“I think there are bad things going on in the world, but good comes from the bad. I said this about October 7. I think one, it has brought the Jewish community globally together more so than ever before, and I think that’s a good thing. Two, I think it’s a wake up call for Israel to resolve all the internal stress,” says Bill Ackman, the founder and CEO of hedge fund Pershing Square Capital Management, in an interview with Calcalist.

“If AI doesn’t kill us, it will save us. Look at this weekend (referring to Iran’s attack on Israel): Israeli technology saved the country. What country wouldn’t want what Israel has?” he notes.

Does this mean you want to invest and be more involved in the Israeli economy in the future?

“One, I’m Jewish; two, I’m married to an Israeli; three, I care about the country; four, I feel like Israel needs our support more than ever; and five, I’m in a position to be helpful.”

A ‘good weekend’ for Israel

Ackman’s exclusive interview with Calcalist – his first given to the Israeli media – took place on a spring day, the kind that sends New Yorkers outdoors to celebrate the first sun after a cold winter. He speaks with the confidence and decisiveness typical of seasoned finance professionals, but there’s something slightly softer compared to his colleagues, perhaps because Ackman makes a point to speak very quietly. He knows regardless of volume, people listen to what he has to say.

The day before our meeting, Israel was attacked by hundreds of Iranian missiles and UAVs, and the question of Israel’s response and its intensity still hangs in the air. “I think Israel should respond. I think the response should be to take out Iran’s ability to do this again,” says Ackman, “This was a good weekend for Israel: support from Jordan, support from Saudi Arabia. It made Iran look like an outlier, sort of an outcast.

“What does Saudi Arabia want? They want peace and money, business activity, weapons, growth in GDP, safety, security. That’s what they want in Qatar, that’s what they want in Oman, that’s what they want everywhere. Except Iran, North Korea, Russia, and North Korea. Even China wants it.”

Ackman also notes that the loudest voices from within the U.S. are not representative of national opinion. “Despite some of the negative stuff that Israelis read about the U.S. and the protests, I do think the substantial majority of the country and Congress are very supportive of Israel. So, we shouldn’t get down because of some louder voices. The other thing that’s happened more recently is you’re seeing the same people (referring to anti-Israel protests), who are, in effect, supportive of terrorists, and also saying things like ‘Death to America.’ We have enemies in our midst, and I think there’s more clarity about that.”

Pershing manages about $19 billion worth of assets and is considered one of the largest and most successful hedge funds in the world. Ackman explains that most of the fund is managed by only eight investment managers, and the entire fund, established in 2004, employs 40 people. The Manhattan offices located on the edge of the Hudson are far from the hustle and bustle of Wall Street, but also from private equity funds, most of which are located on Park Avenue.

One of the most intriguing figures in the U.S. and global finance industry, Ackman enjoys being different. From the Pershing offices, he manages not only the billions that steadfast investors pour into him but also his Twitter skirmishes. In Wall Street parlance, these are called “proxy battles,” but the battles have changed beyond recognition since October 7. Prior to, Ackman was known in Israel mainly for his financial prowess and his well-publicized struggles against companies like Herbalife, after shorting the company for $1 billion, claiming it was a pyramid scheme.

But since October 7, the opinionated billionaire has become a much more familiar figure, especially to Israelis, as a vocal activist against anti-Semitism and in particular at Ivy League universities. Ackman was the first to raise the red flag against Harvard’s conduct following October 7, after a statement was released immediately following the attack, signed by dozens of student organizations which stated that “the apartheid regime is the only one to blame.” His battle against the university ended with the dismissal of Claudine Gay, Harvard’s first black president.

His social media activity since the outbreak of the Israel-Hamas war has brought Ackman over a million followers on X, an unparalleled feat for someone in the finance industry, and has attracted attention. In February, New York Magazine dedicated an article to his social media activity surrounding the Gaza war, entitled “Raging Bill” in a nod to Martin Scorsese’s classic film, and perhaps also to Wall Street’s iconic Charging Bull sculpture.

Ackman rarely gives interviews, and has only given a few to date. But now it’s evident that he wants to make his voice heard. Despite his team’s efforts to make our conversation “off the record,” Ackman insists on speaking. Some of his direct, sharp responses make his chief of staff shift uncomfortably in his chair, but that’s what he pays them for.

How has your attitude toward Israel and Judaism changed in the past year?

“I’ve always identified as Jewish. My parents are Jewish, it’s an important part of my heritage. I was raised in the Reform movement, so not particularly religious, but I also raised my kids Jewish. I married an Israeli.

“Marty Peretz, a professor of mine [at Harvard], asked me to join the board of the Jerusalem Foundation, and I became the youngest chair of the Jerusalem foundation. Since then, and even before, I’ve spent a lot of time in Israel. It’s always been something I’ve thought about, but not front of mind – until October 7. Then a couple of things happened. The response [to the attacks] was crazy, let alone at my own university (Ackman was a Harvard alumnus and large donor), which made me look deeper into what was going on. That raised a lot of concern I had about higher education in the United States, and then about concerns for Israel, anti-Semitism, and the world.”

You didn’t think that antisemitism existed anymore?

“It’s not that I didn’t think that antisemitism existed – I didn’t think of it as a real problem, at least certainly in the United States. It was a huge surprise for everybody.”

You took these events seriously, and ultimately, your actions led to the resignation of Claudine Gay from her position at Harvard. How do your colleagues on Wall Street react to this?

“Actually, I would say the Wall street community is very supportive, maybe even more supportive of me now.”

Why do you think that happened?

“Whether you care about Israel or antisemitism, or what’s going on in university campuses, the DEI ideology and the problems with it, I think these are universal concerns for people in the finance industry.”

We in Israel were shocked by the lack of any reference to the war or hostages by Jewish actors and directors at the Oscars. How do you explain the silence of the industry, of those working within it who have often exploited their Jewishness?

“Many Jews in the United States are, or at least have been, part of the Democratic Party. I think it’s inherent in the Jewish people to support groups in society that are suffering, so the Jewish community has been very supportive historically of the black community, of low-income people etc. But now, this kind of ideology that has come out of universities sees a world divided into so-called oppressors and oppressed. The success of Jewish people and Israel generally, I think, has, at least in the minds of many people on the left-wing part of the Democratic party, made Israel the enemy.”

Even in the eyes of Jews?

“Even some Jewish people feel this way. And Hollywood is a notoriously left-wing industry, whereas the finance industry is much more balanced, either centrist or more conservative. The technology industry is also very concerned by the DEI ideology, which seeks forced equality of outcome, as opposed to equality of opportunity and a more meritocratic world.”

Do you think the recent events, specifically at Ivy League universities, could change anything among the American left and on campuses?

“I don’t know if you can talk now about a better approach towards Israel, but I think some balance will be restored. A lot of people – and I’m a prime example – didn’t really appreciate how far the pendulum had swung on university campuses. Universities and faculty have always been pretty left-wing but there was still some balance. It was probably 80% for many years – now its like 98%,” Ackman adds, “The Democratic Party generally has shifted meaningfully left, and I think that’s unfortunate because the best answers for any society tend not to be at the extremes.”

In October, you and some of your colleagues in the finance and legal industries announced that you would not employ anyone at your companies who was involved in antisemitic activity on campuses. Are you actually implementing this?

“What I said was that no one wants to hire someone that supports terrorists for obvious reasons,” says Ackman. “I followed this story of a woman in California standing in front of some committee and she says that she’s going to kill them all for not calling for an immediate ceasefire. And then she gets arrested, as it’s actually illegal to say that, and she’s crying in court. A lot of people don’t understand that they’re going to be held accountable for their actions and statements. I think it’s good for people to recognize that.

“By the way, this is separate from someone who criticizes Israeli policy, which is not a problem at all – I criticize Israel policy a lot. It’s another thing to blame the victims of terrorism for the acts of the terrorists and hold them solely responsible.”

Established his first hedge fund at 26

Ackman isn’t afraid of reactions from colleagues or his investors. To him, the returns (250% in the last decade, compared to the S&P 500’s 225%) are ultimately what matter. In 2020, Ackman’s fund yielded one of Wall Street’s highest returns after betting against the market before the COVID-19 pandemic outbreak, turning tens of millions of dollars into $2.7 billion. “the vast majority of our investors have been very supportive and I receive a lot of supportive notes from them,” he says.

The name of his fund, ‘Pershing Square,’ in fact refers to General John Pershing, whom Ackman explains was “a general during World War One. He fought with courage and went forth unafraid. So this is the role model.” Even as a child, Ackman was very interested in business and established his first hedge fund, Gotham Partners, at the age of 26. He raised the money from people he had never met before, calling each person on Forbes’ list of the 400 richest individuals. Later on, the fund got tangled up in investments in both private and public companies, leading Ackman and his partner to dissolve the business.

Based on lessons learned since then, today Pershing Square operates according to very strict rules of investments. Until now, investors have been limited to highly wealthy individuals with offshore accounts, with the average American having no access to the fund, though this is also likely to change soon. Over the course of his three decades of financial activity, Ackman has amassed a fortune estimated at $4 billion. Meanwhile, he signed onto Warren Buffett and Bill Gates’ Giving Pledge initiative, committing to donate at least half of his wealth to philanthropic purposes and not to pass it on to his descendants.

Ackman has three children from his first wife, landscape architect Karen Herskovitz, whom he divorced in 2016 after twenty years of marriage. In 2019, he married Neri Oxman, 48, a professor at MIT in a ceremony at Central Synagogue in Manhattan, with whom he has one daughter. “Almost seven years ago, I met Neri, and she’s amazing. In fact, you should interview her, not me,” Ackman says smiling. His wife is a famous designer and academic, and was once rumored to have been involved with Brad Pitt.

Oxman, born in Haifa, is currently settling into Pershing’s offices, where she is moving her new and intriguing startup, the eponymous “OXMAN,” which is already creating a buzz in New York. It’s a lab that combines design and innovative environmentally friendly materials. Oxman has paid the price for Ackman’s extensive activity against antisemitism. After the scandal involving Claudine Gay’s plagiarism as a student at Harvard, an article was published by Business Insider accusing Oxman herself of plagiarism in her MIT doctorate. Ackman threatened to sue, and it’s likely that the matter will end in a settlement.

Ackman and Oxman purchased 5% of the shares on the Tel Aviv Stock Exchange in January, amid the Gaza conflict, at NIS 95 million ($25 million), which is small change for them. The deal, organized and led by investment bank Jefferies, was a statement, considering that Ackman doesn’t get out of bed for transactions that aren’t in the billions. On a day-to-day basis, Ackman believes in holding large stakes in a few companies, mostly those with strong and stable brands, hence his main holdings today are in companies like Hilton and Chipotle.

What made you interested in Israel and its economy that wasn’t part of philanthropy? After all, everything in the country seems very unstable right now.

“I’ve never invested in public Israeli companies, just as I haven’t invested in Japanese companies, because Pershing Square invests generally in the U.S. And, I’m not actually permitted to make investments in public companies other than through Pershing. I requested special approval to make the investment personally,” he says. “I thought it was an interesting investment. Even if it had nothing to do with Israel, I thought it was a good investment. But I also like the idea of making an investment in something as high profile as the stock exchange. I thought there was symbolic value in being supportive.” Beyond that, Ackman has also invested in a few Israeli VC funds, including Avi Eyal’s Entrée Capital.

“I’ve done some things in New York for the Jewish community, but it was not a major part of my sort of philanthropic effort, partially because I feel like the Jewish community is very successful generally, and Israel was doing great. But, this whole experience [since October 7] has made us very careful about what organizations we support, to make sure that we’re not supporting organizations that create risk for Israel or the Jewish community. I’ve also been supporting a number of initiatives for the benefit of Israel directly relating to October 7. I’ve been more focused on helping people understand a little bit more about the facts, a lot of people have been misled about Israeli history. I also think our enemies – of both Israel and the United States – have made a successful effort to influence a generation of young people to be anti-Israel. There’s a lot of work to do.”

Would you have considered buying a stake in the Israeli stock exchange before October 7th, or were the events what created the interest and willingness?

“I would have considered it, but I didn’t see it as important before. Today I think it is. I wanted to send a signal to Israelis that the United States and investors here are supportive of what’s going on there. There’s a real symbolism; stock exchanges do well when countries do well, and when you bet on the success of an exchange, it means you think that companies are going to grow in Israel and that new companies can be formed that are going to list in Israel. It’s a very good symbolic investment, but if I thought it was a bad investment, I wouldn’t have invested. It wasn’t charity.”

These days, Ackman is raising capital for a new fund, and according to sources in the Israeli capital market, there have already been several discussions with some of the largest institutional bodies about the possibility of raising part of the fund from them. This move is part of a larger but quiet decision by many Jewish investment managers, both on Wall Street and in VC funds, to shift their investments from prestigious universities to Israeli investors. According to reports, this is a $10 billion fund that will raise money from the general public for the first time, and take advantage of Ackman’s social media fame.

The new fund will invest in American companies. How do you view the American economy now? Recent inflation figures were negative, and contrary to expectations, it seems that interest rates won’t drop soon.

“The world has become a more expensive place. Every country in the world will have to spend more on defense. Supply chains are going to have to be brought closer to home. No one wants to rely on a supply chain of important materials based in countries that could be hostile. In the last 40 years, there was a huge interest rate subsidy as rates came from 20% down to zero.

“There were big Chinese subsidies, for outsourcing and reduced cost of products – and now that’s being reversed. Also, the just efforts to transition energy, which are very expensive. All of these things are inflationary, so I don’t see a world where we go back to zero unless really bad things happen.”

What about in the near future?

“I could see a world in which interest rates could stay around their current range for another ten years,” Ackman says. “We may be stuck here for a while. The implications for highly leveraged industries like real estate, are not good. Just now, I just saw a building on Lexington Avenue being sold for $50 million which was being sold for $400 million not that long ago.

“The economy is weakened. Tesla is letting go 3000 people, a meaningful number of companies have stopped hiring or are postponing hiring and some companies are letting people go. So, I think we’re getting closer to a weakened economy, which implies that the Fed should be able to reduce rates. And obviously, if the Middle East situation gets worse then energy prices could go up a lot. When people start focusing on security and insurance rates for shipping and risks of various straits being closed etc, it’s not good for business. It creates uncertainty and the more uncertainty, the more perceived risk, the more reluctant a CEO is to make big investment decisions.”

You mentioned at the beginning of the conversation the internal tension in Israel, but the United States is not free of such tension either. What is the impact of domestic politics on the American economy?

“It’s a significant negative factor. I think when we look back at this period of time in history, social media will be [seen as] an important causal factor for all of this. It really has pushed people in various directions.”

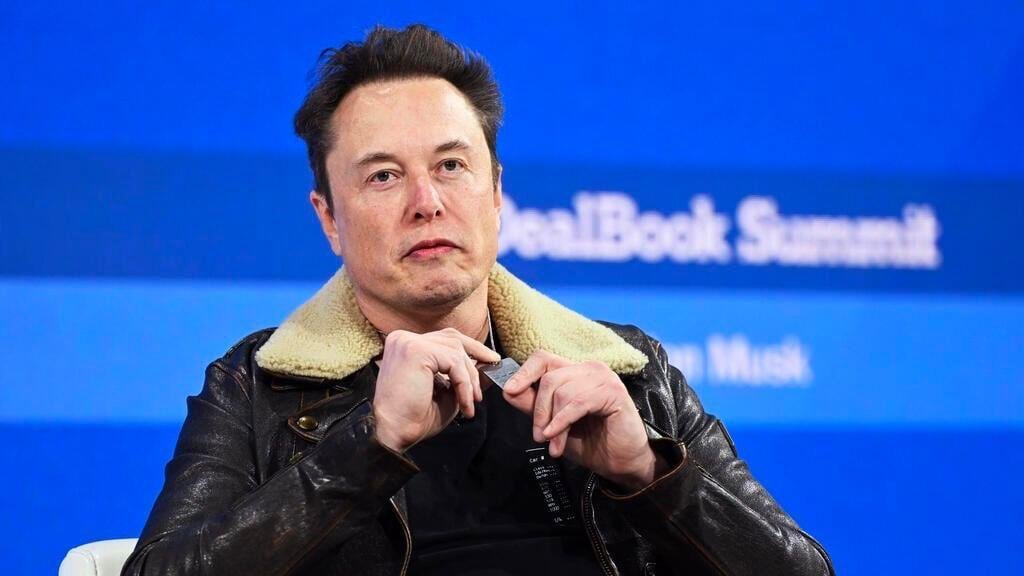

But you are one of the most active people on X, and have communications with Elon Musk, the owner of the social network. Has the ease of tweeting changed you?

“Being on Twitter has opened my eyes in a positive way. I feel like I can get a more objective and broader understanding, and I try to follow people on multiple sides of the same issue. How do you get to the truth? You hear from the strongest advocate on one side, strongest advocate on the other side, and then you form a view of the truth.”