Over the years, PYMNTS Intelligence research reveals, fewer and fewer consumers find themselves with savings enough to fall back on, and they are adjusting their spending habits accordingly.

By the Numbers

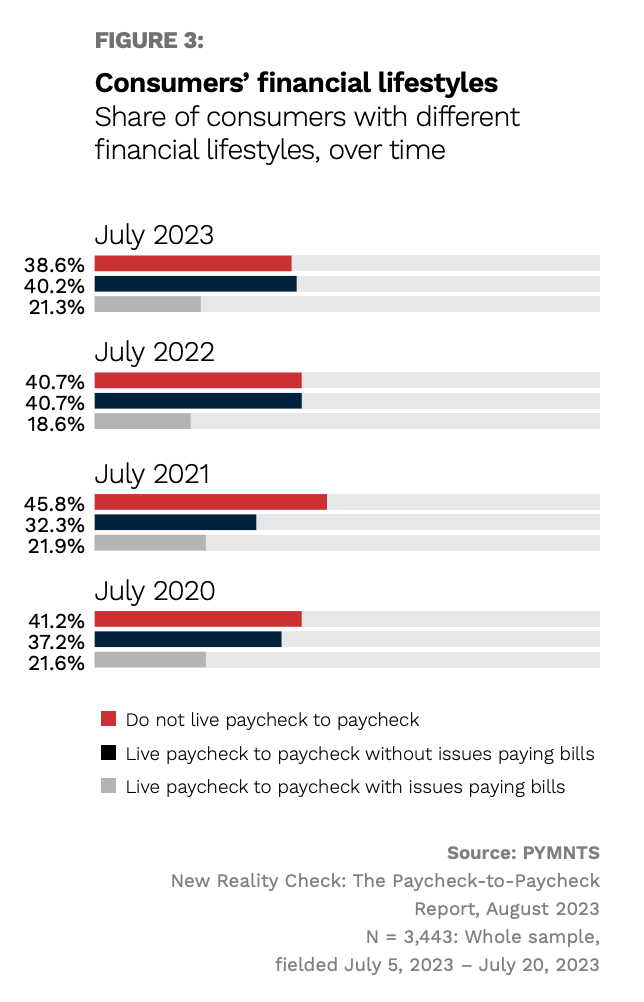

“The Nonessential Spending Deep Dive Edition” of PYMNTS Intelligence’s New Reality Check: The Paycheck-To-Paycheck Report tracked consumers’ financial lifestyles from year to year. As of last summer, the study found, consumers were more financially unstable than in previous years.

The proportion of consumers experiencing financial strain from living paycheck to paycheck witnessed a nearly 3-percentage-point increase year over year. By July, 21% of consumers found themselves in this situation, struggling to meet their financial obligations.

Among low-income consumers, 34% faced challenges in paying bills, marking an increase from 31% in the prior year. Meanwhile, among high-income consumers, the proportion experiencing bill payment struggles rose to 13% from 9% in 2022.

The share of consumers who do not live paycheck to paycheck, meanwhile, fell to 39% last year, down 7 percentage points on a two-year stack from 46% in 2021.

These shifts in the financial circumstances of U.S. households highlight ongoing inflationary pressures. Consequently, consumers are compelled to seek additional means to manage their spending and adhere to their financial constraints.

The Data in Context

It seems that, this coming July, there may be little improvement in consumer spending. Retailers have seen consumers continue to cut back and hold off on major purchases, suggesting that shoppers are not feeling particularly financially secure.

“We missed our sales goal due largely to continued pullback and consumer spending by our core customers, particularly in high-ticket discretionary items,” Bruce Thorn, president and CEO of Big Lots, told analysts on the company’s earnings call Thursday (June 6). “The consumer environment softened in the first quarter, as both consumer confidence and sentiment declined due to concerns about inflation, unemployment and interest rates.”

Similarly, Victoria’s Secret noted on its own call with analysts Thursday that the “retail environment in North America was challenging,” with shoppers demanding more discounts, creating a “promotional environment” that was “very competitive,” per CEO Martin Waters.