The GameStop investor known as Roaring Kitty appeared YouTube on Friday – and showed he had a huge $320 million position in the video game retailer.

Keith Gill, the man who inspired short squeeze in the company in 2021, had first reappeared on social media in the past few weeks after being silent for three years.

Gill became a hero among retail investors during the pandemic as an ordinary American who made millions on betting GameStop could turn around its business.

But Wall Street experts are now questioning whether he has backing from a big investor given the size of his current position.

The stock price had been rising all week – and popped on Thursday after Gill said he would do the YouTube broadcast on Friday.

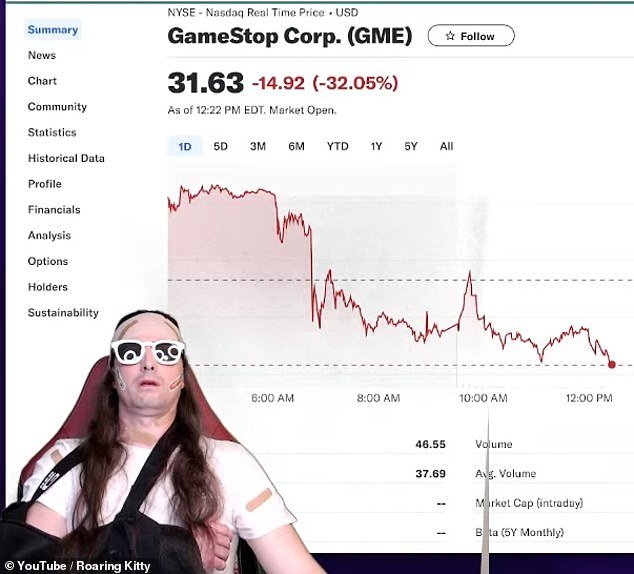

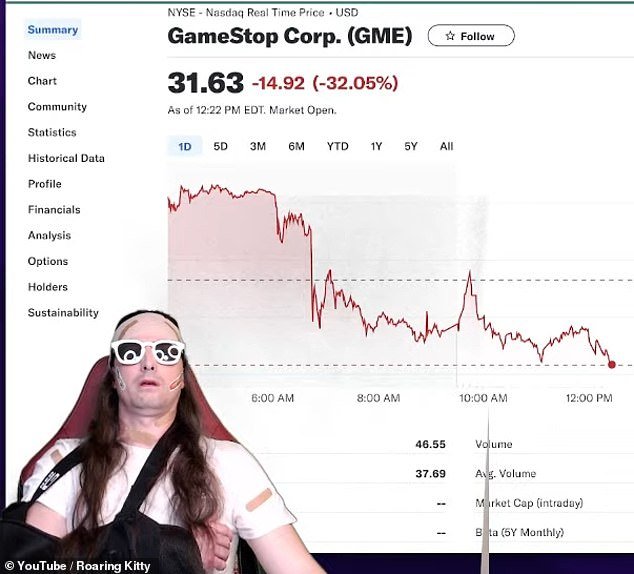

But it slipped Friday morning – which is the big drop shown on the chart below – after GameStop bosses said they were diluting the stock by selling more shares. But once the Gill’s YouTube began it make bigm moves up and down.

Roaring Kitty on the YouTube livestream on Friday

Keith Gill, the man who inspired that year’s short squeeze and is also known by his online pseudonym Roaring Kitty, resurfaced in recent years. He is seen here back in 2021

Early on in the broadcast, he said: ‘Those are my positions. I’m not working with anybody else, with hedge funds. I thought I have to hop on the stream and just remind people I’m not an institutional investor.’

But Andrew Left, founder of Citron Research – who has bet Gamestop shares will fall- said he thought Gill had backing from a big investment banks or hedge funds.

‘This does not pass the sniff test,’ Left told CNBC on Friday, ahead of the YouTube broadcast.

‘Where woud he get the $160million to buy these shares. I could be wrong. The regulators will find out.’

‘There is something funny going on here,’ added Jim Lebenthal, chief equity strategist at Cerity Partners.

During the broadcast, Gill reiterated his belief in Gamestop, and also the potenial of the CEO Ryan Cohen to turn the business around.

During the broadcast he showed his current positions in GameStop, which were valued at about $320 million.

Shares were halted multipe times due to volatility as the price see-sawed up and down.

GameStop shares were trading at $36.95 ahead of the livestream after trading was halted several times for volatility.

After the live stream ended, it was at $29 at about 1.30pm ET – down about 37 percent on the day.

In 2021, Gill’s championing of GameStop helped its shares rally by as much as 1,600 percent before they tumbled. He won a cult-like following among some investors and notoriety with others.

Gill has helped attract a flood of retail cash to the beleaguered bricks-and-mortar retailer with his bullish case on Reddit posts and YouTube streams where he often appeared wearing a bright red pirate bandana.

His apparent return has sent GameStop shares soaring in recent weeks.

They rose nearly 150 percent since May 13, when an account on X linked to Gill began posting memes that some investors viewed as a sign of him being bullish on the company.

The frenzy Friday was a throwback to 2021 when GameStop hit the headlines for a ‘short squeeze’ on its stock. Back then, it was a video game retailer struggling to survive as consumers switched rapidly from discs to digital downloads.

Big Wall Street hedge funds were betting against it, or shorting its stock – expecting it to go bankrupt. But Gill and his fans disagreed and bought up millions of GameStop shares.

That began what is known as a ‘short squeeze,’ when those big investors that had bet against GameStop were forced to buy its rapidly rising stock to offset their massive losses.

NOT LIKE 2021

While the 2021 rally was fueled in part by retail investors banding together to punish hedge funds that had taken bearish positions in GameStop and other companies, some analysts said the same degree of fervor appears to be missing this time.

‘Despite Keith Gill’s renewed weekend appearance and ensuing GME price spike, retail traders do not look to be sticking around too long in the trade,’ analysts at Vanda Track wrote in a note earlier this week.

At the same time, Vanda said, ‘high-frequency institutional traders are front-running retail’s efforts, and performance data demonstrate that this is indeed not turning into a widespread bullish phenomenon for the meme stocks cohort.’

Short interest in the stock stood at 19.92 percent of free float, according to data and analytics company Ortex, which also noted a steady increase in bearish bets since last Friday when it was at 18.4 percent.

Results showed first-quarter net sales declined from year ago as GameStop struggles with customers turning to e-commerce firms for buying video games and collectibles.