While the media and sell-side analysts are preoccupied with

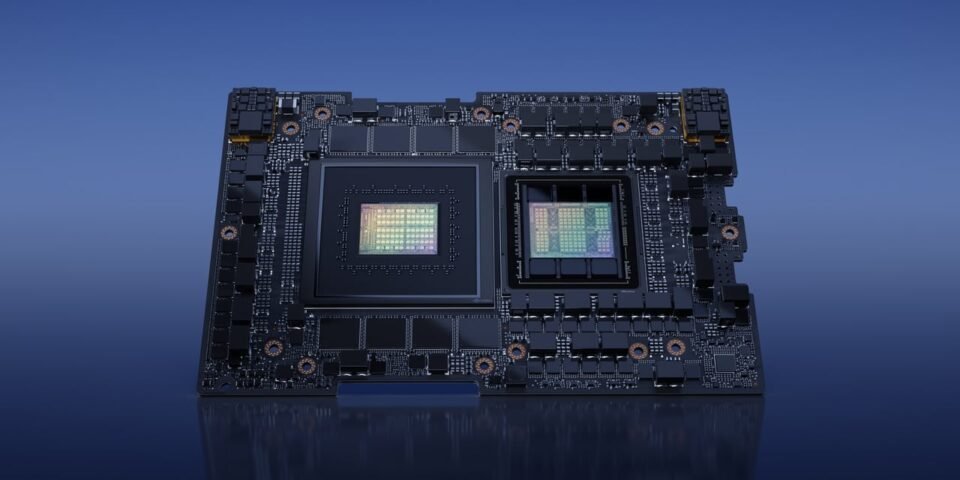

Nvidia

,

and

jockeying for the top market cap, the smart money’s been selling tech and internet stocks.

That’s what

reports, in the latest readout from the prime services unit that caters to the broker’s hedge fund clients. The June report from the Goldman unit says hedge funds have such aggressive sellers of info tech, internet and communications stocks, that June’s selling is on track to be the highest that Goldman’s seen in any month of the last eight years.

Like other brokers’ reports, Goldman doesn’t name particular stocks or, of course, its hedge fund clients. Yet the reports give a good sense of aggregate trends.

Within the tech sector, the broker’s hedge fund clients reversed their year to date buying of semiconductors and semi production gear, to make those stocks some of June’s most sold, followed by software and Internet stocks.

Hedge funds also unloaded consumer stocks in June—both staples like food, and discretionary spending on luxuries and leisure.

Advertisement – Scroll to Continue

Buying of financial stocks began outpacing selling, in May, with net long positions in bank stocks recently reaching their highest levels since 2022. The sector with the highest volume of buying in June were energy stocks, which followed the price of Brent crude oil as it climbed through the month.

So are these hedge funds truly the smart money? Among Goldman’s prime services clients, the conventional long/short funds are up nearly 8% this year. Systematic long/shorts, who build positions with quantitative methods, are up nearly 16%.

That performance is certainly respectable, even in a year when the

is up more than 16% and the

is up nearly 23%.

Advertisement – Scroll to Continue

Write to Bill Alpert at william.alpert@barrons.com