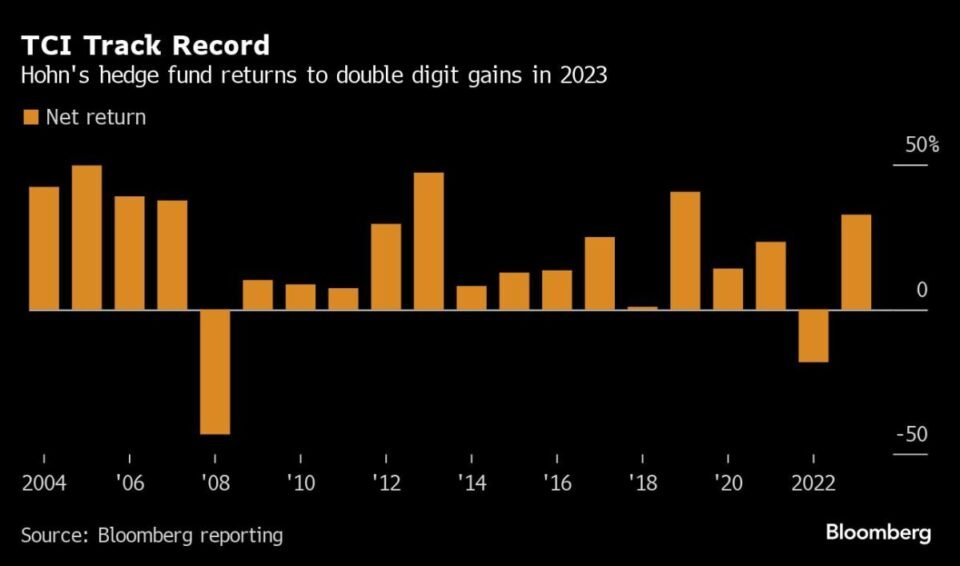

(Bloomberg) — Activist investor and philanthropist Chris Hohn’s fund surged by nearly 33% last year to record its best performance in four years, far ahead of the majority of hedge fund peers.

Most Read from Bloomberg

The Children’s Investment fund’s gains, set out in a letter to investors seen by Bloomberg, mark a return to profitability. A loss of 18% in 2022 ended a profitable streak that had spanned almost a decade and a half.

A spokesperson for London-based TCI Fund Management, which manages around $57 billion in assets across the business, declined to comment.

Hohn, who is best known for building stakes in companies and agitating for change to help boost share prices, runs a long-biased portfolio spread over a small number of stocks. The fund’s largest holdings include General Electric Co., Moody’s Corp. and Apple Inc., according to regulatory filings.

Hohn’s net worth is estimated at $6.3 billion, according to the Bloomberg Billionaires Index. After working at the London office of Perry Capital, He started TCI and an affiliated charity, the Children’s Investment Fund Foundation, in 2003.

The Financial Times first reported TCI’s performance.

Here’s a look at 2023 returns for other hedge funds:

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.