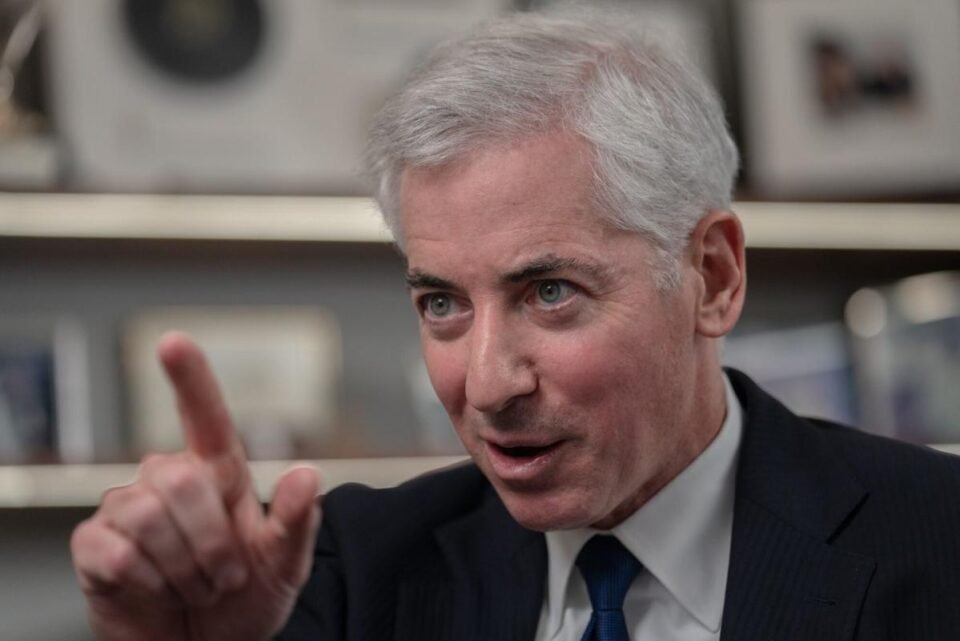

(Bloomberg) — Hedge-fund manager Bill Ackman sold a 10% stake in Pershing Square ahead of a planned initial public offering in a deal valuing the company at more than $10 billion.

Most Read from Bloomberg

Investors include Arch Capital Group Ltd., BTG Pactual, Consulta Ltd., ICONIQ Investment Management, Menora Mivtachim Holdings and an international group of family offices, according to a statement Monday. The purchase price was $1.05 billion.

“We are delighted to invite a group of world-class, long-term partners as investors in our business, which has been entirely owned by Pershing Square employees since our inception more than 20 years ago,” Ackman said in the statement.

Ackman is planning a stock-market listing for Pershing Square as soon as late 2025, a person familiar with the matter said last week.

Pershing Square is the management company that runs closed-end funds — Pershing Square Holdings Ltd., which has about $15 billion in assets, and Pershing Square USA Ltd., which he intends to list on the New York Stock Exchange — as well as unlisted hedge funds.

Read More: Ackman Selling Stake in Pershing Square Ahead of Planned IPO

Ackman made a name for himself as an activist investor with an outsize presence on social media, betting against companies including Herbalife Ltd. and bond insurer MBIA Inc. He has been an active supporter of Israel in recent months and has agitated against antisemitism on US college campuses.

Pershing Square also created an independent board of directors and reorganized its ownership structure, according to Monday’s statement. Ben Hakim was named president and Nick Botta vice chairman.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.