(Bloomberg) — European stocks paused back as investors awaited fresh catalysts after last week’s push close to a record high. US markets are shut for the Presidents’ Day holiday.

Most Read from Bloomberg

The Stoxx Europe 600 was little changed following the previous week’s 1.4% surge that took the gauge to within four points of its January 2021 high. The technology sub-index was the biggest loser, falling 1% amid a growing conviction that central banks will be cautious in lowering interest rates.

Among individual movers, AstraZeneca PLc climbed more than 3% after trial data showed its blockbuster drug Tagrisso slowed disease progression in patients with advanced lung cancer. German arms manufacturer Rheinmetall AG advanced as much as 4% after announcing it will open a new plant in Ukraine to produce artillery ammunition with a local joint venture partner.

US and global stocks are yet to respond to the selloff in Treasuries this month. This comes after a string of better-than-expected economic data and hawkish comments by policy makers drove traders to roll back aggressive bets on rate cuts. Swaps are now pricing about 90 basis points of Federal Reserve rate cuts in 2024 — from more than 150 basis points at the start of February. In Europe, wagers have been whittled down to about 100 basis points, from 150.

Meanwhile, investors and companies are flagging that the war in the Middle East and Red Sea shipping chaos poses a major risk for earnings.

“Our base case remains that equities will end the year higher than current levels, but we do not expect it to be a straight path,” said Mohit Kumar, the chief economist for Europe at Jefferies INternational Ltd. “We are looking for a bit of a pull-back in the near term, which would provide better levels to reset long positions.”

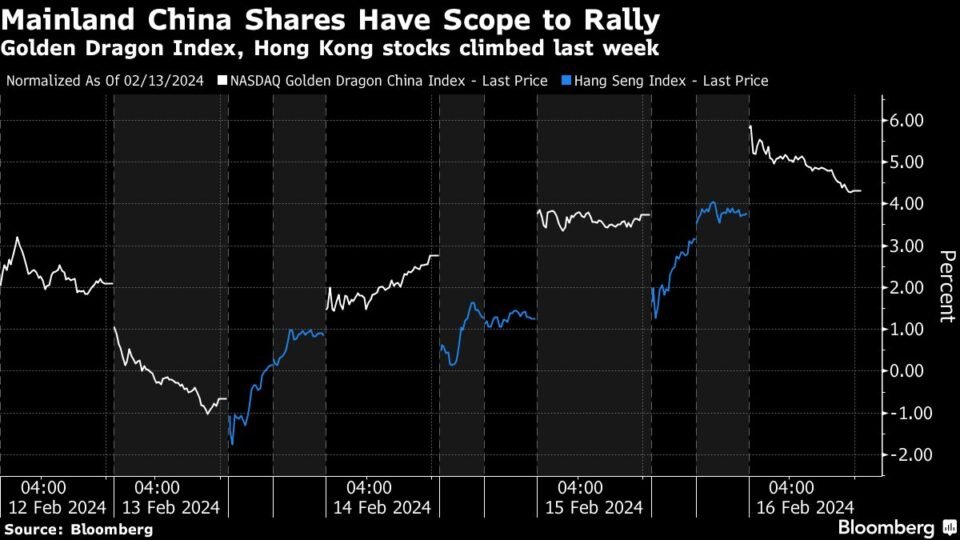

A gauge of Asia Pacific shares ticked upwards and was set to climb for a third session. China mainland benchmark CSI 300 Index rebounded from earlier losses in the first day of trading after the Lunar New Year break, while Chinese shares in Hong Kong remained on the back foot. The stocks had struggled in the early hours despite buoyant travel and tourism data that suggested consumption revved up even as the broader economy struggles with deflation and a property crisis.

Traders are now looking for further policy support across China’s monetary and fiscal space, in addition to a cut in the reserve requirement ratio already undertaken. Chinese Premier Li Qiang on Sunday called for “pragmatic and forceful” action to boost the nation’s confidence in the economy.

“For the Hang Seng China Enterprises Index, I think it’s normal to see a pull back after three consecutive sessions of gains, and there is some profit taking in Hong Kong market today,” said Dickie Wong, executive director of research at Kingston Securities Ltd. “The next thing to watch is a potential lowering of the five-year loan prime rate,” Wong added, referring to China’s reference rate for mortgages with data set to come out on Tuesday.

Elsewhere, Japan’s Tokyo Stock Price Index rose, with bank shares leading the gains. The Nikkei-225 Stock Average was little changed with the index remaining near its record close in 1989. Contracts for Europe equities fell, but those for the US climbed marginally higher after the S&P 500 Index dropped 0.5% on Friday on signs that inflation in the US is “stickier” than expected.

There was no cash trading of Treasuries in Asia due to the US holiday. They fell on Friday, with two-year yields up seven basis points to 4.65% after the producer price index rose on a sizable jump in costs of services.

The yen strengthened to around 150 per dollar with the greenback weakening against most of its Group-of-10 peers. The yuan was little changed after the People’s Bank of China on Sunday held the interest rate on its one-year policy loans at 2.5% while injecting a small amount of cash into the financial system.

In commodities, oil slid from the highest level in three weeks as lingering concerns over the demand outlook offset ongoing Middle East tensions. Gold held a two-day gain. Concerns over China’s economy also led iron ore to tumble after five days of gains.

For JPMorgan Asset Management, US stocks are priced for perfection amid “healthier” market momentum since the beginning of the year.

“Markets have adjusted to the idea that rate cuts would come later and probably be less important than what was originally priced,” Vincent Juvyns, global market strategist, said on Bloomberg Television. The move upward are also “really driven by decent earnings growth that we have seen during the fourth quarter,” he added.

This week, traders will be keeping an eye on European inflation data as well as earnings from Nvidia Corp. and mining giants BHP Group Ltd and Rio Tinto Plc to help gauge the health of the global economy. Meantime, conflict in the Middle East is set to drag on as negotiations aimed at securing an Israel-Hamas cease-fire and the release of hostages haven’t progressed as hoped, Qatar’s foreign minister said.

Some of the key events this week:

-

Reserve Bank of Australia Feb. meeting minutes, Tuesday

-

China loan prime rates, Tuesday

-

BHP Group Ltd earnings, Tuesday

-

European Central Bank publishes euro-area indicator of negotiated wage rates, Tuesday

-

Rio Tinto Plc earnings, Wednesday

-

Eurozone consumer confidence, Wednesday

-

Nvidia Corp earnings, Wednesday

-

Federal Reserve Jan. meeting minutes, Wednesday

-

Atlanta Fed President Raphael Bostic speaks, Wednesday

-

Eurozone CPI, PMI, Thursday

-

European Central Bank issues account of Jan. 25 meeting, Thursday

-

Fed Governor Lisa Cook, Minneapolis Fed President Neel Kashkar speak, Thursday

-

China property prices, Friday

-

European Central Bank executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 was little changed as of 8:19 a.m. London time

-

The MSCI Asia Pacific Index rose 0.2%

-

The MSCI Emerging Markets Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0784

-

The Japanese yen rose 0.2% to 149.94 per dollar

-

The offshore yuan was little changed at 7.2109 per dollar

-

The British pound rose 0.2% to $1.2625

Cryptocurrencies

-

Bitcoin rose 0.8% to $52,303.73

-

Ether rose 2.5% to $2,917.79

Bonds

Commodities

Coming soon: Sign up for Hong Kong Edition to get an insider’s guide to the money and people shaking up the Asian finance hub.

-

Brent crude fell 0.7% to $82.87 a barrel

-

Spot gold rose 0.4% to $2,020.89 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Charlotte Yang.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.