Personal finance classes have become a requirement for high school graduation in dozens of states in the past few years, sparking hope for activists that financial literacy is finally receiving the support it deserves.

A tracker from Next Gen Personal Finance shows that in 2020, only eight states had a stand-alone personal finance course available for all high schoolers. This year, 25 states will offer a financial literacy class in K-12. Eight of those states have fully implemented the class, while 17 are still in progress.

“All of a sudden, it does seem like states are sitting up and taking notice, and it’s really just happened in the past couple of years,” said Jessica Pelletier, executive director of FitMoney.

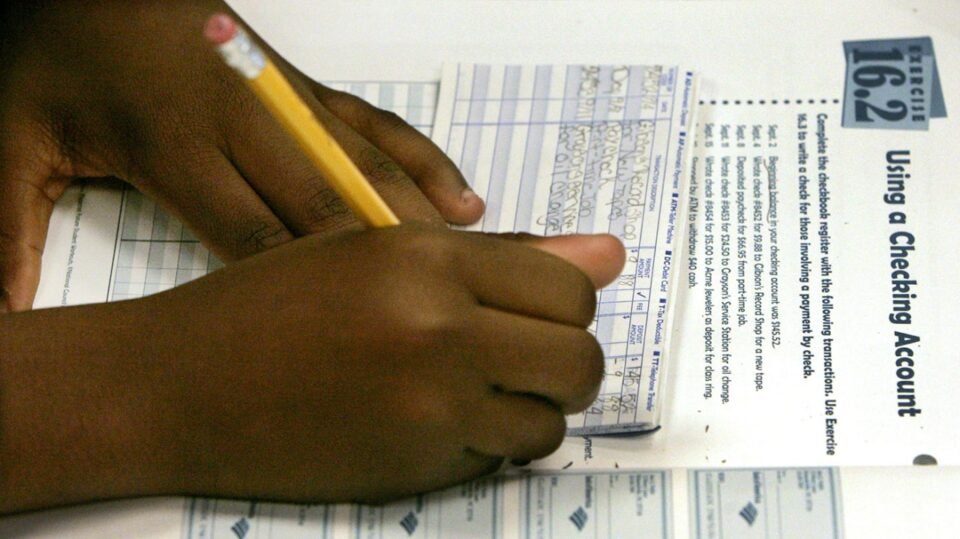

Experts say these classes are about more than writing checks and, despite COVID-19 giving a boost to the cause, that they will continue to grow for high schoolers — and potentially middle school.

Pelletier speculated the pandemic produced some urgency for educators and parents on financial literacy as the economy plummeted and households struggled with finances.

“I think those two things combined really made parents and educators together become a very cohesive voice for financial literacy, and so legislators are taking notice [of] what they’re hearing from their constituents, that this is what they want,” she said.

Lindsay Torrico, executive director of the American Bankers Association (ABA) Foundation, said they have doubled the number of individuals they have reached through financial education resources and programs since 2019.

“Last year, we launched a new effort in a new commitment to engage more banks in financial education. We have a new commitment for banks to sign on to with a goal to reach 5 million people with financial education in the next three years,” Torrico said. “And the response has been overwhelmingly positive. In that effort, we have about 816 banks that have signed on in about a year, and collectively we’re reaching 1.23 million people through financial education services and resources.”

Financial literacy has been steadily growing in schools in the past two decades, according to Laura Levine, president and CEO of Jump$tart Coalition for Personal Financial Literacy, with the topic naturally getting a boost during periods of economic instability, such as during the 2008 recession and the 2020 pandemic.

She said the coalition has had a “National Standards for Personal Finance Education” guide since 1999. The most recent version hits on six topics: earning income, spending, saving, investing, managing credit and managing risk.

In school financial literacy lessons, Levine said, “We’re seeing if you look at the standard, it covers investing, insurance, savings, spending, budgeting, you know, it’s kind of a full spectrum.”

This includes K-12 schools in states with or without a requirement for finance education classes, with much of the movement coming from a voluntary interest in the topic.

While legislative efforts are welcomed, many schools are beginning to recognize that relying on financial education at home is not feasible for many students who need it.

“Some kids don’t have families, you know, foster kids […] or maybe your family is less advantaged and your parents don’t know that much about the financial system,” Levine said.

Not only are the financial education courses becoming more comprehensive, but activists are also aiming for them to start earlier.

The ABA Foundation has a program that directly targets kindergarten through eighth grade, where bankers go into elementary classrooms with PowerPoint presentations and lessons.

“This program is actively being used by close to 1,000 banks at this time, where different unique banks are using our materials to access kids those ages and try to push forward financial literacy, despite the fact that many states still do not have legislation supporting financial literacy in it. So the communities have taken it upon themselves to really step up and help out as much as they can with having bankers go into these classrooms and get these kids on the path to financial understanding,” said Kelsey Havemann, senior manager of the ABA Foundation’s youth financial education program.

The push for more financial literacy largely revolves around convincing adults to bring in the material, as experts say children are eager to dive in.

“This is one of the only classes I’ve really heard of that almost every single student wants to take. You know the old adage, ‘When am I ever going to need this?’ … Every student recognizes very quickly, when they’re learning about budgets and credit scores and insurance, they all say, ‘Oh, OK, I get it. I absolutely will need all of this information when I am an adult,’” Pelletier said. “And so, it’s a very easy sell, so to speak, when you’re talking to students.”

Copyright 2024 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.