(Bloomberg) — China’s equity rout a few weeks ago was exacerbated by quantitative funds stampeding to exit positions, akin to a 2007 episode in the US when such investors suffered an abrupt meltdown that roiled markets.

Most Read from Bloomberg

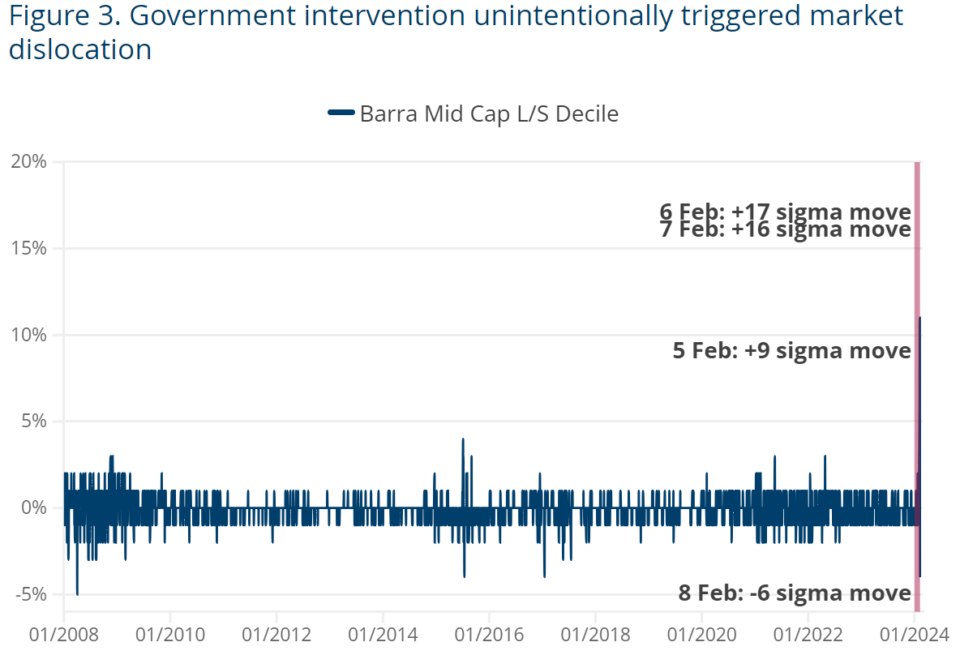

That’s the analysis of Man Group’s Ziang Fang, who said in a note this week that the unwinding of these funds’ positions was so massive that it spurred small-cap stocks to underperform by a historic margin. China’s intervention to stem the turmoil also caused significant market dislocations, compounding the losses for these funds, according to Fang, a portfolio manager at the world’s largest publicly listed hedge fund.

Crowded positioning and high leverage contributed to the Chinese quants’ woes, resembling the events of August 2007 when a number of US model-driven hedge funds saw similarly sudden losses, he said.

“China’s recent ‘quant quake’ has revealed systemic financial risks as a series of interconnected events and highlights the perils of crowding and leverage,” according to Fang, a Boston-based manager responsible for China and emerging-market strategies at Man Numeric, a quant investment division at Man Group.

A spokesperson at the firm declined to comment on details of their China strategies.

In the US in August 2007, as the subprime mortgage market was starting to deteriorate, some long-short quant funds saw sudden, large losses. Subsequent research found that the declines may have been the result of a chain of events, where quantitative portfolios being unwound fueled the unraveling of other similar portfolios.

Read more: Goldman’s Quant Unit Rebuilt on Lessons Learned in 2007 Meltdown

Now Chinese quant funds are drawing increasing scrutiny from regulators around whether they amplified a stock selloff that has wiped out more than $6 trillion of market valuation in China and Hong Kong since a peak in 2021. In the past, such funds have countered that they bought the dip in the nation’s stocks. China’s benchmark CSI 300 Index sank to a five-year low this month.

On Tuesday, China’s two main stock exchanges froze the accounts of a major quantitative hedge fund for three days after the money manager dumped 2.57 billion yuan ($360 million) in shares within a minute. China has also banned major institutional investors from reducing equity holdings at the open and close of each trading day, part of steps to bolster the market.

In the note, Man Group’s Fang laid out how these funds were caught up in the selloff and examined their role in deepening the slide.

A popular strategy for these model-driven funds involves buying small-cap stocks, which are seen as more prone to mispricing relative to their underlying value, and therefore, more profitable for computer programs to exploit. To hedge their broad market exposure, the funds would sell short index futures, such as the CSI 500 Index.

The trouble for the long-short strategy – with leverage ratios sometimes reaching more than 3:1 — started to emerge in early February as equities tumbled, Fang said. The slump triggered some features of financial derivatives that prompted issuers of the instruments to sell index futures for protection.

As the futures tumbled and volatility skyrocketed, so did hedging costs for the quant funds, and their long-short strategy suddenly faltered, the portfolio manager wrote.

Read more: China Snowballs and Their Role in This Year’s Stock Selloff: Q&A

Adding to their struggles, Fang wrote, state-affiliated funds swooped in and bought large-cap and mid-cap equities to stabilize the market, leaving small stocks behind.

The intervention had unintended consequences, he said. Investors flocked to large stocks as havens, exacerbating the declines for smaller stocks. That led to large-scale dumping of both long and short positions by quant funds.

Read more: China’s Small-Cap Crash Shows What Happens Without Market Rescue

For several days, stocks with the smallest market valuation trailed those with the largest market-cap by more than 10%, according to Fang. In Wall Street parlance, it was a 10-sigma move, he said, an event that, in theory, would almost never have happened. Even more striking, the divergence between mid-cap stocks and the rest of the markets represented a 16-sigma move.

State-backed funds later appeared to have expanded their support to small-caps, buying exchange-traded funds targeting the sector and putting a floor under the market. The CSI 300 has rebounded 9% from the five-year low touched Feb. 2. Small-cap stocks fared even better, with the CSI 1000 rising 18% from the Feb. 5 close.

Fang, however, said that it remains to be seen whether the government’s rescue is enough to revive market confidence, noting that similar efforts in 2015-2016 didn’t lead to a “V-shaped recovery.”

Even after this month’s rebound, the CSI 300 is still down about 40% over the past three years on concern that authorities aren’t doing enough to boost the economy and market confidence amid a years-long housing slump.

“Ultimately, a revival in the Chinese economy and an upturn in corporate earnings are essential for overcoming this crisis,” Fang said.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.