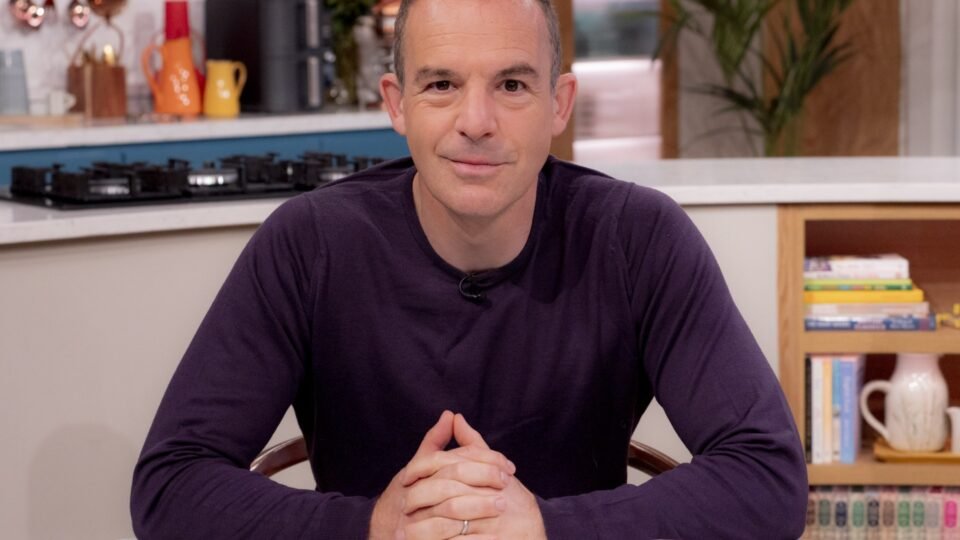

MARTIN Lewis has warned that the “clock is ticking” for Brits affected by the car finance scandal to claim their money back.

Drivers could be owed thousands if they are one of the millions who are believed to have been charged hidden fees on their car loans without even realising.

The Financial Conduct Authority (FCA) is looking into the use of discretionary commission arrangements (DCAs) by brokers up to 2021.

The watchdog is expected to issue its report on September 25 but there is plenty to do before then, according to Martin.

The Money Saving Expert has, as ever, been campaigning tirelessly to help get consumers a fair deal.

Now, he has issued his latest update on the case – including the necessary next steps.

In his weekly newsletter, he revealed that a whopping 74% of people who use the free tool on his website to help draft their complaint had been told by their broker that they had been affected by a DCA.

What is the FCA investigating and who is eligible for compensation?

By Jacob Jaffa

What is being investigated?

The FCA announced in January that it would investigate allegations of “widespread misconduct” related to discretionary commission agreements (DCAs) on car loans.

When you buy a car on finance, you are effectively loaned the value of the car while you pay it off.

These loans have interest payments charged on top of them and are often organised on behalf of lenders by brokers – usually the finance arm of a dealership.

These brokers earn money in the form of commission – a percentage of the interest payments on the loan.

DCAs allowed brokers to, to a certain extent, increase the interest rate on a loan, which in turn increased the amount of commission they received.

The practice was banned by the FCA in 2021.

Who is eligible for compensation?

The FCA estimates that around 40% of car deals may have been affected before 2021.

There are two criteria you must meet to have a chance at receiving compensation.

First, you must be complaining in relation to a finance deal on a motor vehicle (including cars, vans, motorbikes and motorhomes) that was agreed before January 28 2021.

Second, you must have bought the vehicle through a mechanism like Personal Contract Purchase (PCP) or Hire Purchase (HP), which make up the majority of finance deals and mean you own the vehicle at the end of the agreement.

Drivers who leased a car through something like a Personal Contract Hire, where you give the car back at the end of the lease, are not eligible.

You can check whether you might be owed money and submit a complaint using Martin Lewis’ free tool here.

He advised anyone who suspects they might have fallen victim to the scheme but who has not yet submitted a complaint to do so now.

The FCA has “suspended” the deadline for firms to give a reply until after its report is published but lodging after that date anyone who lodged their query now will receive a reply telling them whether or not they had a DCA in place.

Likewise, if you have made your complaint and been told you did have a DCA you just have to “sit back” and wait until a compensation scheme is announced.

However, some complainants have only received a response acknowledging their query and not informing them either way about a DCA.

In this case, Martin recommended chasing up to try and get answers but added: “Crucially it means your complaint is logged.”

The only outlier is when firm’s respond to say that you were subject to a DCA but that your complaint has been rejected.

Martin explained: “This is rare, but does happen. In fact most important is your provider’s confirmed you’ve had a DCA and has logged your complaint.

“The rest is just a fob-off, as until 25 Sept when the FCA reports, no one knows exactly what’ll count as mis-selling.

“If yours then does, it’ll almost certainly have to reopen it.

“As an aside, the Financial Ombudsman has now effectively suspended dealing with these DCA complaints until after 25 Sept.

“Yet that’s no issue as for all those who complained via the tool, you’ve 15 months to decide whether to go to it, so it’s a wait and see.”

It comes after the lawyer who helped kick off the FCA investigation dubbed the scandal to “next PPI” in an exclusive interview with SunMotors and estimated that the total compensation payout will reach into the “billions”.