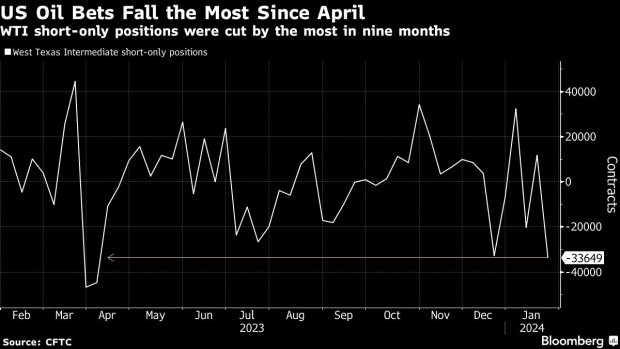

(Bloomberg) — Hedge funds slashed their bearish bets on US crude by the most in nine months after a cold snap disrupted output and roiled imports.

Money managers cut their gross short positions on the US benchmark by 33,649 lots to 78,598, the biggest cut since April. The trimming of short positions helped bring net-long positions in WTI to 134,140, the highest in 11 weeks, according to weekly CFTC data.

Below freezing temperatures in North Dakota and parts of Texas, home of the Bakken and Permian shale formations, reduced US crude output by about a million barrels a day, data from the US Energy Information Administration showed. Extreme cold also descended on Alberta’s oil sands and US crude flows from Canada plunged by the most since at least 2010.

©2024 Bloomberg L.P.