This is a joint post with Tess Turner and Michael Weilandt.

When China decided that it wanted to fund infrastructure investment throughout the developing world (The Belt and Road Initiative) it put real financial muscle behind its new ambition.

More on:

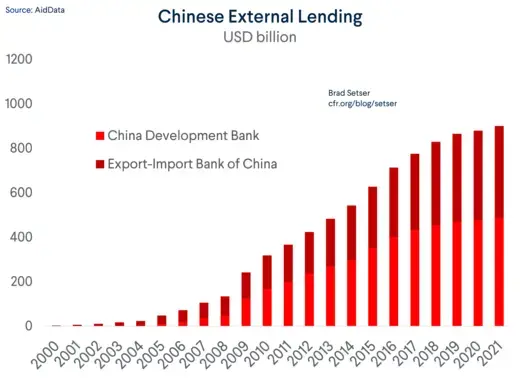

Perhaps most importantly, it provided $90 billion in capital to its two leading policy banks—the Export-Import Bank of China (Exim) and the China Development Bank (CDB)—and put more money into a host of lesser-known investment funds (The Silk Road Fund, for example) to make supporting investments.

Additionally—through mechanisms like entrusted loans—China helped provide the debt financing that allowed the policy banks to lend an estimated $900 billion over ten years (hat tip to AidData/Brad Parks). The results have been mixed, but no one doubts that China financed and built a lot of real infrastructure around the globe.

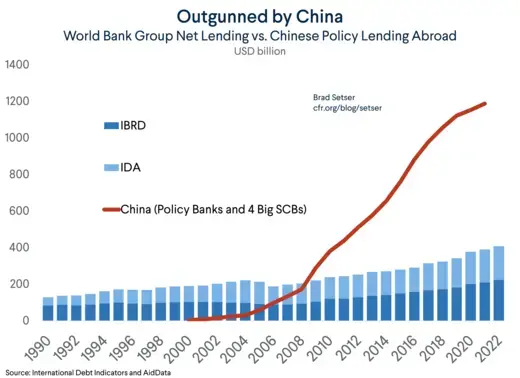

The United States and the G7, by contrast, have often been long on rhetoric and short on real money. Huge sums are announced, but little actually materializes. Judged by comparable criteria, the Western multilaterals lagged far behind China. The World Bank—combining its concessional arm, IDA and the IBRD —increased its lending to the developing world by around $100 billion over the last ten years while China’s policy banks and “big four” state commercial banks lent out over $1 trillion.

This chart, which shows how China’s development lending now dwarves the total lending of the World Bank, an institution created by the United States that remains central to global development finance, should generate serious reflection in Washington and the other G7 capitals.

There are enormous needs for clean energy investment across the developing world—as Jean Pisani Ferry and Selma Mahfouz have noted, most clean energy fundamentally substitutes capital for fossil fuels. Current market interest rates are slowing investment in clean energy in the advanced economies, and, as Mia Motley and others have argued, clean energy investment in the developing world is essentially cost-prohibitive.

More on:

Fortunately, the needed innovation here isn’t so much an innovation as a rediscovery.

Multilateral development banks already have the ability to mobilize funding at the advanced economies’ cost of funds, more or less. They can safely lend at a small spread to a host of developing economies, and they do so at a modest budget cost to their main shareholders. Institutions like the World Bank are, in fact, banks — and are intrinsically levered; $1 in new equity currently would support $5 billion in lending, and $10 billion in lending (counting the capital generated by reinvested earnings) over 10 years.

But they cannot provide the funding on the scale needed unless the United States starts to think bigger—much bigger.

That is the thesis of a new paper that Lily Bermel, Tess Turner, Michael Weilandt, Brian Deese and I wrote for the MIT Center for Energy and Environmental Policy Research (CEEPR).

The paper recognizes that the MDBs are the only credible existing source for the long-term, low-cost financing required for clean energy investment on the scale needed to address climate change.

But to meet today’s challenges, these institutions need more financial firepower.

While our long-term goals are transformative, we start with proposals that could be implemented now, using funds that Congress has already appropriated and legislative authority that already exists.

The first proposal is making more use of the multilateral institutions’ callable capital, or the treaty-backed commitment to bail out bondholders in the remote event of insolvency. Take the World Bank, for example: it has only $22 billion in paid-in capital (the rest of its around $50 billion in equity is essentially retained earnings) but around $296 billion in callable capital. Recent work has shown that $65 billion of that has already been appropriated and is available to cover losses without any new votes. That includes $8 billion from the United States that the U.S. Congress has already appropriated.

It thus is imminently reasonable—and indeed financially wise—for the World Bank to take a bit more risk with its existing capital because it already has a fully functional capital backstop (unlike most private banks). Callable capital doesn’t sit on the balance sheet, but it is fully capable of absorbing losses in the unlikely event that the World Bank’s existing equity capital is compromised.

The rating agencies understand the risk-mitigating value of callable capital, and even include it in their bank ratings, and generally think the MDBs have been too prudent. The internal work on it is done and it is thus time to pick a number or calculated portion of callable capital to incorporate into the World Bank’s internal modeling. We suggest incorporating the already appropriated callable capital into the Bank’s capital adequacy framework so as to yield $50 billion in increased lending. So rather than thinking of the Bank’s market program as $50 billion in capital supporting $250 billion in lending, it would be conceived of as $50 billion in paid-in capital and $65 billion in already-appropriated callable capital supporting $300 billion in lending. That’s still a quite conservatively-run institution.

Second, to solve the current funding challenge facing the World Bank’s vital concessional lending arm, IDA, we propose using a small fraction of the currently idle pool of SDRs to create a $25 billion SDR-based IDA funding facility to cover IDA’s net borrowing need during this funding cycle.

Right now, IDA is paying close to 100 basis points over the risk-free rate and struggling to raise funds at the same maturity that it lends (the natural market for World Bank bonds for five-year paper, not thirty-year paper). Because an SDR bond effectively is a more liquid alternative to holding SDRs at the IMF, a long-term SDR would not require paying this premium over risk-free—a huge advantage for concessional lending in a high-rate world.

This only requires that the United States recognizes that the legislation governing the Exchange Stabilization Fund (ESF), which allows the ESF to deal in securities, already authorizes the United States to invest its SDRs in safe World Bank bonds. The United States could easily cover the $25 billion net financing need on its own (it has over $150 billion in SDRs).

It would be better, of course, if the UK joined in—adding to the functional liquidity and thus utility of its reserve portfolio in the process—and if the ECB came to the obvious conclusion that a well-structured, MDB-based channel for using SDRs is not monetary financing. An SDR bond does need to be well-designed, but the members of the euro system already invest their dollar reserves in MDB bonds, and investing SDRs in SDR bonds is no different.

Frankly, if the IMF’s current SDR-based trust funds—like the Resilience and Sustainability Trust (RST)—were not granted close to a free pass by the ECB’s current rules, it isn’t at all clear that they would be considered safe reserve assets. The RST uses SDRs (and other currencies) to make long-term loans—so its assets are intrinsically illiquid. For the SDRs committed to the RST to remain reserve assets, they need the support of a complex encashment system (where other SDR lenders step in if one participant wants to withdraw).

Conversely, but for ECB’s presumption that SDR rechanneling through the IMF is fine (it is based on Council regulation 3603/93, which might be usefully updated) , an SDR-linked World Bank bond would much more clearly satisfy all of the ECB’s underlying principles: it is clearly a liquid reserve asset (being a dollar- or euro-settled security issued by a highly-rated multilateral institution), and the funds are being invested not to achieve any policy goal but rather to take advantage of the greater liquidity created by a traded instrument.

These items alone would constitute real progress if achieved by the end of the year, which implies a need for concrete progress by the time of the Bank’s annual meeting. But they should be the first step in a more ambitious agenda with three prongs.

The United States should contribute generously to an ambitious ($100 billion or more) IDA replenishment and help make said ambition financially viable by committing to help fund a $30 billion (or more) IDA funding facility with its idle SDRs.

IDA is both the world’s key source of concessional lending and a vital source of clean energy finance to low-income countries. About half of its new lending is now directed at climate goals.

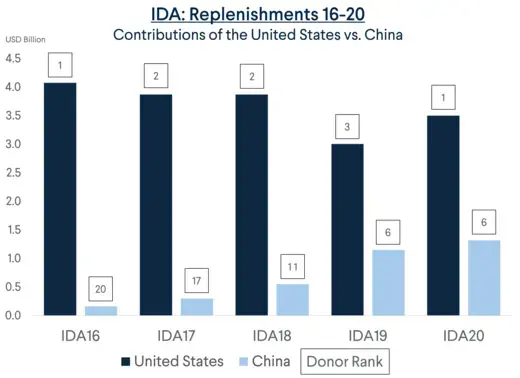

But keeping the money flowing is challenging—the previous $90 billion funding cycle benefited from the carryover of undisbursed funds from past cycles and was designed in an era of low borrowing rates. As a result, the same budget commitment as in the previous funding cycle would mean a smaller replenishment. The United States can step up and offer $4.5 billion of the approximately $30 billion in grant financing needed to meet a $100 billion target. It can provide additional support through participation in a new IDA funding facility that allows IDA to incrementally use leverage to increase its lending without taking on the cost or the risk associated with market borrowing. Over the last several replenishments, China’s contributions have increased while those of the United States have generally faltered.

The United States and the Green Climate Fund should create “challenge funds” designed to allocate capital to institutions based on their climate ambition and the ability to scale that climate finance quickly.

The United States can lead the way in spurring boldness and creativity among the MDBs by building on the newly established portfolio guarantee program at the World Bank and proposing a new $5 billion fund that could invest in subordinated debt or participate in a portfolio guarantee program* from any of the multilateral institutions, and thus create competition among the MDBs for innovative ideas.

The Green Climate Fund, acting in ways consistent with its mandate, could do something similar. To date, the Green Climate Fund has received $33.1 billion in pledges but only disbursed $4.2 billion. To get money out the door and extend its financial reach, the Green Climate Fund should use a portion of its existing capital to invest in hybrid capital issued by the MDBs, with a commitment by the issuing MDB that the funds would be used in ways that are consistent with the Green Climate Fund’s mission.

Scored conservatively, the “challenge funds,” taken together, could immediately mobilize close to $50 billion in new balance sheet lending and potentially $100 billion in additional lending over the next decade.

Most importantly, the World Bank should establish a Dedicated Clean Energy Window to prioritize, price, and properly direct needed resources to clean energy financing.

The ideal lending structure for clean energy finance would have a fixed interest rate priced as close to risk-free as possible for all borrowers, as an incentive to rapidly scale up clean energy investment.

A Dedicated Clean Energy Window could facilitate this kind of financing. It would:

(a) enable proper resourcing for clean energy within the World Bank without cannibalizing existing development financing

(b) provide differentiated lending terms that can be better tailored to long-term clean energy investments

The exact lending terms of the Clean Energy Window would need to be worked out, but in theory, shareholders could provide something like $50 billion in new equity to back the program (this could be structured as subordinated debt with interest on the subordinated bonds returned to the Bank) to back $250-300 billion in new lending. The loans’ pricing would be at the Bank’s cost of funds—there would be no attempt to build capital—and ideally carry a fixed rate. One way to do this would be with SDR floating-rate bonds that could be swapped into fixed rates. Right now, that would enable long-term lending at an interest rate of perhaps 3.5 or 4 percent. Concessional resources could also be used to buy down the interest rate for low-income countries.

There are various other structures that also would work. The basic idea, though, is to structure and price the window to encourage its use. Clean energy investment by developing countries has positive global externalities; it reduces climate risk and can precipitate a development boom as it expands access to reliable power.

Our proposals are realistic and appropriately ambitious reforms that would serve to accelerate the clean energy transition globally and generally bolster the movement of funds at the IBRD and IDA to help them meet global climate goals. They do imply a bigger World Bank balance sheet, but there is no realistic way the United States and the G-7 can compete with China if they aren’t prepared to use their existing financial strength to mobilize real funds to support clean energy projects across the developing world.

U.S. leadership in this arena would help to match current lofty rhetoric with real resources, and deliver financing to developing countries on a scale big enough to matter.

The World Bank shareholders have not fully appreciated the basic structure of the World Bank, and the power of old-fashioned development banking. It is shocking that the paid-in capital of the IBRD is only $22.5 billion, less than a quarter of the capital the PBOC provided China Exim and the China Development Bank when it capitalized the institutions in support of the Belt and Road Initiative. These proposed reforms would allow the Bank to once again be a major player in the new world of development and clean energy finance, and show that the United States can, in practice, still lead and inspire.

Read the full paper, published by MIT CEEPR, here.

* The World Bank’s proposed portfolio guarantee program currently has a very favorable US budget score. Our calculations though use the leverage estimated by the World Bank, which believes $5 in a portfolio guarantee program would enable $30 billion in new loans. The program is structured so that participants take the first loss on all the World Bank’s existing lending, with the guarantee absorbing loss before the World Bank’s own equity is put at risk. That makes it as good as new equity from the Bank’s point of view. But it is technically junior to the Bank’s paid-in capital, and thus there is an argument that it should be scored for budget purposes similarly to paid-in capital.