancing its AI infrastructure and expanding its product line to include more affordable vehicle models and advanced autonomous driving technologies. Tesla’s commitment to reducing costs and improving operational efficiency was evident in its strategic cost-cutting measures and optimization of production processes.

Detailed Financial Analysis

The financial statements reveal a complex picture of Tesla’s performance. Net income for Q1 2024 was reported at $1.1 billion, a 55% decrease from the previous year. The company’s operating income also declined by 56% year-over-year to $1.17 billion, reflecting increased operational costs and lower vehicle sales. Furthermore, Tesla’s free cash flow was negative $2.5 billion, primarily due to significant investments in AI infrastructure and an increase in inventory levels.

Looking Ahead

Tesla’s outlook for 2024 suggests a cautious approach amid ongoing challenges. The company anticipates lower vehicle volume growth as it prepares to launch new products on its next-generation vehicle platform. However, Tesla expects the growth rates of its energy storage deployments and revenue to outpace its automotive business, highlighting the increasing importance of its energy solutions.

Conclusion

While Tesla Inc (NASDAQ:TSLA) navigates through a period of significant challenges and transitions, its focus on innovation, cost management, and market expansion continues to position it as a key player in the electric vehicle and renewable energy sectors. Investors and stakeholders will be watching closely to see how the company’s strategic initiatives unfold in the coming quarters.

For a deeper dive into Tesla’s Q1 2024 financial details and to stay updated on future performances, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Tesla Inc for further details.

This article first appeared on GuruFocus.