In this environment, which appears chronically vulnerable to shocks, investors have come to expect constant central bank bailouts, a morally hazardous inducement to more risk-taking and debt accumulation.

Each one of these market disruptions can be explained as the product of particular circumstances. Yet, they all reflect profound long-run changes in the role and structure of the world’s financial system.

In the immediate postwar period, the central task of this system was simple. The household sector in the developed world saved for precautionary reasons and for retirement. It passed those savings, via the banking system and the capital markets, to governments to fund budget deficits and to the corporate sector to finance working capital and investment.

Not so today. A combination of globalisation, surging debt, and changes in industrial structure have reduced the capital intensity of corporate sectors in advanced economies. The old financial certainties are vanishing, and new ones are yet to replace them.

A vitally important part of this evolution has been the growing dependence of many developed countries, including the US and UK, on debt to drive economic growth. According to the IMF, debt in the 39 economies it terms “advanced” rose from 110 per cent of gross domestic product in the 1950s to 278 per cent in 2022.

The rise was substantially financed from the 1980s by emerging Asian countries, most notably China, that ran undervalued exchange rates to facilitate export-led growth. The resulting trade surpluses, combined with under-developed banking systems and poor welfare provision in those countries, led to huge surpluses of national savings over investment.

Contrary to the pattern established by Britain in the late 19th century, when the British exported large sums of capital to mainly newly settled, low-income countries, funds flowed from the Asian poor to the rich West. This Asian savings glut was then supplemented by Japan, where an ageing population meant lower investment opportunities and higher savings as Baby Boomers approached retirement.

The global labour market shock arising from China and other developing countries joining the international trading system partly led to the global corporate sector transforming from a net borrower to a net saver. Bloomberg

Before the 2007-08 financial crisis, the glut of imported savings contributed to low interest rates and a credit bubble that financed real estate booms in the US and elsewhere. When they turned to busts, those savings were directed into government and non-financial corporate debt instead.

The financial markets facilitated a huge recycling operation to address these imbalances, with the debt instruments ending up financing household consumption via the banking system and investments in securitised mortgages.

While the Asian dimension of this glut has attracted most attention, excess savings have been a much wider phenomenon. In a paper for the National Bureau of Economic Research, Peter Chen and colleagues have shown that from the early 1980s, investment across the world went from being funded mostly by household saving to being nearly two-thirds funded by corporate saving, derived from operating cash flow exceeding capital investment.

The global labour market shock arising from China and other developing countries joining the international trading system had led to lower labour costs and higher corporate profit margins. Financing costs and corporate taxes fell, while dividends did not rise as rapidly as profits. The global corporate sector was thus transformed from a net borrower to a net saver.

The most conspicuous cash hoarders today are the so-called Magnificent Seven US technology giants that have driven the rise in US equities over the past year or so – Amazon, Alphabet, Nvidia, Tesla, Meta, Apple and Microsoft. Their savings in 2023 are reckoned to have exceeded $US300 billion ($466 billion).

The ultimate owners of these savings are the rich households that, directly or indirectly, hold shares in such companies. The share of disposable income going to the wealthy has been rising consistently since 1980, increasing inequality within many of the world’s largest countries.

Since the rich save more of their income, inequality has led to the accumulation of a large savings surplus among wealthy individuals, which has risen in tandem with corporate earnings.

Economists Atif Mian, Ludwig Straub and Amir Sufi calculate that the rise in savings of the rich has matched the excess savings entering the US from abroad. These funds went into US government IOUs – so-called safe assets – and into lending via the banking system and capital markets to American households.

The combination of global financial imbalances and ultra-loose monetary policy after the financial crisis resulted in a turbocharged debt surge. From the mid-2000s to 2022, public debt in the advanced economies rose from 76.8 per cent to 113.5 per cent of GDP, reflecting not only the hefty interventions necessitated by that crisis and the COVID-19 pandemic, but also the ease of debt service when tax revenues fuelled by economic growth exceeded low government financing costs. Such debt levels have not hitherto been seen outside wartime.

It was a similar story among non-financial corporations, where outstanding bonds reached a record $US16.6 trillion in 2021, more than double the amount in 2008. The US accounted for 40 per cent of total issuance over that period.

As Michael Howell, of Cross Border Capital, has put it: “With vast and visible stockpiles of past capital accumulation, modern capitalism has to operate a huge refinancing system.”

Its chief purpose is to refinance the debt that has kept economic growth going, rather than raising fresh capital. Howell notes that shadow banks are typically involved in two-thirds of this refunding.

At the same time, developed world equity issuance has plunged, and what remains of it has shifted eastward. In the 1990s, European non-financial companies accounted for 41 per cent of all capital raised via initial public offerings, with more than 3500 listings during the period. Yet, they raised only 19 per cent between 2012 and 2022 – a far greater drop than for the US.

European policymakers worry that domestic equity markets have failed in promoting economic growth. But the numbers tell a story about the polarisation of global industry and a shift to Asia, where investment still largely goes into capital-hungry physical plant and machinery rather than the human capital and other intangible assets that dominate Western companies’ funding requirements.

Another reason for declining IPOs is that many private equity firms overpaid for acquisitions during the period of ultra-low interest rates. They are sitting on $US3.2 trillion of unsold assets that they are reluctant to sell back to public markets until stock prices rise sufficiently to minimise losses or generate a profit.

Alongside providing exit routes for private owners, the main primary financing role of the global equity market is now to provide fresh capital to bolster corporate solvency in times of stress.

In 2009, for example, after the financial crisis, quoted non-financial companies raised a record $US511 billion in new equity through the sharemarket. The pattern was repeated during the 2020 pandemic when the market raised $US626 billion of new equity for listed non-financial companies.

What dangers does this complex, debt-laden financial landscape pose for the economy and financial stability? Clearly, debt accumulation in excess of national income growth cannot continue forever and raises questions about debt sustainability.

Among the prerequisites for sovereign debt reduction are economic growth, relatively low interest rates, and primary budget surpluses excluding interest costs. Few of the major economies exhibit all of these.

The trouble with debt that has been used to finance consumption is that borrowers have to cut consumption to repay their lenders. This depresses aggregate demand because those savers are reluctant to spend the repaid funds on consumption.

That feeds into an already depressed growth picture. The IMF projects that growth five years ahead is set to fall to the lowest level in decades because of mediocre productivity growth, weaker demographics, feeble investment levels, and continued scarring from the pandemic.

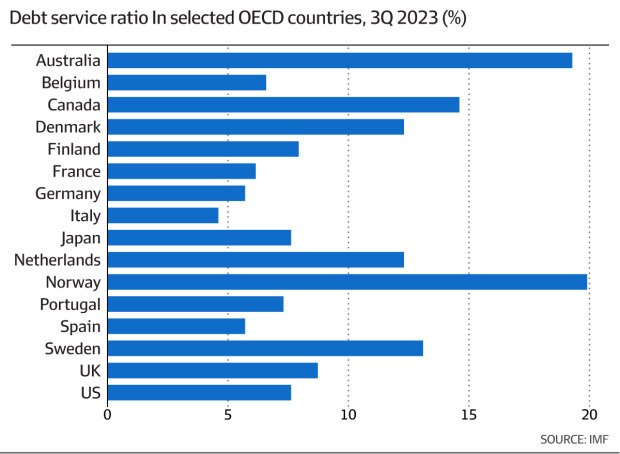

Additionally, governments are under intense pressure both to raise public spending and cut taxes. It is an increasingly unrealistic expectation; since the return of inflation, the biggest rise in interest rates in decades has intensified the burden of debt service.

As for financial stability, Atif Mian points out that an economy reliant on a constant supply of new debt to generate demand is always susceptible to disruptions in financial markets. That implies no escape from central banks having to provide an ever-ready backstop, derisking public markets while taking on more risk to their own balance sheets.

All of this may call for a wider rethinking of the nature of risk in financial markets. Economists and actuaries have long referred to sovereign bonds as “safe” assets that deliver a risk-free return. Many also claim that bonds provide insurance against the volatility of “risky” equities.

To be regarded as genuinely risk-free, a sovereign bond should, at a minimum, offer negligible default risk and the backing of a fiscally conservative government. Historically, such credentials have been lacking, and inflation has made a nonsense of safety. Investors in gilts during the inflationary period from 1972 to 1974, for example, lost half their real wealth.

In the UBS Global Investment Returns Yearbook, academics Elroy Dimson, Paul Marsh and Mike Staunton show that bond market drawdowns – peak to trough falls – have historically been larger and/or longer than for equities. They bluntly conclude that bonds are not “safe” assets.

They also point out that while the negative correlations between stocks and bonds since the late 1990s have made the two assets a hedge for each other, this period was the exception, not the rule. It was essentially the product of freakishly loose monetary policy and very low inflation.

The issues of rising default risk, fiscal profligacy and high volatility raise particular questions for the US, which accounts for 44 per cent of the value of the global sovereign bond market. It also manages the world’s pre-eminent reserve currency and is the provider-in-chief of “safe” assets to risk-averse global investors.

Those investors cannot escape the growing reality of burgeoning fiscal deficits and debt, first under the Trump administration and now under President Joe Biden. The US Treasury itself has declared the public debt burden unsustainable, and constant partisan battles on Capitol Hill over the government’s debt ceiling have brought the US dangerously close to default.

Could the mighty dollar also be dethroned? Such predictions go back a long way and have always proved wrong because those countries that offer genuinely safe assets, notably Germany and the Nordic states in Europe, can only provide enough of them to satisfy a small fraction of global demand.

Even with its chaotic politics, growing fiscal fragility and increasingly turbulent public debt markets, there remains no realistic alternative to US financial hegemony.

All of which suggests the Federal Reserve will need to continue backstopping the Treasury market and the banking system. With the US and many others responding to debt-dependent growth by applying short-term fiscal and monetary remedies rather than structural reforms, the financial system will continue to act as a gigantic sticking plaster to address endemic imbalances and periodic crises.

Financial Times