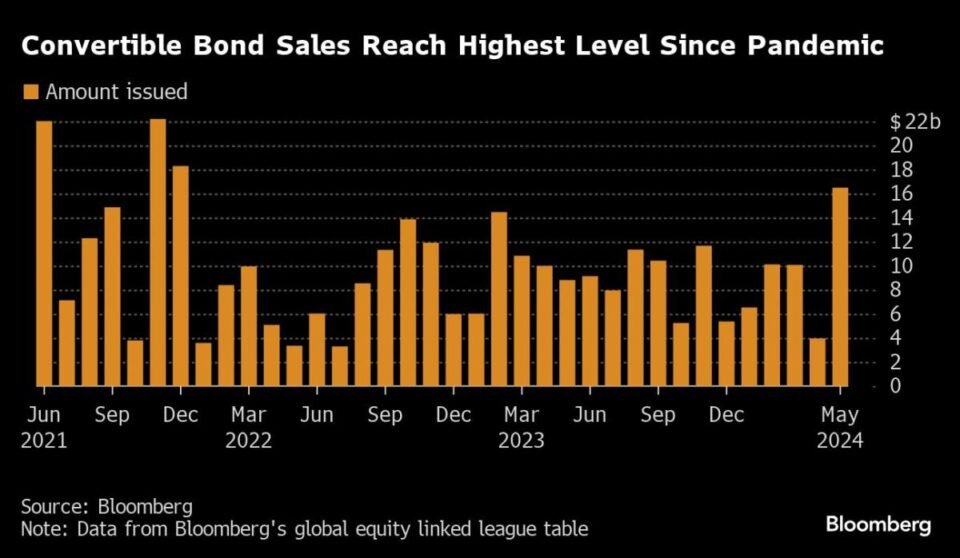

(Bloomberg) — A surge in issuance of a type of bond that can convert into stock on maturity is helping revive a hedge fund strategy that was crushed during the financial crisis.

Most Read from Bloomberg

So-called convertible arbitrage, in which investors try to capitalize on price discrepancies between a convertible bond and its underlying stock, attracted inflows in the first quarter as investors pulled billions out of other strategies, according to data from Nasdaq eVestment.

A typical trade involves taking a long position on a convertible bond and a short position on the underlying stock. If the share price falls, investors profit from the short. If it gains to a certain level, they can convert the bond into equity on maturity. It’s win-win unless refinancing concerns cause a sudden slump in the bond price.

The strategy returned 4.4% in the first four months of 2024, outperforming other relative value strategies, according to Hedge Fund Research. It’s set for another boost as companies look to extend maturities on more than $200 billion of convertible bonds due in the next five years. Other firms are entering the market for the first time, attracted by interest rates that are lower than on conventional debt, and encouraged by stock prices near historic highs.

The favorable conditions are already boosting hedge fund performance. US-based convertible arbitrage-focused hedge fund Linden Advisors gained 5.8% from the start of the year through April, building on gains in 2023 of nearly 12%, according to a person familiar with the matter. Context Partners, which also specializes in the strategy and manages around $1.7 billion of assets, gained more than 6% through May 10, according to a document seen by Bloomberg News.

Man Group Plc., the world’s largest listed hedge fund, is increasing its exposure to the strategy via its External Alpha team, according to Chief Investment Officer Adam Singleton.

The jump in issuance could lead to “interesting opportunities for hedge funds, as there will be a clear dispersion between winners and losers,” Singleton said in an interview. “The refinancing process will be particularly interesting because interest rates around the world have stayed higher than firms expected.”

Lehman Consequences

The strategy crumbled in the aftermath of the Lehman Brothers collapse in 2008, causing something of an existential crisis. In a paper published the following year by the CFA Institute, associates at AQR Capital Management called it a “disaster” and said the trade handed investors losses of 34% in 2008. This was particularly brutal because they estimated that arbitrageurs owned 75% of the US convertible bond market.

Ownership is now more balanced between traditional asset managers that don’t use leverage and convertible arbitrage strategies inside large multi-strategy hedge funds, according to Alexandre Fade, a convertible bond portfolio manager at Fisch Asset Management. Such firms now have “much tighter controls and lower leverage than in the 2000s,” he added.

The trade underwent a revival between 2019 and 2021, the height of the easy-money era, with hedge funds that specialize in it recording double digit returns. That came to a juddering halt in 2022 when inflation and rate hikes led to a sharp stock market sell off, pushing many convertible bonds into distressed territory.

“The strategy can sometimes behave as a short-volatility strategy — managers get caught out when markets get illiquid and there’s forced selling,” said Lawrence Berner, director of research at Stable, a provider of capital to emerging investment firms including hedge funds. A lot of traditional long-only investors simply abandoned the market in 2022, he said.

Cryptocurrency exchange Coinbase Global Inc. and French video-game maker Ubisoft Entertainment SA are among firms that recently sold convertible bonds in an issuance splurge that comes as companies seek to refinance debt sold when interest rates were near record lows during the pandemic. Chinese e-commerce pioneer Alibaba Group Holding Ltd. joined the market for the first time last week with a $4.5 billion convertible bond sale.

Hedge funds’ exposure to US techonolgy behemoths is also at a record high, according to Goldman Sachs Group Inc.’s prime brokerage.

“Hedge funds have been more dominant in the convertible bond market and we can feel that in the demand for primary market,” said Pierre Henri de Monts de Savasse, a convertible bond portfolio manager at BlueBay Asset Management. “It’s a healthy trend and brings a lot of liquidity.”

(Adds quote from Fisch Asset Management in paragraph 9, elaborates on Stable’s business in paragraph 11)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.