In a significant shift towards mainstream adoption of digital assets, over half of the top U.S. hedge funds now own bitcoin Exchange-Traded Funds (ETFs), according to the report from River.

Of the largest 25 hedge funds in the US, over half now have exposure to bitcoin. Additionally, 11 of the largest 25 Registered Investment Advisors (RIAs) now have an allocation, as well as hundreds of smaller ones, according to the report.

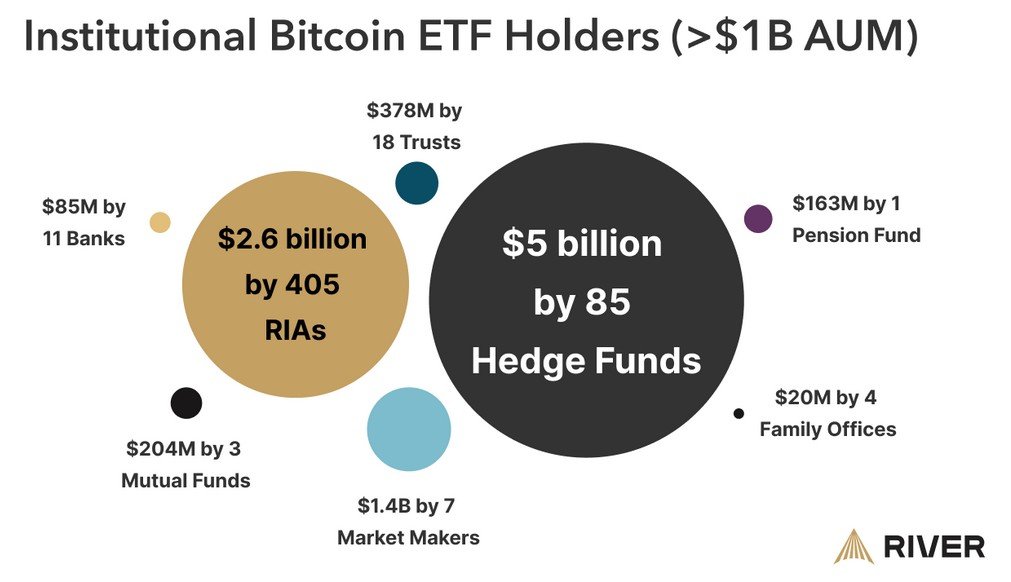

In total, there are 534 institutions with over $1 billion in assets now hold bitcoin ETFs.

The increasing investment in bitcoin ETFs by hedge funds is an indicative of a broader trend towards diversification and innovation in investment strategies. As traditional markets face uncertainties and challenges, hedge funds are exploring alternative assets like cryptocurrencies to enhance their portfolios’ performance and hedge against inflation and economic instability.

This growing interest in bitcoin ETFs among hedge funds is expected to have a ripple effect across the financial sector. It could lead to increased demand for bitcoin and other digital assets, further driving their prices and market capitalization.