Prime brokerage is a set of services offered to hedge funds and other non-bank financial institutions by broker-dealers, most of which are part of large banking groups. It centres around the provision of leverage via both derivatives and securities financing transactions, such as margin loans, and of the necessary infrastructure related to market access, custody, clearing and related support. Past research has studied how liquidity and funding shocks at prime brokers (PBs) can spill over to hedge funds, but contagion can run in both directions. This box uses several relatively underexplored data sets to look at how hedge funds might contribute to the risks of their PB counterparties.

but contagion can run in both directions. This box uses several relatively underexplored data sets to look at how hedge funds might contribute to the risks of their PB counterparties.

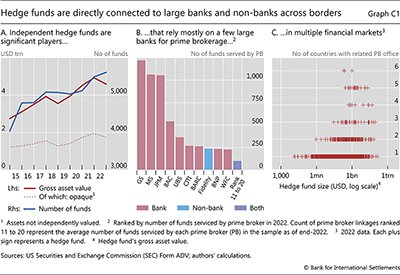

As of end-2022, US-registered hedge funds held over $4.5 trillion of gross assets (Graph C1.A). This sum refers to those funds not associated with any bank, broker-dealer or insurance company. Their gross assets are small relative to the global assets of non-bank financial institutions, estimated at between $63 trillion and $218 trillion. But hedge funds attract particular attention because of their ability to ramp up leverage, which can create financial stability risks.

But hedge funds attract particular attention because of their ability to ramp up leverage, which can create financial stability risks.

Hedge funds rely mostly on a few PBs, who tend to be global systemically important banks, with the largest ones each serving more than 1,000 funds (Graph C1.B). Larger hedge funds tend to have relationships with PB offices located in various jurisdictions (Graph C1.C), helping them to broaden their trading reach across markets.

Prime brokerage is designed to be a low-risk activity, but wrong-way risk (WWR), the opaqueness of funds’ positions and poor risk management can create vulnerabilities for PBs. WWR refers to the risk that a PB’s credit exposure to a hedge fund counterparty increases at the same time as the likelihood of the counterparty’s default. Opaqueness is present when the PB does not have the necessary visibility into the funds’ positions, eg because they are booked in different entities, the assets are complex or the assets do not have readily verifiable market values. The resulting risk exposures often become apparent only when the fund is facing severe difficulties.

These factors played out, for example, in the Archegos Capital Management episode. The fund had large and concentrated positions in a small number of shares. When these stocks suddenly plummeted, the fund’s financial strength suffered a blow, while PBs’ exposure to the fund surged, exacerbated by leverage – a case of WWR. Illustrating opaqueness, Archegos’ PBs were not fully aware of the size of the fund’s positions with other banks, thereby underestimating its overall leverage and impact on the markets in which it was active. Compounding these risks, Credit Suisse, the PB most affected by Archegos’ failure, had not set sufficiently conservative terms for the leverage it had provided. This resulted in both an excessive credit exposure for the bank and excessive leverage of the fund.

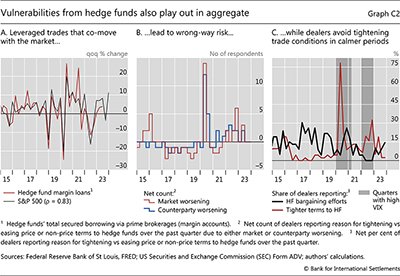

The hedge fund sector as a whole also demonstrates signs of procyclical leverage, WWR and opaqueness. PBs tend to provide more margin loans to hedge funds when markets are buoyant: secured borrowing by hedge funds correlates closely with stock market valuations (Graph C2.A), just as leverage in dealer balance sheets is procyclical. Hedge fund credit quality as perceived by dealers (Graph C2.B, blue line) deteriorates during weak market conditions (red line), when the value of assets the banks hold as collateral vis-à-vis the funds falls. This positive correlation between default probability and net credit exposure constitutes WWR. As for opaqueness, the assets of a quarter of hedge funds are not fully independently valued,

Hedge fund credit quality as perceived by dealers (Graph C2.B, blue line) deteriorates during weak market conditions (red line), when the value of assets the banks hold as collateral vis-à-vis the funds falls. This positive correlation between default probability and net credit exposure constitutes WWR. As for opaqueness, the assets of a quarter of hedge funds are not fully independently valued, comprising 38% of hedge fund assets (Graph C1.A), making it more difficult for PBs to trust the fund’s stated asset values, especially in adverse market conditions.

comprising 38% of hedge fund assets (Graph C1.A), making it more difficult for PBs to trust the fund’s stated asset values, especially in adverse market conditions.

PBs accommodate hedge fund requests for better conditions on margin loans during calmer market periods, only to tighten these conditions during stress episodes (Graph C2.C). The Archegos episode is an extreme example: well in advance of the fund’s troubles, those in Credit Suisse who wanted to maintain a relationship with Archegos reportedly resisted efforts by risk management to demand more margin. Evidence suggests that such efforts to accommodate customers occur in the market in aggregate, reinforcing procyclicality. When hedge funds seek looser trade conditions with their PBs, such as better pricing or lower margin requirements (Graph C2.C, black line), fewer dealers report margin loan tightening (Graph C2.C, red line). Dealers tighten such terms when markets turn volatile (quarters with darker shading).

These vulnerabilities call for sound risk management by PBs, overseen by risk-based, proactive supervision. Further, the global nature of prime brokerage illustrates the value of international supervisory collaboration.