-

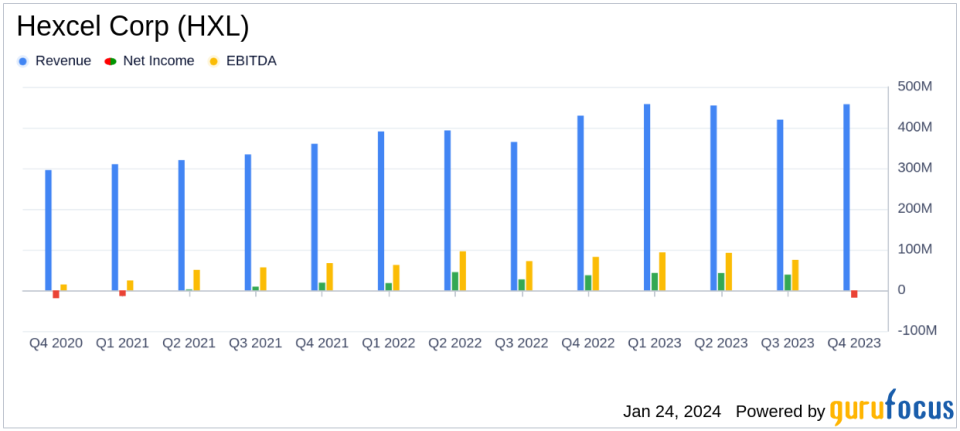

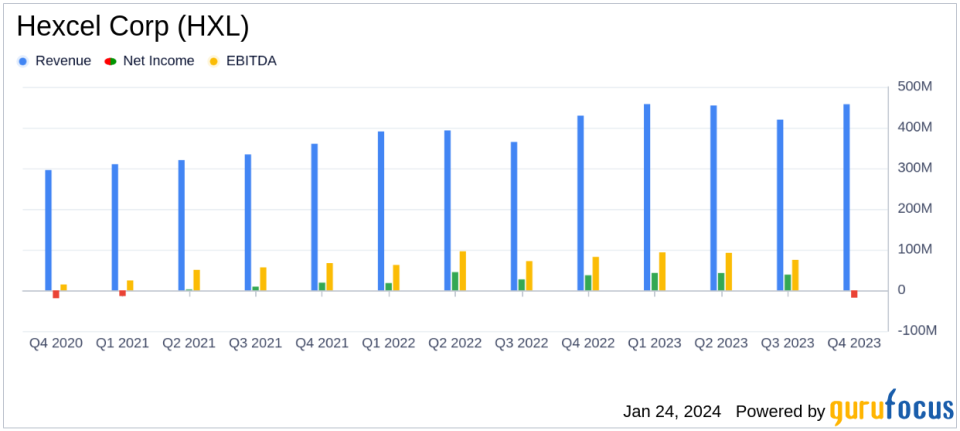

Revenue Growth: FY 2023 sales increased by 13.4% to $1,789 million from $1,578 million in FY 2022.

-

Adjusted Earnings: Q4 2023 adjusted diluted EPS rose to $0.43 from $0.40 in Q4 2022, with FY 2023 adjusted diluted EPS up 41.4% to $1.81.

-

Net Income Fluctuation: Q4 2023 GAAP diluted EPS was $(0.21), impacted by a non-cash pension charge, down from $0.43 in Q4 2022.

-

Free Cash Flow: FY 2023 free cash flow was robust at $149 million, including a $7.5 million cash dividend from a joint venture.

-

Dividend Increase: Quarterly dividend raised by 20% to $0.15 per share.

-

Strategic Divestiture: Sold 50% interest in Boeing/Hexcel 50:50 ACM JV to Boeing in Q4 2023.

-

2024 Outlook: Anticipates double-digit sales growth with sales forecasted between $1.925 billion to $2.025 billion and adjusted EPS of $2.10 to $2.30.

On January 24, 2024, Hexcel Corp (NYSE:HXL) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a global leader in advanced lightweight composites technology, reported a year of strategic maneuvers, including a pension plan buy-out and the divestiture of its joint venture interest, which influenced its financial outcomes.

Founded in 1948, Hexcel designs and manufactures high-performance composite materials for commercial aerospace, defense, and industrial markets. Its products, known for their light weight and rigidity, are integral to various aircraft components and subassemblies. Airbus and Boeing are among Hexcel’s largest customers, highlighting the company’s significance in the Aerospace & Defense industry.

Financial Performance and Challenges

Hexcel’s 2023 fiscal year was marked by a 13.4% increase in sales, reaching $1,789 million, compared to $1,578 million in the previous year. The adjusted diluted EPS for FY 2023 grew significantly by 41.4% to $1.81. However, the company faced a setback in Q4 2023, with a GAAP diluted EPS of $(0.21), primarily due to a non-cash charge of $70.5 million related to the strategic buy-out of its UK defined benefit pension plan. Despite this, the adjusted diluted EPS for Q4 2023 increased to $0.43 from $0.40 in Q4 2022.

The challenges faced by Hexcel, including the pension plan buy-out and the sale of its interest in the Aerospace Composites Malaysia joint venture, reflect the company’s proactive approach to managing its long-term liabilities and focusing on core operations. These strategic decisions, while impacting short-term earnings, are intended to strengthen Hexcel’s financial position and operational readiness for future growth.

Key Financial Metrics

Hexcel’s financial achievements in 2023, including a robust free cash flow of $149 million and a 20% increase in its quarterly dividend, underscore the company’s commitment to generating shareholder value and maintaining a strong cash position. These achievements are particularly important in the Aerospace & Defense industry, where long-term contracts and capital-intensive projects necessitate a solid financial foundation.

Important metrics from the financial statements include:

|

Financial Metric |

2023 |

2022 |

% Change |

|---|---|---|---|

|

Net Sales |

$1,789.0 million |

$1,577.7 million |

13.4% |

|

Operating Income |

$215.3 million |

$175.2 million |

22.9% |

|

Net Income |

$105.7 million |

$126.3 million |

(16.3%) |

|

Adjusted Net Income |

$154.8 million |

$108.8 million |

42.3% |

|

Free Cash Flow |

$148.9 million |

$96.8 million |

53.8% |

These metrics are crucial as they reflect the company’s operational efficiency, profitability, and liquidity, all of which are vital for sustaining growth and competitiveness in the market.

Management Commentary

Chairman, CEO, and President Nick Stanage commented on the company’s performance, highlighting the 17% growth in both the Commercial Aerospace and Space & Defense markets. He emphasized the company’s focus on operational readiness for expected growth, despite some near-term margin pressure. CFO Patrick Winterlich noted the strategic pension plan transfer, which removed future liabilities for the company.

“Based on record commercial aircraft backlogs and our customers anticipated build rate ramp, we expect double digit sales growth again in 2024. Operational margins are expected to continue to grow as the business benefits from increased operating leverage and enhanced productivity, supporting another year of strong EPS growth forecasted in 2024.” – Nick Stanage, Chairman, CEO, and President of Hexcel Corp.

Looking Ahead

For 2024, Hexcel anticipates continued sales growth and operational margin expansion, with a forecast of sales between $1.925 billion to $2.025 billion and adjusted diluted EPS of $2.

Explore the complete 8-K earnings release (here) from Hexcel Corp for further details.

This article first appeared on GuruFocus.