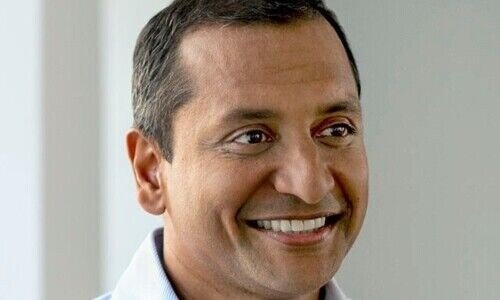

Before launching his hedge fund, Robert Jain really banged the marketing drum in the media, promising the biggest launch ever. Now he will have to backpedal.

Robert Jain chose the name of his fund after himself. But even the British financial newspaper «Financial Times» found that Jain Global was to raise $10 billion in client assets to achieve Jain’s complex market bets.

Reports back then said that this would be the biggest launch of a hedge fund in financial history.

Expectations Set Too High?

As the «Financial Times» reports now, Jain has to scale back the volume. By the launch, it may be the case that only half of the target assets, $5 or $6 billion came together – despite a «perpetual» discount on fees that Jain offered to clients investing more than $250 million at once.

According to the report, the reason for the target correction is that Jain Global had set expectations too high which the fund later found too difficult to fulfill.

For 20 Years at Credit Suisse

Jain is not an unknown from a Swiss perspective. He worked at Credit Suisse for a total of 20 years before leaving the bank in 2016. Most recently, he managed the entire fund business at the bank – now a subsidiary of UBS. His successor, Eric Varvel, had to resign after the Greensill fund debacle in 2021.