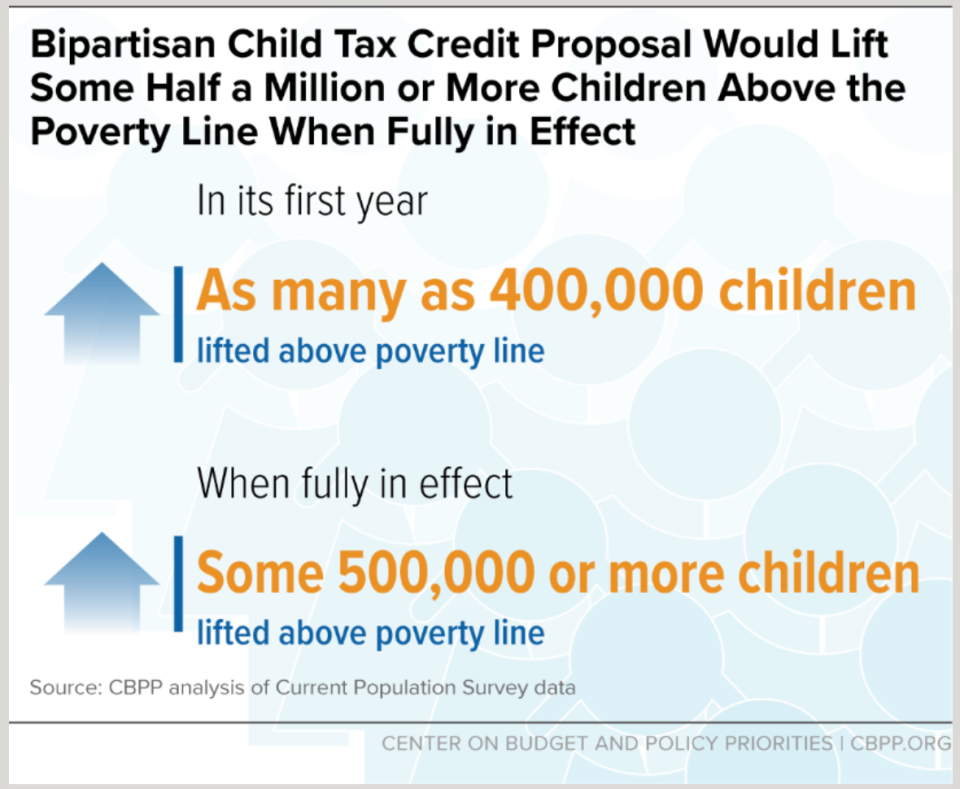

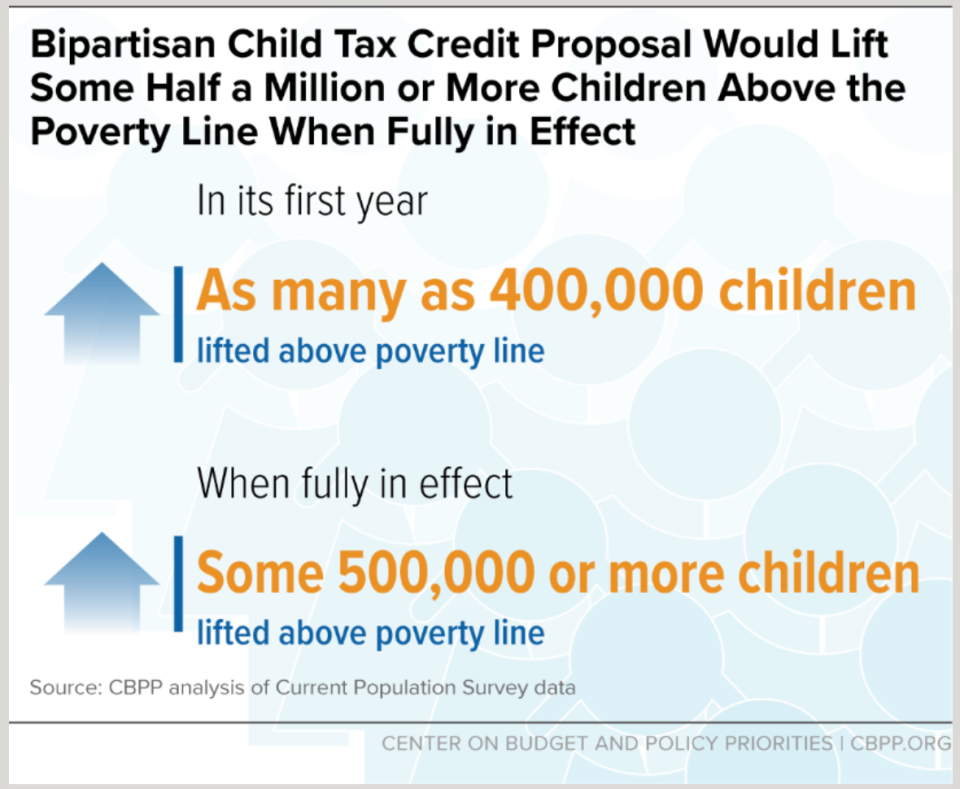

Congress is considering an expansion of the federal child tax credit (CTC), a measure that could lift as many as half a million children from the poverty line.

The bipartisan proposal for the CTC expansion would increase the maximum credit per child to $2,000 from $1,600 through 2025.

While that increase is lower compared to the American Rescue Plan credit expansion that expired at the end of 2021, the new expansion would significantly improve the financial stability of roughly 19 million children who currently get a partial credit or none at all because their families’ incomes are too low, the Center on Budget and Policy Priorities (CBPP) found.

The measure would also eliminate a provision that largely penalizes lower-income households with more than one child. As it stands, the child tax credit benefits middle- and higher-earning families — excluding those who need it the most.

“This is great news for families. The Child Tax Credit is one of the most transformative pieces of legislation that we have seen in the last few years, and in 2021 it lifted millions of kids out of poverty,” Ailen Arreaza, executive director of ParentsTogether Action, told Yahoo Finance. “This bipartisan agreement is a step in the right direction.”

Arreaza added: “There are still some kids who are excluded because their families don’t earn enough income, which seems quite frankly, backwards. However, 80% of the 19 million children who are either getting a partial credit or none at all are being included. That’s a huge progress.”

Read more: Child tax credit: Everything you need to know for the 2023 tax year

‘A policy that transforms families’ lives’

After years of fighting to get a new version of the expanded child tax credit, families may finally get some much needed relief.

“This would mark the beginning of a much-needed reversal of the sharp rise in child poverty that occurred in 2022, following the expiration of the child Tax Credit and other COVID relief measures,” CBPP analysts wrote. immediate relief. This figure includes 3 million children under the age of 3, the CBPP found.

“This would mark the beginning of a much-needed reversal of the sharp rise in child poverty that occurred in 2022, following the expiration of the child tax credit and other COVID relief measures,” CBPP analysts wrote.

Under the proposal, half of the 16 million children who would benefit from the credits within the first year live in families who would gain $630 or more, the CBPP found. Nearly 40% of children who would benefit would see their households gain $1,000 or more, and approximately 25% of children are in families that would see a gain of more than $1,400 within that first year.

The gains would be significant for low-income families with more than one child, which represent close to three-quarters of children. They would get at least $1,000 or more within the first year of the credit expansion.

According to the analysis, for a parent with a toddler and second grader earning $15,000, the first year of the expanded child tax credit would increase from $1,875 to $3,600. That’s a bump of $1,725.

“It’s really encouraging. We know our parents are really excited that this is happening because it is a policy that transforms families’ lives,” Arreaza said. “We hear over and over again that it’s getting harder to raise a family and that parents are really struggling and these types of benefits make the difference.”

Full coverage: Taxes 2024 — Everything you need to file your taxes on time

When the American Rescue Plan temporarily expanded the federal child tax credit, the nation’s child poverty rate was cut by half to a historic low of 5%.

The pandemic-era expansion helped lift 3 million children out of poverty, according to the US Census Bureau, which said that most parents used the credit payments for everyday, crucial expenses like shelter costs, food, and daycare.

“Some parents were telling us that they finally didn’t have to make impossible choices between paying rent and buying school supplies or paying for medication, or utilities,” Arreaza noted. “The stories I loved the most were parents who said they could finally afford kids’ soccer cleats or karate lessons, enriching their lives.”

The Rescue Plan’s CTC raised the maximum credit amount from $2,000 to $3,600 for children under 6 and $3,000 for children between the ages of 6-17. It was also the first time 17-year-olds were included. The credits were fully refundable – meaning families with little to no income were eligible for the tax credits for the first time.

In 2021 alone, the temporary child tax credit helped child poverty decrease by 46%, lifting 716,000 Black, 820,000 white, and 1.2 million Latino children and families out of poverty.

“It was a stunning achievement,” Marisa Calderon, president and CEO of Prosperity Now, said in an emailed statement. “It was a major success benefiting millions of children and their families, but it was only temporary. Once the child tax credit was cut back, child poverty rose, and millions of children and families fell back into poverty.”

The failure to renew the CTC back then and the end of pandemic stimulus payments had severe impacts on children’s financial stability in the US. The child poverty rate more than doubled, from 4 million in 2021 to 9 million in 2022, the US Census Bureau revealed.

Those impacted the most were among the most systemically vulnerable groups. Black and Latino child poverty increased the most in 2022. According to the Census Bureau, Black child poverty increased from 8.3% to 18.3%, and the Latino child poverty rate increased from 8.4% to 19.5%.

The new proposal could reverse some of those trends significantly.

Within the first year of the proposal, more than 1 in 5 children under the age of 17 would benefit from the expanded tax credit, according to analysts at CBPP. Black, Latino, American Indian, and Alaska Native children would also benefit the most.

More than 1 in 3 Black and Latino children under 17 would receive immediate relief, followed by 3 in 10 Alaska Native children, and 1 in 7 white and Asian children.

While the new proposal for the CTC expansion has its merits, it falls short in other areas. The bipartisan compromise doesn’t not include children in families without earnings.

“Much more will need to be done to fully reverse this increase — and if there are opportunities to strengthen the proposal to improve its impacts for children in families with low incomes, that would of course be preferable,” researchers at the CBPP wrote.

Changes include lookback provision, refundability

The new design of the expanded child tax credit offers a few improvements.

First, the expansion would eliminate a provision that reduced the amount of tax credits for lower-income households with more than one child. Instead, the proposal would provide each child in a family with their own same-sized credit, the same as higher-income families.

Under the current child tax credit, the lowest-income families with two or three children get the same total credit as a family with one child at the same income level.

Second, taxpayers would be able to use their income from the current or prior year when calculating the child tax credit amount. The adoption of the “lookback provision” would allow families that experience a drop in income and no longer qualify for the credits to use the prior year earnings in tax years 2024 and 2025.

Third, the proposal would change the refundability cap to help families with modest earnings be eligible for a higher amount of tax credits. The current cap is set at $1,800, which would be lifted to $1,900 in 2023 and $2,000 in tax year 2025.

“Now is the time to push ahead,” Calderon said. “We need all hands on deck to make sure Congress shows up for families and pushes this deal through. We have a real chance for Congress to give families and kids the support they need this year.”

Gabriella is a personal finance and housing reporter at Yahoo Finance. Follow her on X @__gabriellacruz.