Three weeks ago, the most important data release of the first quarter occurred. On Feb. 14, while some people were shooting proverbial love arrows at their significant others, institutional money managers with at least $100 million in assets under management were filing Form 13F with the Securities and Exchange Commission. A 13F allows investors to see what Wall Street’s smartest and most successful investors have been buying, selling, and holding.

During 13F season, it’s not uncommon for investors to focus their attention on the moves made by billionaire asset managers. For instance, investors have used 13Fs to ride Warren Buffett’s coattails at Berkshire Hathaway to market-trouncing returns.

But when it comes to making money, Citadel’s Ken Griffin is in a class of his own. His firm’s hedge fund, Citadel Advisors, closed out the December quarter with a whopping $500 billion in managed securities spread across thousands upon thousands of investments. Citadel has also generated a $74 billion net gain for its investors since its inception in 1990, which is tops among hedge funds.

To be fair, Griffin and his investment team do a lot of options hedging — i.e., they lean on put-call spreads to hedge against their long positions. On a notional dollar basis (if the options were exercised), many of the fund’s largest holdings are hedged option positions.

Removing options from the equation, we’re left with five securities that Griffin and his team are betting on big-time.

1. SPDR S&P 500 ETF Trust: $2.63 billion in market value (as of Dec. 31, 2023)

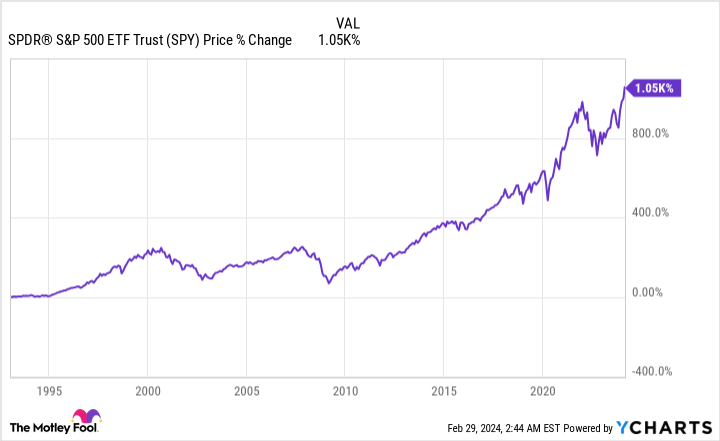

Despite owning stakes in thousands of businesses, the largest non-derivative holding in Citadel’s hedge fund is the SPDR S&P 500 ETF Trust (NYSEMKT: SPY), which is an index fund that attempts to mirror the performance of the benchmark S&P 500. Griffin’s hedge fund added more than 3.1 million shares in the fourth quarter, which brought this leading position to north of $2.6 billion.

There are two good reasons Ken Griffin and his team have invested aggressively in this S&P 500-tracking index fund. First, bull markets historically last substantially longer than bear markets. According to a data set published last June by Bespoke Investment Group, the typical S&P 500 bull market (since the start of the Great Depression in September 1929) has stuck around for 1,011 calendar days. By comparison, the average S&P 500 bear market has resolved in just 286 calendar days.

The other reason to lean on the SPDR S&P 500 ETF Trust is that economic data hasn’t produced any proverbial smoking guns signaling that the U.S. economy and stock market are in trouble. Although there are a couple of money-based metrics and predictive indicators that suggest a recession in the U.S. is likely in 2024, Griffin and his investment team have little reason to alter their strategy with corporate earnings remaining strong.

2. Nvidia: $1.8 billion in market value

The second-largest non-options holding in Ken Griffin’s hedge fund is none other than the hottest megacap stock on the planet, semiconductor kingpin Nvidia (NASDAQ: NVDA). The more than 3.63 million shares Citadel held at the end of December works out to a $1.8 billion stake.

Nvidia has quickly evolved into the infrastructure backbone of the artificial intelligence (AI) movement. The company’s A100 and H100 graphics processing units (GPUs) have become staples of high-compute data centers where split-second decision-making is needed for AI software and systems. It’s possible that Nvidia’s GPUs could account for a 90% share of GPUs in use in AI-accelerated data centers this year.

The other catalyst for Nvidia is an expected ramping up of production of its high-powered GPUs. A sizable uptick in chip-on-wafer-on-substrate capacity from chip fabrication giant Taiwan Semiconductor Manufacturing should help Nvidia meet more orders this year.

However, not everyone (i.e., me) is buying into the AI hype. Nvidia could easily cannibalize its pricing power, and it’s set to face a lot of external and internal competition. To boot, U.S. regulators have clamped down on exports of its high-powered AI chips to China.

3. Microsoft: $1.61 billion in market value

Citadel Advisors’ third-biggest non-options stake in terms of market value is software and cloud titan Microsoft (NASDAQ: MSFT). Despite selling nearly 797,000 shares of Microsoft during the fourth quarter, Griffin’s hedge fund still held 4.24 million shares (as of Dec. 31).

The lure of Microsoft has long been the blending of its cash-flow-rich legacy segments with its higher-growth initiatives. Though Windows and Office aren’t the growth stories they once were, they’re still responsible for a lot of cash flow that Microsoft has been able to repurpose in faster-growing projects.

Microsoft’s bread-and-butter growth for the past couple of years has derived from its cloud services. In particular, Azure has claimed about a quarter of global cloud infrastructure service spend share. Azure grew currency-neutral sales by a staggering 28% in the December-ended quarter, which is phenomenal, considering how much it’s already scaled.

Microsoft is also a logical candidate to benefit from the rise of AI. It’s made big investments into OpenAI, the company behind ChatGPT, and has been incorporating AI and generative AI solutions into its search engine and cloud infrastructure service platform.

4. Amazon: $945.9 million in market value

The fourth-largest position by market value in Griffin’s hedge fund is leading e-commerce company Amazon (NASDAQ: AMZN). Citadel added over 4.3 million shares during the fourth quarter, bringing its total stake to more than 6.22 million shares.

Although Amazon is responsible for roughly 38% of U.S. online retail sales, e-commerce is a low-margin segment for the company. What likely enticed Griffin and his team of researchers to pile into Amazon stock is the company’s considerably faster-growing and higher-margin ancillary operations.

No segment is more important to the future of Amazon than its cloud infrastructure service platform Amazon Web Services (AWS). AWS accounted for nearly a third of worldwide cloud infrastructure service spending in the third quarter of 2023. Since enterprise cloud spending is still in its relatively early stages, AWS can be counted on to expand by a sustained double-digit percentage.

Interestingly enough, Amazon is historically cheap, too. If the company were to meet Wall Street’s consensus cash-flow target of $13.79 per share in 2025, it would be trading at a 45% discount to its average cash-flow multiple over the trailing-five-year period.

5. Advanced Micro Devices: $885.3 million in market value

The fifth-largest non-derivative holding in Ken Griffin’s $500 billion hedge fund is another semiconductor powerhouse, Advanced Micro Devices (NASDAQ: AMD). Griffin and his team added north of 3.5 million shares of AMD during the fourth quarter, which brought Citadel Advisors’ position to about 6 million shares.

Although AMD has been “chipping away” (it would be a crime not to make this pun) at Intel‘s central processing unit (CPU) share in data centers and personal computers (PCs) over the past couple of years, it’s the company’s potential in AI-accelerated data centers that’s been raising eyebrows.

In June 2023, AMD unveiled its MI300X AI-driven GPU as a direct competitor to Nvidia’s high-compute data center dominance. While the rollout of the MI300X went to only a small number of customers last year, production and delivery should ramp up in a big way in 2024. If demand for high-powered GPUs continues to outpace supply, AMD should enjoy exceptional pricing power.

Griffin and his team might also be optimistic that AMD’s legacy segments will pay dividends. A stabilization of the PC market, coupled with ongoing CPU share gains in data centers, PCs, and mobile, could add even more pep to AMD’s skyrocketing stock.

Should you invest $1,000 in SPDR S&P 500 ETF Trust right now?

Before you buy stock in SPDR S&P 500 ETF Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SPDR S&P 500 ETF Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Berkshire Hathaway, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short February 2024 $47 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Citadel’s Ken Griffin Oversees $500 Billion in Managed Assets: These Are His Top 5 Holdings was originally published by The Motley Fool