Hedge funds are increasingly short the Japanese yen, pointing to more downside of the currency. The USD/JPY exchange rate was trading at 159.81 on Wednesday, a few pips below the year-to-date high of 160.22.

Are you looking for signals & alerts from pro-traders? Sign-up to Invezz Signals™ for FREE. Takes 2 mins.

Hedge funds are short the yen

The Japanese yen has been the worst-performing currency in developed countries in the past few years. It has already crashed by over 5% from the highest level in May and by over 20% from its post-pandemic high.

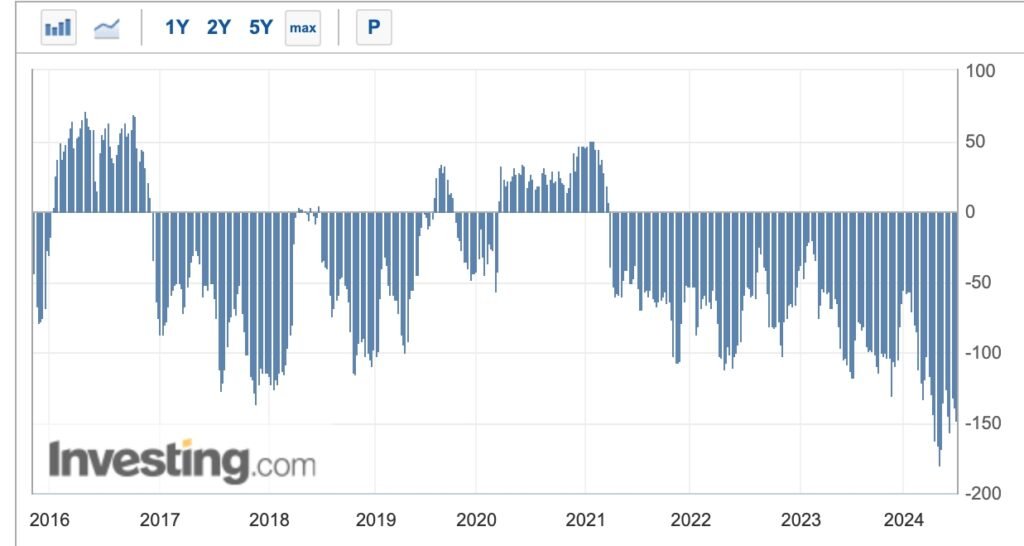

Hedge funds have continued to increase their short bets against the Japanese yen. Data by the CFTC shows that these funds have been short the currency since 2021 and the size of bets has continued to increase.

The most recent data showed that the short bets increased to 147.8k, up from 138.6k in the previous week.

Japanese yen short bets

Hedge funds and other speculators have a good reason to short the Japanese yen. For one, the country has become highly indebted with a debt-to-GDP ratio of over 200%.

The soaring debt has made it difficult for the Bank of Japan (BoJ) to implement normal monetary policy. While it recently ended negative interest rates, its rates are still at zero percent.

The BoJ will always find it difficult to hike interest rates because of the impact on the country’s budget. Japan already spends over $169 billion to repay its debt, a significant amount since the country’s budget stands at over $744 billion.

Yen’s performance is a sign that currency interventions rarely work. As we saw in 2022 when Japan pumped billions of dollars to the economy, its inteeventions this year only slowed the yen’s collapse.

The USD/JPY pair has also surged because of the hawkish sentiment by the Federal Reserve. It has left interest rates unchanged between 5.25% and 5.50% and hinted that they will remain higher for longer.

As a result, the spread between Japan and US interest rates is expected to be wide for a long time.

USD/JPY technical analysis

The weekly chart shows that the USD to JPY exchange rate has been in a strong uptrend in the past few years. This rally stalled recently as the Japanese government continued its interventions.

The pair has constantly remained above the 50-week and 25-week moving averages while oscillators have continued rising. It has also formed a rising wedge chart pattern, which is often a bearish sign.

Therefore, the USD/JPY pair could retreat slightly in the next few weeks as Japan implements interventions. If this happens, it could drop and retest the support at 155 and then resume the bullish trend.

Ad

Want easy-to-follow crypto, forex & stock trading signals? Make trading simple by copying our team of pro-traders. Consistent results. Sign-up today at Invezz Signals™.