-

Net Income: Reported at $338 million, up 14% from $297 million in the prior year quarter, below the estimated $375.21 million.

-

Earnings Per Share (EPS): Achieved $1.24, below the estimated $1.40.

-

Revenue: Net investment income rose to $609 million, contributing to overall strong financial performance.

-

P&C Core Income: Increased to $372 million from $346 million, driven by higher investment income and favorable net prior year development.

-

Combined Ratio: Slightly deteriorated to 94.6% from 93.9% last year, influenced by higher catastrophe losses.

-

Dividends: Declared a regular quarterly cash dividend of $0.44 per share, maintaining shareholder returns.

-

Book Value Per Share: Excluding AOCI, increased by 2% to $45.10, adjusting for dividends of $2.44 per share.

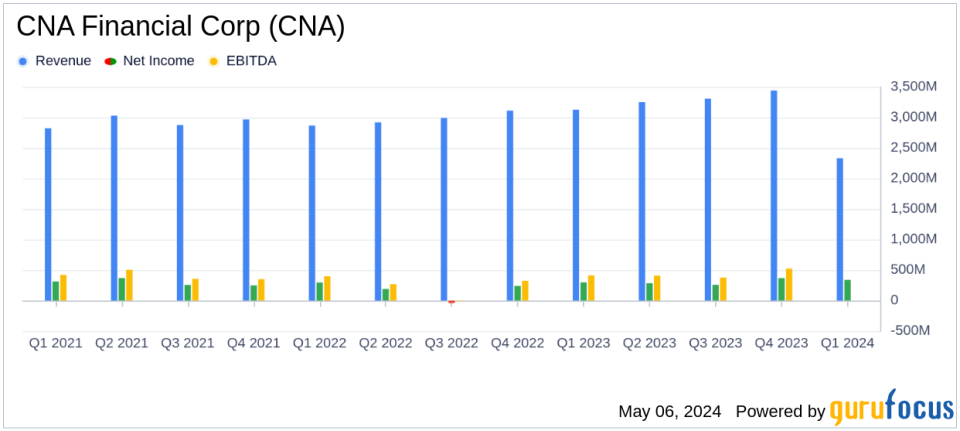

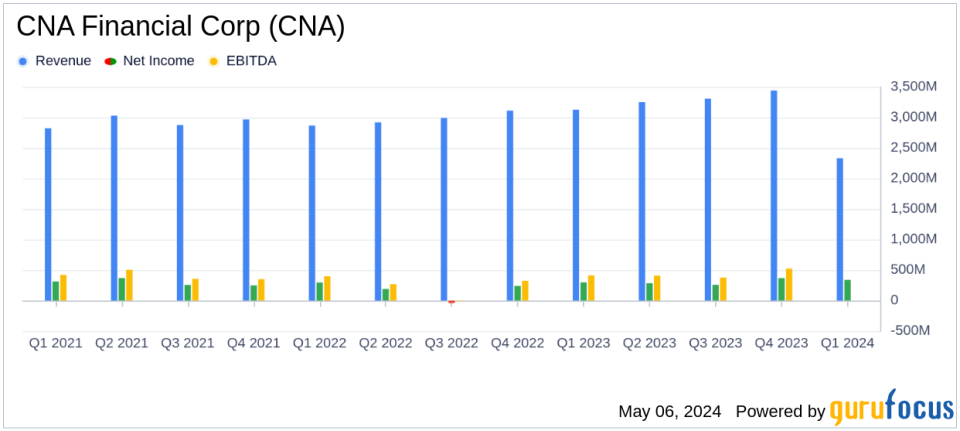

On May 6, 2024, CNA Financial Corp (NYSE:CNA) disclosed its first-quarter earnings for the year, revealing a mixed performance against analyst expectations. The company announced a net income of $338 million, translating to $1.24 per share, which fell short of the estimated earnings per share of $1.40. However, CNA Financial demonstrated robust revenue figures, with reported earnings slightly surpassing the anticipated $2997 million. For a detailed view of the financial results, see the 8-K filing.

CNA Financial Corporation operates as an insurance holding entity, providing a wide array of commercial property and casualty insurance products. It serves a diverse clientele across the U.S., Canada, and Europe, focusing on small to medium-sized businesses through its Specialty, Commercial, and International segments. The company’s performance in these core areas significantly impacts its overall financial health.

Quarterly Financial Highlights

The first quarter of 2024 saw CNA Financial achieving a record core income of $355 million, a 9% increase from the previous year, primarily driven by a 16% rise in net investment income. The Property and Casualty (P&C) segment reported a core income of $372 million, up from $346 million in the prior year, aided by higher investment returns and favorable developments, though partly offset by increased catastrophe losses.

The company’s P&C combined ratio deteriorated slightly to 94.6% from 93.9% year-over-year, influenced by a higher impact from catastrophe losses. Nonetheless, the underlying combined ratio for P&C showed minimal change, indicating stable core underwriting performance.

Significant growth was noted in gross written premiums, with an 8% increase in the P&C segments excluding third-party captives. This growth reflects a strong retention rate of 85% and an encouraging renewal premium change of +6%. Moreover, the book value per share excluding AOCI (Accumulated Other Comprehensive Income) saw a modest 2% increase from the end of 2023, adjusting for dividends.

Investment and Underwriting Performance

Net investment income for the quarter stood at $609 million before taxes, with substantial contributions from both fixed income securities and equity holdings. This represents a significant component of CNA Financial’s income, emphasizing the importance of investment operations to its overall profitability.

The underwriting gains, although slightly lower than the previous year, demonstrate the company’s ability to maintain profitability in its core operations amid varying market conditions. The slight increase in the combined ratio is offset by the strong performance in net written and earned premiums, which grew by 6% and 9%, respectively.

“We are off to an excellent start with a record first quarter core income of $355 million, which benefited from 16% growth in net investment income and continued strong top and bottom line P&C performance,” said Dino E. Robusto, Chairman & Chief Executive Officer of CNA Financial Corporation.

Looking Forward

Despite the challenges posed by higher catastrophe losses and competitive pressures in certain lines, CNA Financial is positioned to leverage its strong market presence and robust capital position to pursue profitable growth opportunities. The company’s strategic focus on enhancing its commercial portfolio and disciplined underwriting practices are expected to sustain its financial momentum going forward.

For more detailed financial information and future updates, stakeholders are encouraged to refer to the official documents and announcements directly from CNA Financial.

Explore the complete 8-K earnings release (here) from CNA Financial Corp for further details.

This article first appeared on GuruFocus.