(Bloomberg) — As a stock rout hit markets mid-July, some of the world’s biggest equity hedge funds lost hundreds of millions of dollars from piling into popular tech stocks that led the meltdown.

Most Read from Bloomberg

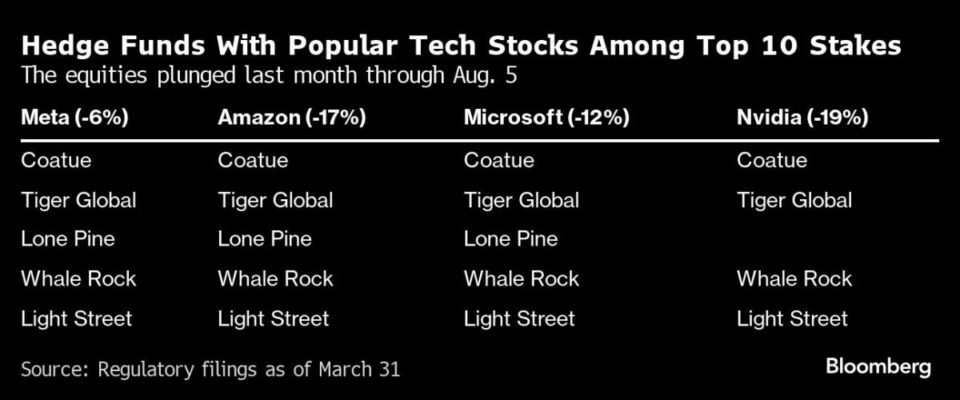

Worst hit were Glen Kacher’s Light Street Capital Management, Bill Ackman’s Pershing Square Capital Management and Philippe Laffont’s Coatue Management, according to people familiar with the matter. Light Street’s hedge fund lost 9.2%, while Coatue fell 3.6%. Pershing — which has just 13 long positions — tumbled 4.7%.

Tiger Global Management fell 1.9% and Lone Pine Capital declined about 2%. Meanwhile, Viking Global Investors — which makes fewer tech bets than its peers — was about flat, some of the people said. The people asked for anonymity to discuss the private returns.

AI darling Nvidia Corp., Facebook parent Meta Platforms Inc., Amazon.com and other “Magnificent Seven” tech stocks sold off in July. This week, stocks got off to an even worse start, with the tech-heavy Nasdaq 100 dropping 3% and the VIX, or so-called fear index, at one point reaching its highest level since March 2020.

Stocks rose Tuesday as investors snapped up cheap equities.

In the past few months, there have been “intimations” of this week’s collapse, according to Jon Caplis, founder of hedge fund research firm PivotalPath.

“Funds have been net sellers of big tech,” he said. “We have also seen a number of clients and funds express concern about being over-exposed to the US and its highly concentrated equity markets, where the fate of a few participants can turn the whole market.”

Magnificient Seven firms often made up the biggest holdings of tech-focused hedge funds. Some managers had stakes worth more than $1 billion as of March 31.

In the first three trading days of August, the Nasdaq 100 Index nosedived 7.6% — its worst start to a month since 2008. Meanwhile, the Bloomberg Magnificent 7 Total Return Index plunged 9%.

Based on PivotalPath’s proprietary model, that 9% decline indicates a loss of as much as 4% for tech, media and telecom-focused hedge funds that manage more than $1 billion.

Global stock-picking funds lost 3.3% between end of day Thursday and noon Monday, a Goldman Sachs prime brokerage report found.

David Einhorn’s Greenlight Capital and Jim Simons’ Renaissance Technologies bucked the trend and gained at least 2% each last month.

Multistrategy funds, which trade across a variety of assets, weathered the storm relatively well, posting gains or losses of less than 1%. Still, the equity selloff likely hindered their typical return, which is usually at least 1% a month.

–With assistance from Nishant Kumar and Katherine Burton.

(Updates to include Lone Pine performance in third paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.