Bitcoin is trending lower at spot rates, sliding away from all-time highs. Looking at the performance in the daily chart, it looks like bears are stepping up, following the general inactivity in an overwhelmingly bearish trend. When writing, the coin is down 10% from March 2024 highs but steady.

Will Bitcoin Consolidate For Two More Months?

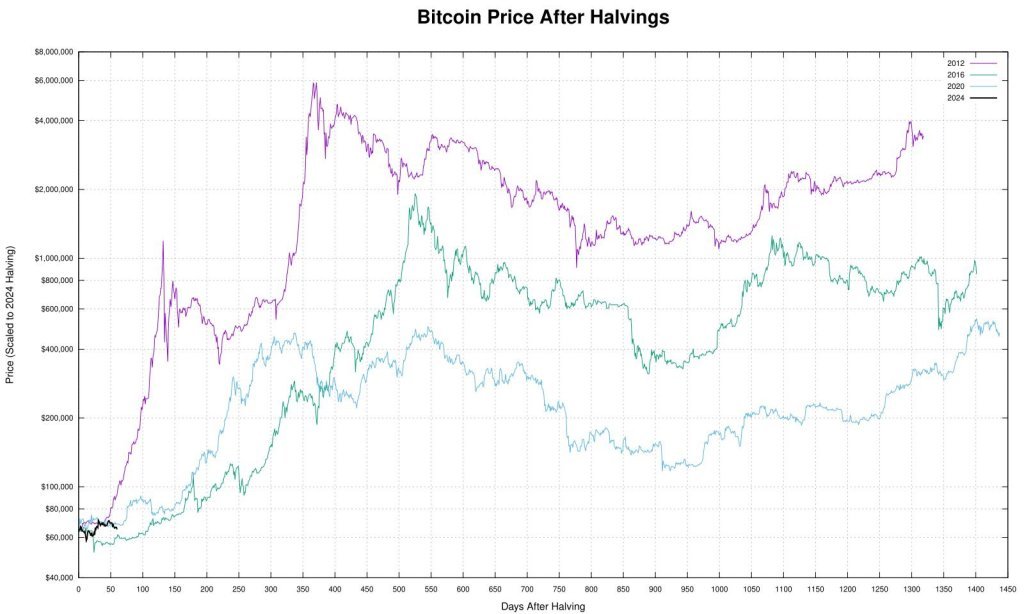

Taking to X, one analyst argued that the current state of affairs will likely continue in the days ahead. While most experts predicted Bitcoin prices to rebound sharply, even breaching all-time highs and race to $100,000 after the all-important Halving event on April 20, bears have had the upper hand.

So far, the coin is stuck in a broad horizontal range with caps at around $74,000 on the upper end and $56,500, registered in May. Technically, the uptrend remains from a top-down preview following the welcomed push higher in Q1 2024.

However, even as traders expect more gains in the days ahead, the analyst said prices will likely stagnate in the next few trading weeks.

When the network halved network rewards in 2020, the analyst notes that the coin moved sideways for 150 days, with prices capped between $9,000 and $11,000. Currently, the sideways consolidation, the analyst added, has been for 90 days, nearly halfway through the last cycle.

If this guides, prices could continue moving sideways for the next two months, even dumping below the key support levels.

Thus far, Bitcoin bear bars are banding along the lower BB, pointing to intense selling momentum. At the same time, the divergence between the middle and lower BB points to rising volatility, swinging in favor of sellers.

Crypto Hedge Funds Reducing BTC Exposure As Whales Sell Via OTC

Currently, macroeconomic factors and on-chain data paint a cause for concern. One analyst observed that more crypto hedge funds have reduced their BTC exposure, indicating a loss of confidence.

Over the past 20 trading days, the analyst claims that crypto hedge funds have slashed their Bitcoin market exposure to 0.37, the lowest level since October 2020.

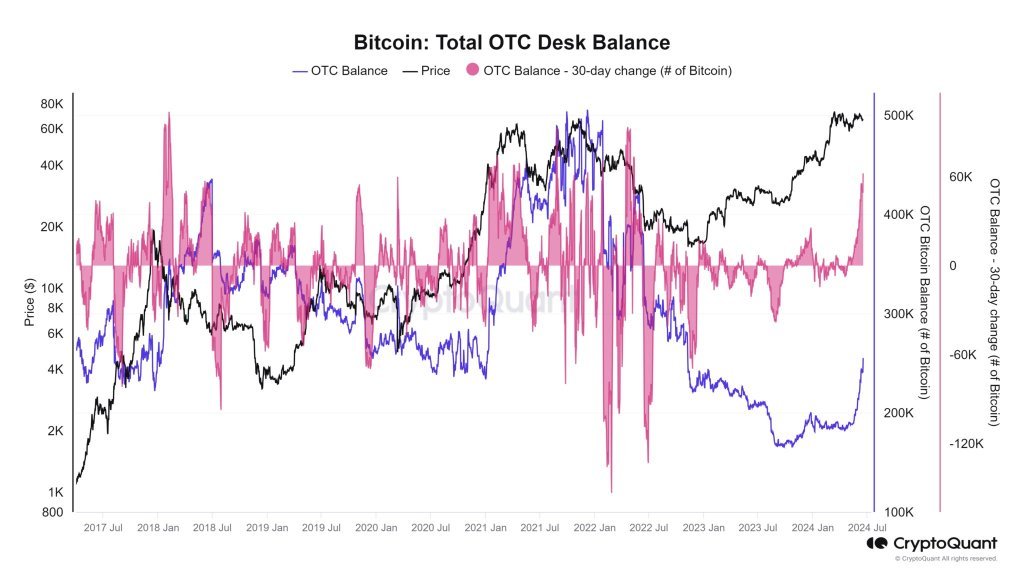

While crypto hedge funds reduce exposure, another analyst said inflow to over-the-counter (OTC) desks has risen since Halving.

This suggests that miners or big institutions are offloading BTC away from exchanges. On-chain data shows that OTC balances rose by 62,000 BTC, one of the largest 30-day recorded changes since 2017.

Feature image from DALLE, chart from TradingView