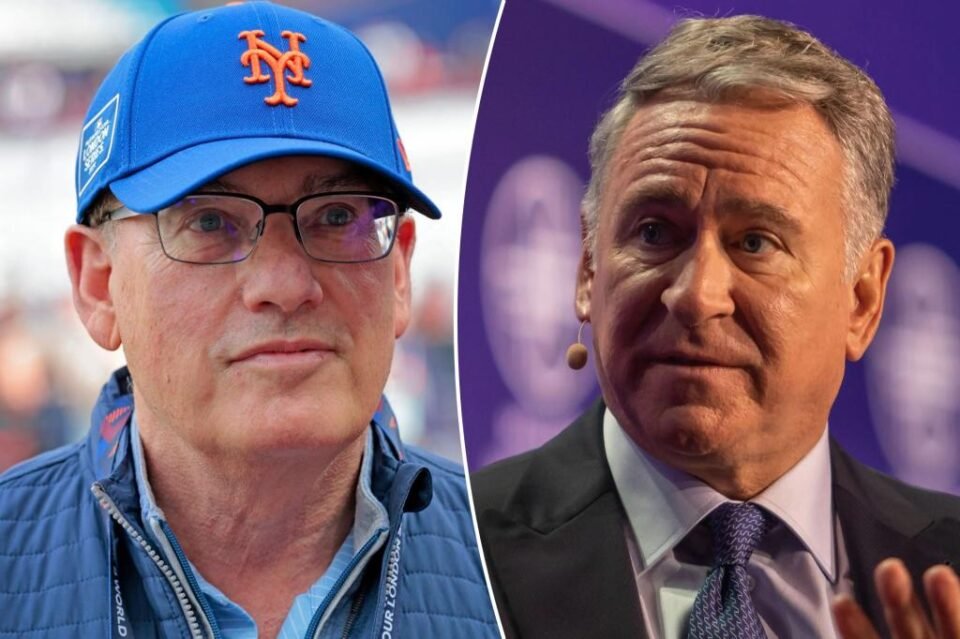

Mets owner Steve Cohen’s Point72, Ken Griffin’s Citadel and Izzy Englander’s Millennium were among the top-performing hedge funds in the first six months of the year as big investment firms on Wall Street rebounded from a sluggish 2023.

Point72, the Connecticut-based hedge fund run by Cohen, was up 8.7% year-to-date, according to figures obtained by Business Insider.

The flagship funds run by Citadel and Millennium both posted robust gains in the first half of the year.

Citadel saw its flagship Wellington fund rise 8.1% by the end of June while Millennium’s flagship fund rose 6.9%.

Citadel’s Tactical Trading Fund scored the biggest returns of them all so far this year — clocking in at 13.7%, a source close to the situation told The Post.

Nevertheless, the top-tier hedge funds’ performance continued to lag that of the S&P 500 index, which rose more than 16% during the same time period.

Last year, Cohen, Griffin and Millennium’s Izzy Englander also failed to keep pace with the S&P 500 and the Nasdaq.

Overall, hedge funds reported an average gain of 5.2% by the end of May, according to Hedge Fund Research.

Schonfeld, the Long Island-based former family office which was converted into a hedge fund run by 37-year-old math whiz Ryan Tolkin, managed some of the biggest returns on investment in the first half of the year.

Schonfeld’s Fundamental Equity fund went up 11% in the first half of the year and 2.6% in June while its flagship fund Strategic Partners ended the first half of the year up 10.3%.

Schonfeld’s results come after a more lukewarm performance in 2023, when its flagship fund finished up 3%.

After reducing its headcount last year, the hedge fund has added 40 investment professionals in 2024, including eight portfolio managers, the source said.

Schonfeld, Point72, Citadel and Millennium have all declined to comment.

Quantitative equities, tactical trading, global macro, relative value and credit were among the most important investment strategies so far this year, a source familiar with the matter told Reuters.

For Schonfeld, technology, industrials and healthcare were the main sector contributors to performance in equities, while in terms of geography, Asia was the main highlight.

Hedge funds are starting to disclose to clients their performance in the first half of year, a period of strong performance for global markets.

The MSCI’s 47-country world stock index rose roughly 11% since January, while the S&P 500 soared 15% in the first half of the year, mainly booted by megacap stocks such as Nvidia.

Last month, Bloomberg News reported that Cohen wants to raise $1 billion to buy stock in artificial intelligence firms.

With Post Wires