In the weeks before she received a tip-off, Debbie Hiatt sensed that something was wrong.

Most weekdays, after her 8-year-old son Zachary finished school, she drove down from their home in the mountains near Medford, Oregon, through the Rogue Valley, a region of sloping vineyards and pine forests. From Medford, she would collect Zachary from a small clinic where he received therapy for autism. Staff turnover at the clinic was nothing new, but now, everyone seemed to be leaving. One evening in late June 2022, an employee who had grown friendly during Zachary’s frequent visits followed Hiatt out to the parking lot to deliver a message through the car window. The clinic was going to close down, along with all nine other treatment sites across Oregon operated by the state’s largest chain of autism clinics, the Center for Autism and Related Disorders (CARD).

Texas-based CARD provided an intensive form of therapy called applied behavior analysis to more than 200 Oregonians, largely children like Zachary. For the Hiatts, the news was crushing. The Medford CARD clinic, a white stucco-faced building tucked between the airport and the highway, where kids sometimes doodled with colored chalk on the pavement, had transformed their lives. The treatment, at first in a padded room, helped Zachary manage his aggressive feelings and curb the sometimes violent outbursts that had been a daily ordeal, says Hiatt. From 10 “meltdowns” a day, Zachary was after two years of gradual progress having fewer than five a week.

In the days that followed the heads-up the staffer gave Hiatt in the parking lot, CARD sent a letter to parents confirming and lamenting this “difficult” decision and “disappointing” outcome, which it says was made after unsuccessful negotiations with insurers. Oregon’s “inadequate reimbursement rates” did not reflect the increasing costs of providing care, making the company’s operations in the state unsustainable, the statement said.

For more than five years, Jasmine and Chris Merritt’s two children regularly visited CARD in Beaverton, Oregon, a suburb of Portland that neighbors the sprawling corporate campus of Nike. In the six weeks between the announcement and the closure of their clinic, the Merritts saw each of their two children’s 20-hour-per-week care schedules fall apart as therapists left for other groups. They spent days over the summer driving back and forth to rescheduled appointments. “I cried a lot,” says Jasmine Merritt.

Along with the bad news, the CARD employee who spoke to Hiatt had provided a glimmer of hope: They thought that if Oregon’s public insurers could be convinced to hike their rates for treatment, the clinic might be able to stay open. Public insurers typically pay less than private, and records show that most of CARD’s clients in Oregon used Medicaid.

“I was like: ‘Yeah, let’s do it, man!’” says Hiatt. She soon made the local news and got in touch with sympathetic individuals in the state government. Hiatt began firing off emails to health officials. “I don’t know if you can help, I don’t know what I can even do. All I know is I have to try something,” wrote Hiatt in one message to an employee at Oregon Health Authority, which administers the state’s Medicaid. “I [can’t] just give up and let my son down.”

Autism care: Boom and bust?

The Hiatts and the Merritts are just two families among the thousands across the country who have been caught up in rapid and unpredictable changes in autism services, as all 50 states passed laws requiring insurers to pay for behavioral therapy, and Wall Street investors, sensing big profits, have snapped up hundreds of clinics.

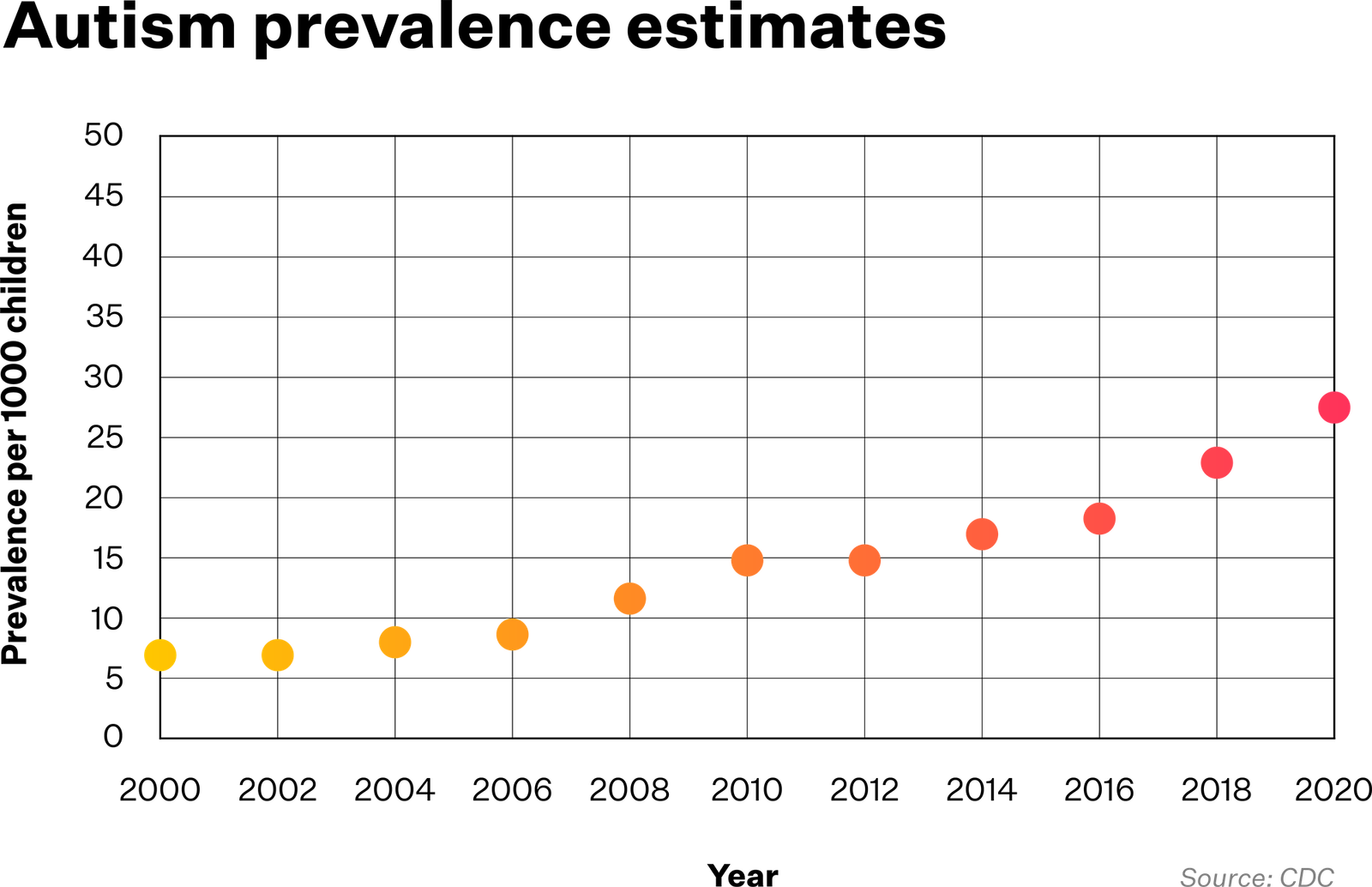

Autism rates in the United States have nearly doubled in the last decade, and today, 1 in 36 children are diagnosed with autism spectrum disorder. In this timeframe, many states, including Oregon, have gone from almost no support for autism to an ecosystem of clinics across the state. Despite investment flowing into communities across Oregon and nationwide, the initial boom in care has turned into an unpredictable and patchy new normal, in which some locations and demographics are well served while others have been left behind.

As quickly as treatment options grew, for some they began to shift or contract, leaving shattered support networks and a trail of angry and confused families like the Hiatts and the Merritts.

More than a year on from that parking lot conversation in which the staffer told her the clinic would soon be shuttered, Hiatt has been asking whether she stood a chance of saving her son’s clinic, as parents have questioned who is responsible for its financial troubles. CARD quit the state on August 15, 2022, leaving Zachary and the Merritt’s children without care as the already months-long waitlists for other clinics were overloaded by former CARD patients. Above all, both the Hiatts and Merritts had feared that when therapy stopped, the children would begin to lose what they had painstakingly learned with CARD’s therapists through applied behavior analysis (ABA).

The skills that applied behavior analysis teaches are part of an ongoing process of controlled reinforcement, where people with autism spend up to 40 hours per week with a technician who carefully rewards effective communication and controlled behavior. Hiatt calls it a “use it or lose it” kind of skill, and had already noticed lapses each time staff left CARD. “Every time he loses somebody, he regresses,” she says. She wrote another, final, email to the Oregon Health Authority in October 2022, confirming the worst. “I knew my son was going to regress,” she wrote, but had no idea “it would [be] this bad and this fast.” The result was a heartrending decline, as Zachary stopped eating many foods, fell behind in school, started running away, and returned to having daily tantrums. “Big ones, screaming, hitting, throwing chairs,” Hiatt says.

Amid these changes, parents and children are left feeling powerless and demanding answers, with Oregon’s public insurance program drawing the brunt of the criticism. CARD’s sudden exit from Oregon also surprised many investors, who in the years before had plowed billions into companies offering applied behavior analysis services. It soon became clear that this was one front in a major retreat by CARD. At the same time as quitting Oregon, CARD was shutting clinics in Michigan, Missouri, and Rhode Island. By November 2022, it had already left or was in the process of leaving 10 of the 23 states where it had clinics. According to CARD records obtained by proto.life, it was described internally as an “aggressive plan” to downsize and focus on its most profitable states.

Alarm bells had been ringing inside the company for months. The previous summer, the company was running low on cash as it failed to return to profitability post-COVID-19 and in June 2021, CARD drew the first of four rounds of short-term loans. By May 2022, according to those company records, only half of CARD’s clinics were operating in the black, and the company risked running out of cash within months.

In many states, applied behavior analysis remains the only autism treatment that insurance covers.

Things were supposed to have gone differently.

CARD was bought in May 2018 by one of the world’s biggest private equity firms, Blackstone, for a reported $600 million—a dramatic entry into a fast-growing market that appeared to justify the hype surrounding autism services. Laws like Oregon’s 2013 insurance mandate required coverage for applied behavior analysis—which provided a surefire revenue stream in a market where clinics could scarcely open fast enough to meet demand.

Doreen Granpeesheh, an Iranian-American doctor and entrepreneur who founded CARD, watched her booming empire crumble after she stepped down as CEO in 2019. In late 2022, she wrote that she regretted selling to Blackstone, and posted a TikTok video asking how things had gone south so quickly for autism care providers that sold to private equity. “Is that because COVID turned things upside down? Is it because private equity companies paid their management teams a lot higher than we ever did, and that puts stress on the company? Is it because the people that are running [applied behavior analysis] companies… don’t care as much about the [clinical] mission as they do about profits? I don’t know.”

A year on, we can begin to provide some, if not all, of the answers. CARD declined from a company that at the start of the COVID-19 pandemic billed itself as the world’s leading autism provider, with more than 230 clinics serving thousands of clients. Its dramatic fall was capped in June 2023 when it filed for bankruptcy in Texas. Court filings show the company lost $82 million in the 12 months ending in April 2023. By then it had also accumulated debt amounting to $245 million. Granpeesheh, who retained a stake, has now bought the company back for less than 10 percent the valuation Blackstone paid for it, or what’s left of it after further clinics were sold to other chains. In its bankruptcy filing, CARD cited insufficient reimbursements from insurers, shortages of therapists, burdensome leases, and rising interest rates among the reasons for its dire financial situation.

None of these explanations—issues faced by nearly all providers of applied behavior analysis—give a clear answer to why CARD is the only national chain to have gone bankrupt. Understanding why CARD vanished from Oregon can help shed light on the risk faced by states and families nationwide from private equity investment in a field reliant on low-paid labor and poorly regulated clinics.

While many people in the state have continued to blame Oregon’s insurers for not offering sustainable reimbursement rates, Hiatt now refuses to accept that narrative. A caregiver at a senior home, she and her husband Jeremy have charge sheets showing the amounts that CARD was billing their Medicaid insurer, and they struggle to fathom how the company failed to make it work. Rather than asking why Oregon didn’t pay more, Hiatt has a more vexing question: “How did they go bankrupt?”

The boom in behaviorism

Between 2001 and 2019, state after state passed laws that require insurers to cover applied behavior analysis, enshrining it as the first autism therapy that insurers are obliged to fund nationwide. In many states, it remains the only autism treatment that insurance covers.

The effort to pass these insurance mandates across the nation was driven by two things: determined parents and Autism Speaks, the nonprofit advocacy and research organization founded in 2005. After South Carolina lawyer Lorri Unumb’s son was diagnosed with autism, she led the state’s successful campaign in 2007 and soon after, Autism Speaks hired her to tour other states. Paul Terdal, a father of two boys with autism, led Oregon’s push and coordinated with her. Rather than taking years to write legislation with comprehensive systems of licensing and regulation, parents were first-and-foremost motivated to get laws passed that would get their children therapy as quickly as possible. “What you had were parents driving the creation of this profession, and our sole focus was, ‘I want insurance to pay for this,’” says Terdal. Care expanded fast but growing pains were soon evident.

Oregon was a relative latecomer. The state mandated applied behavior analysis coverage in 2013, and two years later the state’s Medicaid and children’s health insurance program began to cover it. In 2019, Tennessee became the 50th state to mandate such coverage, completing a countrywide sweep that also included requirements to cover behavioral health in both the 2010 Affordable Care Act and the Medicaid expansion in 2014. The pace of growth for applied behavior analysis—from a few hundred qualified analysts at the turn of the millennium to 66,000 nationwide in 2023—means it has consistently lacked institutions associated with mature sciences, like training schools. “We weren’t set up to man a field this big,” says John Bailey, an emeritus professor of psychology at Florida State University.

Today, fierce controversy surrounds this budding practice and the fact that it is the sole treatment available for many Americans who have autism. Parents like the Hiatts and Merritts found the support it provided life changing, and national organizations such as the American Psychological Association have recognised it as an evidence-based practice. Critics meanwhile challenge its research base, its efficacy, and its ethics—especially the use of 40-hour schedules for children as young as two. Services for autism can take a wide range of forms, reflecting the diverse ways that autism impacts the lives of children and adults, from relationship-based play time to occupational therapy that supports people with autism and helps them to negotiate schools or workplaces. There are other options as well, such as speech and language therapy, cognitive behavioral therapy, and medication for symptoms. Yet for a significant slice of the population—especially those who are insured by Medicaid providers—applied behavior analysis is the only covered form of therapy and their only alternative to paying huge sums out of pocket.

By 2021, applied behavior analysis (ABA) programs were generating $3.65 billion a year in revenues, according to a report by Marketdata Enterprises, representing the lion’s share of the $4.1 billion autism services industry. As laws were passed across the country, applied behavior analysis evolved from a market made up almost exclusively of nonprofits and small mom-and-pop clinics, usually run by a single therapist, to one where large treatment clinics and nationwide chains could be found operating in most major cities. The transformation was explosive. By 2021, there were at least 1,656 clinics, some for profit, others not. The majority of these were operated by 13 chains, which accounted for a quarter of all earnings for applied behavior analysis providers. As the money flowed, the landscape was evolving, and those chains were “aggressively acquiring competing centers and building new ones,” says the Marketdata Enterprises report.

Today, private equity firms are the largest for-profit players in autism services.

Eight of these 13 chains are backed by private equity firms, investors who typically buy companies and aim to grow their value rapidly before selling them. Private equity spent billions on applied behavior analysis, the majority on buyouts of existing clinics rather than supplying growth equity to build new ones, found researchers at the Center for Economic and Policy Research (CEPR), described by some as a left-leaning Washington economic think tank. Between 2017 and 2022, CEPR found that private equity firms were responsible for 85 percent of all mergers and acquisitions in autism services. Today, private equity firms are the largest for-profit players in autism services.

Autism became another new frontier for private equity investors. These firms built on decades of similar acquisitions in health care sectors from dentistry to podiatry to cardiology to residential nursing homes, where they merged disparate clinics into nationwide chains. The applied behavior analysis market seemed a natural fit for this well-worn playbook. In many health care fields, private equity firms have aggressively negotiated contracts with insurance companies to drive up reimbursement rates and cut staff-to-patient ratios to drive down costs, while leaving providers carrying unprecedented debts. A growing body of research has shown private equity ownership in these sectors is often associated with increased cost to patients and payers and “mixed” if not outright harmful impact on quality of care.

John McLaughlin, whose company McLaughlin Advisors dispenses advice for firms seeking to invest in applied behavior analysis clinics and for clinics looking to sell, says the “flash point” came in 2018 with investments by two of the world’s largest private equity firms. First Blackstone purchased CARD, “the granddaddy” of all applied behavior analysis chains. Following that, New York-based KKR began investing in the startup BlueSprig, based in Houston. McLaughlin says most investors closely watched the moves made by these giants, whom they jealously regarded as the “smartest money in the world,” McLaughlin says. “As soon as those two entered the industry, it was like waving the green flag at the Daytona 500.”

“The race was on.”

Breakneck expansion and growing pains

On health care’s frontlines, private equity buyouts and aggressive growth strategies sometimes bring worrisome changes. The chief value proposition of private equity is that its managers will find efficiencies that drive down costs and increase profitability—by, for example, streamlining payroll or renegotiating contracts with suppliers. In settings like applied behavior analysis, where staffing is the greatest cost and where experts say the rapport people have with their therapists is the bedrock of effective treatment, strategic upheavals can upset a delicate balance.

CARD began in 1990 as a single clinic run by 27-year-old psychologist Doreen Granpeesheh, a student of UCLA psychologist Ivar Lovaas, who pioneered behaviorism as an intervention for autism in the 1960s. Granpeesheh has been a controversial figure, and appeared in the documentary Vaxxed: From Cover-Up to Catastrophe, which links autism to the measles-mumps-rubella (MMR) vaccine, although she denies she opposes vaccines. Granpeesheh first set up shop in the Los Angeles suburb of Encino, close to the UCLA campus, and for 25 years grew the company gradually. It entered Oregon in 2015, the same year as Medicaid began covering applied behavior analysis there.

CARD began to expand rapidly in the three years before its sale in 2018, quintupling its footprint from 44 to 220 clinics, as the market grew rapidly in the wake of state mandates for applied behavior analysis. Under Blackstone the plan was to use the company’s data expertise to drive further growth, with the company targeting 500 clinics, according to CEPR.

But growing pains were already evident before Blackstone’s takeover, says Isaac Carlson, a therapist in Oregon whose mom-and-pop provider was bought by CARD in 2017. Hiring appeared to become less selective and was instead expedited for growth, with resources for training and support stretched thin. Oscar Lemus and Mica Rudich, who worked at the Portland East CARD clinic, say staff were given just enough hours to fall below the threshold at which CARD was obliged to provide health insurance. Some staffers were reliant on food banks to support themselves. While many such problems were already present, “it started to take a pretty massive turn,” around the time of the takeover, says Carlson. Five frontline staff at CARD interviewed by proto.life say they felt pushed to their limits in the company’s final years there, which had a direct impact on the lives of their clients.

Applied behavior analysis is essentially a two-track system: Board certified behavior analysts (BCBAs)—therapists like Carlson with a masters-level qualification—work with a number of patients to develop individualized care programs and to supervise sessions. Most of the hands-on implementation of those programs is provided by behavior technicians, like Lemus and Rudich. Both were recent university graduates when they started in 2017, a common background for “techs,” who are typically young, but often have no more than a high school diploma. The only training required to become a tech and treat children is a 40-hour course.

The maximum recommended caseload for a board certified behavior analyst is between 10–15 clients, states the Council of Autism Service Providers (CASP). In its final year, caseloads for the sole analyst supervising CARD’s Salem South clinic rose significantly, to around 18–30, says WillaClare Crank. Crank worked night shifts as a forklift operator with Amazon before starting at CARD, where she worked as a tech and later an assistant supervisor from 2018 to 2022. Caseloads above 15 are permitted, according to CASP, if the analyst has the help of an assistant with an undergraduate-level qualification in behavior analysis; but neither Crank nor the other assistant supervisor in her clinic possessed one. Exceeding the recommended caseload “is absolutely unnecessary and kind of unethical,” says Crank, who is now a board certified behavior analyst working in Michigan. Blackstone says it is difficult to comment on specific clinics it no longer owns, but that under its ownership CARD “made it a significant priority” to hire more board certified behavior analysts. Overall caseloads decreased from the time of the takeover to the time of CARD’s bankruptcy, which followed a period of downsizing, from 18 patients per analyst down to 10. It did not comment on the use of assistants. Parents and former employees report an effort to maximize the company’s billable hours.

“Why would techs work somewhere they could get hit, spit on, peed on, if the rate they’re getting reimbursed was the same rate they could get at Starbucks?”

The Center for Economic and Policy Research reports CARD aimed to raise revenues by targeting pre-school age children who could be billed for 30–40 hour per week services, while CARD executives discouraged clinics from admitting more adults, who typically required fewer hours. Such intensive ‘early intervention’ therapy, usually targeting children aged 2–5, is one of the core treatment methods across applied behavior analysis—although it remains controversial. Priscilla Madore, whose son Noah visited a CARD clinic in Portland from 2017–2020, says her son was initially in care for six hours a day, five days a week. “And they were always pushing us to get to 40 hours,” says Madore. Madore felt the toll—a full time schedule on top of school—was excessive, exhausting for a three-year-old. Employees would take up time during parent training sessions, where she learned at-home therapy skills, to look for gaps in his schedule for more therapy.

Lisa Nelson, who began working as a tech at the Salem North CARD clinic in January 2021, says managers were always asking why clients’ billable hours were not higher. “What number of hours the clients really needed or would benefit best from wasn’t really part of the discussion,” she says. Nelson added that CARD management pushed employees to maximize the hours they spent doing billable clinical work, even if that meant asking techs to fill in for sessions with children they had not worked with before, which were usually spent just building rapport and amounted to childcare rather than productive therapy.

In response to questions from proto.life, Blackstone says that the average age for patients was the same when it purchased CARD as when it filed for bankruptcy. It says that, under its ownership, CARD encouraged people to use the full hours they were prescribed and that clients nationwide received an average of 12 hours a week. “CARD focused on ensuring each patient received his/her prescribed hours, as determined by the [board certified behavior analyst],” says Matthew Anderson, senior managing director for global public affairs at Blackstone. “Where patients were not receiving those hours, clinical staff had discussions with the families to address that the patient would not achieve his/her expected outcomes without focusing on treatment adherence.” Schedules of 40 hours per week are clinically recognized as effective, he added. “Attempting to reach and treat this population is fully consistent with CARD’s mission.”

Blackstone says it was at all times “completely focused on supporting CARD’s core mission—delivering high-quality services to its patients.” Blackstone says that it did not have any involvement in setting the course of treatment for clients, leaving that to local, clinical professionals. The company categorically denies the claim that CARD clinics ignored the number of treatment hours a client actually “needed” or would benefit best from. “It was the opposite,” says Anderson.

Low pay and little regulation

Parents who spoke to proto.life praised the hard working techs that made a difference to their children’s lives. Still, some had concerns about their pay and working conditions. Techs struggle with burnout at staggering rates across the industry, and in Oregon, starting rates for techs were comparable to baristas or delivery workers. “Why would techs work somewhere they could get hit, spit on, peed on, if the rate they’re getting reimbursed was the same rate they could get at Starbucks?” says a board certified behavior analyst who worked at a CARD facility in Oregon and asked not to be named, as she continues to work as a therapist.

Under Blackstone, the company earned a reputation among workers in Oregon as the “Walmart of therapy,” says Rudich, who worked at the Portland East clinic until the end of 2020.

Before Blackstone acquired it, CARD had developed an industry-leading in-house training program for techs far exceeding the requisite 40-hour training and including exams and classroom instruction, found the Center for Economic and Policy Research in its report, “Pocketing Money Meant for Kids: Private Equity in Autism Services.” Such programs became less uniform and standardized after the takeover, and often moved online or were conducted unevenly at local clinics, that report found.

Blackstone says that under its ownership, CARD expanded its training program nationwide, creating new tracks for techs wanting to become board certified behavior analysts, among a host of new offerings for ongoing learning. Even so, staff turnover was increasingly common at some CARD clinics, say parents. Hillsboro, Oregon resident Lori Conley’s son started in 2016 and had one tech continually for the first two years, before working with a new arrival just about each week in 2018, around the time of the takeover. She says the frustration of parents in the waiting room was evident. Turnover increased dramatically again during the COVID-19 pandemic, as it did in many other health care fields. In response to questions, Blackstone says staff turnover remained “in line with levels” prior to its investment. But company records show it increased to critical levels.

Workers warned that clients were also hurt by a lack of resources at the frontline. Lemus, working in the Portland East CARD clinic, filed a complaint with the U.S. Occupational Safety and Health Administration in August 2019 over a lack of air conditioning, writing that children were getting nosebleeds on hot days. Staff at his clinic, he says, did not have safety equipment to prevent children from running out of the center or padded clothing to protect against biting—a common occupational hazard in the field—and until mid-2019 they were not trained in CPR to deal with the choking risk associated with a condition called pica, occurring in a quarter of children with autism, which compels them to put non-edible things in their mouths. Blackstone told proto.life it no longer has access to these records of maintenance but that any instances of its centers not adhering to the highest levels of care “would be completely unacceptable.”

One result of the rapid expansion of applied behavior analysis is that clinics in most states remain unregulated. Only about half of U.S. states have a registration board for applied behavior analysts, including Oregon. At the federal level and in many states, “there is no regulation,” says FSU professor Bailey. What regulations do exist tend to govern therapists, not clinics or their owners. When things go wrong, people with autism and their families have few avenues to raise complaints about clinics owned by private equity firms.

For more than a decade, Bailey has run the “ABA Ethics Hotline,” a website where people can report ethical violations—but only by individual therapists, not by the companies that employ them. “Parents will write in and say, ‘I want to report this company,’” Bailey says. “And we have to say, ‘Look, I’m sorry, we can’t help you.’” Worse, when bosses implement rules that violate the code, he adds, it’s the therapists who end up on the hook. “It’s really kind of bizarre.”

At their clinic, Lemus and his colleague Rudich began a unionization drive in 2018. Granpeesheh, who remained a board member under Blackstone’s ownership, appeared in person to plead for a “no” vote, and consultants hired by CARD turned up in the hallways, sometimes pulling staff out of sessions with children. The consultants worked for Labor Diverse, a shadowy organization with little more than a website that contained identical text to that of Cruz & Associates, an anti-union firm hired by the Trump International Hotel Las Vegas to quash a unionization drive in 2016. Nevertheless, on May 29, 2019, Portland East became the first applied behavior analysis clinic in the country to unionize, with employees voting 18 to 4 in favor of doing so.

CARD shut the Portland East clinic in January 2021, along with two others in the state, citing the impact of the pandemic. Lemus and Rudich still have doubts. They say management told them pre-pandemic that unionization could mean management would close the clinic. Blackstone told proto.life that CARD bargained in good faith with its workers, and that the closure of their clinic and two others in Oregon was part of an initial consolidation “to try to preserve service in the state for the remaining centers post pandemic.”

Decline and fall

The impact of the COVID-19 pandemic on the applied behavior analysis was dramatic and flattened the industry for about six months. With infection rates ballooning, people canceled appointments and therapists called in sick or quit. For many people with autism and their families, the dropoff in therapy was a heartbreaking disruption and the start of a challenging period of isolation. During this time, providers including CARD tried to shift to telehealth, finding varying degrees of success. For the Madore family, there was never a chance of six-year-old Noah sitting still in front of a computer screen for hours of Zoom therapy a day. “It was stupid,” says his mother Priscilla.

When lockdowns loosened, inflation and staff shortages soon followed.

The applied behavior analysis industry’s long-standing issues with training therapists and hiring techs went into overdrive, as people with new diagnoses were forced to wait many months, if not years, for therapy. Wage increases in other industries, like retail, lured potential new techs down easier paths. Nationwide, Blackstone says pay for CARD’s frontline workers rose 30 percent between 2019 and 2023 but former staff say they had to put up with inconsistent schedules and burdensome administrative tasks. Turnover remained a stubborn issue and, in Oregon, CARD’s reputation as a poor employer was entrenched across the sector, according to techs, analysts, researchers, and parents who spoke to proto.life. Staffing shortages suppressed the number of hours of therapy CARD could bill, its primary revenue stream. Slumping tech headcount was “directly impacting” the number of hours the company could fulfill, according to an internal report dated June 2022.

The report described “total job burnout.” Turnover among techs had been growing each year since 2020, when the pandemic began, and reached around 150 percent in 2021, the equivalent of replacing its entire workforce of techs every eight months. CARD had predicted in fall 2021 that its declining tech headcount would begin increasing again by November, but the fall continued. By June 2022 its overall number of techs had decreased by a quarter over the previous 12 months.

CARD’s failure to meet its targeted revenue was driven by a decline in the number of hours it billed across its clinics, which in May 2022 were below target, company records show. Increasing the number of billable hours each tech delivered was described in the report as a current focus. One demographic identified to help increase billable hours were preschool clients, who already averaged 23 hours of therapy per week.

Blackstone says CARD was hit nationwide by “a perfect storm of COVID lockdowns, labor shortages, and inflation that massively increased the cost of its services.” Blackstone invested in a strategy for growth, including a $48 million injection during the pandemic, but it became necessary to restructure amid the “crushing impacts of the pandemic and its aftershocks,” says Anderson.

Autism service providers nationwide have consistently argued for higher insurance reimbursement rates, and concerns about sustainability increased as inflation caught fire in 2021. States set baseline Medicaid payment rates, which are typically less than what private insurers pay, and have remained stagnant across many states. Some, like Indiana, have actually cut rates after years of steep rises. Even certain nonprofit providers have refused to accept Medicaid clients because of low reimbursement rates.

In Oregon, around 70 percent of CARD’s clients were on Medicaid, higher than most states in which it operated, and a report from July 2021 showed the state was losing CARD money. The company considered closing clinics and pausing enrollment of patients on Medicaid. Above all, it needed to raise billable hours and boost the rates it received from insurers.

In the weeks and months before the closure announcement that inspired Debbie Hiatt’s public campaign to drive up rates, Oregon Health Authority had already raised its baseline rate for applied behavior analysis therapy, and behind the scenes, insurers were already offering a flurry of significant rate increases. Some insurers, like the Hiatts’ and Merritts’, met CARD’s demands exactly. However, with staff shortages limiting billable hours, a failure to obtain more privately covered clients, and a backdrop of rising inflation, these efforts were still not enough to return CARD to profit in Oregon. Blackstone “urgently negotiated” with insurers for nearly a year but by the time of Oregon Health Authority’s rate rise, it was “too little, too late,” says Anderson. Unless all private and public insurers in Oregon adequately addressed rates, it was not feasible for it to remain, CARD CEO Jennifer Webster wrote in July 2022, in an email to a colleague. “And even then, the decision has been made.”

Unsustainable Oregon?

In its answers to proto.life, Blackstone has consistently stated that CARD’s decision to leave Oregon was driven by well-documented effects of the pandemic and insufficient insurance reimbursement rates.

Questions still remain about why CARD left when so many other clinics in Oregon have been able to continue at the rates the state provides. In the 18 months since CARD closed in Oregon, there has been no major exodus of other applied behavior analysis providers. Many clinics continue to grow despite facing the same modest rates. And statistics from Oregon Health Authority show that the number of applied behavior analysis providers has risen by 38 percent since July 2022, the month before CARD’s closure, while the number of registered board certified behavior analysts has grown by 35 percent. “[The current Medicaid rate] is plenty, as long as you align your practices with it and are thoughtful,” says Carlson, the former CARD analyst who now works at Climb Behavioral Solutions, a small Portland-based provider. “It’s not wrong to say that the rates are kind of low, but I one hundred percent disagree that it’s a reason to not work in Oregon as an ABA provider.”

Oregon was a great state to do business, according to a then-CARD executive who had worked at the company for more than five years (and who asked not to be named for fear of retribution). The state consistently made efforts to improve its applied behavior analysis provision for Medicaid recipients, according to that executive, and the rising rates meant that a longer term plan for sustainability could have worked. “I never would have exited that state,” says the source.

On June 29, 2022, CARD told parents in Oregon that clinics would close on August 15. Families like the Hiatts and Merritts suddenly faced a future without therapy, and frontline staff remember spending the final frantic weeks trying to help them transition to new services, a requirement under the ethics code for board certified behavior analysts.

At this time, Carlson was a clinical director at Centria Healthcare, another large multi-state chain, which sought to take on some of CARD’s clients and staff, and was interested to understand if Centria could preserve one or more clinics. He says their efforts were largely unsuccessful, and that it was difficult to even speak with decision makers at CARD. The experience reinforced his impression that their clients’ welfare was not a priority for the company, Carlson says. “It felt egregious, disgusting. As somebody who is board certified and has an ethical obligation to service clients and provide continuity of care and everything, it was so over the line. It broke all of those ethical rules.”

Blackstone vehemently refutes that characterization. Anderson says CARD worked “with patients, families, and caregivers on transition planning” and CARD’s leadership had “multiple conversations” with Oregon providers who were willing to partner with the company on transitioning patients.

Although CARD told staff and parents in Oregon that clinics would close around six weeks after its June 29 announcement, Blackstone’s account appears to contradict this timeline. It says it always provided a minimum of three months’ notice before closing any facility. The closure period in Oregon extended until the end of September, Anderson says, but “there were effectively no longer hours to provide across most centers by mid-August” because “the vast majority of patients had already been transferred to other providers earlier.” He writes that “if additional hours would have been sought at a center (or in home) after that period through the end of September, the company’s intention was to provide them.” Both the Hiatts and the Merritts say they were not transitioned to new providers.

What went wrong?

As the news broke in November 2022 that it would close in 10 states, CARD began a process to find new owners. Seven months later, in June 2023, it filed for Chapter 11 bankruptcy.

From 220 clinics around the time of Blackstone’s initial investment, CARD was left with around 130.

Even in the aftermath of the pandemic, the backdrop to CARD’s downfall was more growth for the applied behavior analysis market, as demand for autism services has remained strong following the pandemic. In 2022, providers nationwide saw a 39 percent year-over-year increase in the demand for autism services and a 21 percent increase in services billed, according to a presentation at the 2023 Autism Investor Summit by Chris Sullens, CEO of health care software company CentralReach. Financial analysts say applied behavior analysis remains one of the most desirable fields in health care for investors.

CARD remains the biggest applied behavior analysis chain to close across Oregon and the only national chain to declare bankruptcy. Why did it go so wrong? In addition to the common challenges faced by all providers, Blackstone says it suffered from decisions made during CARD’s rapid expansion in the years before its investment.

In addition to the common challenges faced by all providers, Blackstone says problems began during CARD’s rapid expansion in the years before its investment. The company quintupled its number of clinics in the preceding three years, requiring its new owners to make much-needed investments, including to improve appointment scheduling and staffing processes. This expansion took them to states which ultimately did not pay enough, Blackstone says. Then there was CARD’s expensive physical footprint. While other providers offered more in-home treatments, CARD’s model was heavily reliant on in-center care, which burdened it with more rental contracts than its competitors. CARD began to renegotiate its long-term leases at the start of 2022.

The loss of decades of sector-specific knowledge hamstrung CARD’s ability to overcome the obstacles it faced.

CARD founder Doreen Granpeesheh tells proto.life she was entirely honest and transparent with investors that approached her to buy CARD in 2018, including Blackstone. She says CARD was not a troubled company at the time of the takeover but fast growing and in demand from dozens of potential buyers. Blackstone undertook due diligence on various sites in different states and has an “incredible reputation” for analyzing investments before it buys, she adds. Many of the infrastructure investments CARD made under Blackstone were to prepare the company for further growth that did not come to fruition, Granpeesheh says, including new systems for scheduling, employee management, and practice management. “Those steps added expenses to the company. The combined [effect] of added expense and reduced revenue ultimately caused the company to go into bankruptcy,” she says. While COVID-19 impacted revenues, she adds, the insurance reimbursements offered in many locations, including Oregon, would have been sufficient but the company needed higher pay rates to sustain itself due to the combined effects of COVID, increased costs, and “unrealized growth.”

Rosemary Batt, an author of the Center for Economic and Policy Research (CEPR) report, says the loss of decades of sector-specific knowledge, from CEO Granpeesheh down to board certified behavior analysts, also hamstrung the company’s ability to overcome the obstacles it faced. Batt, a professor at Cornell University and co-author of the book Private Equity at Work: When Wall Street Manages Main Street, interviewed CARD managers and found the top management team doubled in size after Blackstone’s acquisition. At the same time new executives—some with little experience with autism—were paid double what their predecessors earned, found CEPR. Many of Blackstone’s new leadership hires came from backgrounds like health care giant McKesson or consultancies such as Deloitte and were used to handling billion-dollar budgets, according to the anonymous executive. But they lacked specific knowledge of applied behavior analysis and found their skills a poor fit for CARD’s comparatively small business: “They shot themselves in the foot a lot,” says the executive.

Blackstone says that CARD retained a large number of clinical leadership staff and that corporate spending remained in line with pre-takeover levels. Anderson says the CEPR report is inaccurate, new executives were paid market rates, and it is false to assert that Blackstone hires lacked knowledge of autism care. He describes them as “deeply experienced healthcare executives” who “brought strong levels of professionalism and practice standards across the organization.” Blackstone highlighted Chief Clinical Officer Dennis Dixon, a long-time CARD employee hired in 2007. However, Dixon was a researcher and data analyst, rather than a practicing board certified behavior analyst, according to the unnamed CARD executive.

Although CARD’s leadership under Blackstone focused on overhauling infrastructure, its clearest systems failure remained unfixed until the end, resulting in CARD’s biggest problem in Oregon, says the executive. Like its competitors, CARD aimed to take on clients from high-paying private insurers, but instead ended up with a large percentage of families using Medicaid. Its 70 percent-Medicaid client base in Oregon far exceeded its goals as well as the percentage of Oregonians who receive Medicaid. “The reason that Medicaid played such an outsized role is that nothing else was functioning at CARD,” says the CARD executive. CARD’s admissions system was “so ineffective” that potential new clients were kept waiting, according to the source. Hiatt experienced this firsthand, when CARD struggled for six months to process her application and lost her paperwork. Commercial clients, who had a plethora of options, were quickly recruited by other providers. The clients who were left not only paid less, they also brought further challenges: Clients with Medicaid were more likely to be older or have complex needs, and their families were often reliant solely on CARD for care. “In the end, we were upside down on our Medicaid population,” says the CARD executive who asked not to be named. Nationwide, Medicaid clients contributed around 10 percent of CARD’s revenue in 2017, rising to 37 percent in May 2022, internal records show.

Blackstone says that its rising Medicaid client-base was driven by other providers increasingly refusing to accept Medicaid patients due to low reimbursement rates, particularly in the wake of the pandemic: “many instead went to CARD— increasing the proportion of Medicaid patients it served.”

Dexter Braff, president of the health care-focused mergers and acquisitions advisors The Braff Group, says many of CARD’s problems can be traced back to the original deal. The amount Blackstone paid was made during a period between 2015 and the pandemic, when applied behavior analysis was generating hype and seemed to offer limitless growth. “The private equity market just went bonkers over autism,” says Braff.

Blackstone’s initial investment was made with 80 percent equity and 20 percent debt, a low debt level compared to similar private equity deals. However, the company’s debt roughly doubled over the course of Blackstone’s investment, reaching $245 million by the time of its bankruptcy.

The most important figure, though, may be its earnings before interest, taxes, depreciation, and amortization (EBITDA), a measure of profitability that is used to evaluate the core performance of the business. PE Hub, a private equity industry site, reported at the time of the takeover that CARD’s EBITDA was $23 million, meaning Blackstone paid more than 20 times this annual figure. Such high valuations, compared with modest earnings, outstripped anything Braff had seen in his 26 years covering health care: “We never see that—we never, ever, ever, ever have seen that.” This had the result of putting “unprecedented pressure” on Blackstone to expand by opening new clinics, he adds. If the company could not grow its revenue, it would be left holding an asset it could sell for a fraction of what it paid—a loss for Blackstone’s investors.

That growth never happened under Blackstone. CARD’s CEO remained bullish even months into the pandemic, but ultimately few clinics opened after its takeover. According to Blackstone’s own figures, 90 percent of growth occurred or was underway before Blackstone made its 2018 investment. By April 2023, CARD’s net operating revenue was scarcely higher than it was reported to be at the time of the Blackstone takeover in 2018. Amid rising costs, its core business was losing almost as much as it had been earning five years before, as the reported $23 million EBITDA earnings had become a $22 million loss.

Are lessons being learned?

Across Oregon, treatment for autism has changed beyond recognition since the state’s 2013 insurance mandate expanded access to applied behavior analysis. A mixture of small mom-and-pops, nonprofits, and larger chains, including private equity-backed Centria Healthcare, make up the state’s provider options today.

Lobbyists for private equity say that the industry has driven this expansion of choice and access in once-underserved states like Oregon. Others say the results are mixed.

Florida State University professor Bailey says the single biggest impact of private equity investment nationwide has been a shift in practice from closely supervised clinician-led care to therapies managed by less-supervised technicians. He calls it “an erosion of the foundation” of applied behavior analysis. The techs’ qualification is “a joke, in reality,” adds Zac Williams, chair of the International Society for Autism Research’s committee for autistic researchers. “So the fact that those are the folks providing most ABA is kind of shocking and sad.”

The lives of people with autism are endlessly varied, so applied behavior analysis must be bespoke.

In health care sectors like dermatology, private equity has been able to cherry-pick a set of replicable procedures, like acne treatment or mole removals, which it can repeat perpetually, while avoiding patients with more complex medical needs. Yet the lives and needs of people with autism are endlessly varied, so applied behavior analysis must always be bespoke, proponents say. It calls for more of a boutique approach than a cookie-cutter one. “The supervisor is supposed to be looking at the data and making treatment decisions based on data over time,” says Bailey. “If all of that system gets sloppy, the therapy is not going to work.”

“Keeping it small, keeping it local, is one of the big takeaways,” says Nelson, who went on to work as a board certified behavior analyst for a smaller provider, which had a lower client-to-analyst ratio and offered more flexibility in billing and therapy. If a client wanted support for off-site activities, like visiting a dentist, they could arrange something with their insurer.

This kind of flexibility has benefits not just for clients, but providers too. Staffing costs hurt bigger chains, says Braff, which are less able to offer the “soft benefits” that make mom-and-pop practices tick—maintaining good working relationships and strong personal connections with clients, for example. Ultimately, private equity may not be able to drive down costs in applied behavior analysis at all. Rising overheads are common following takeovers, according to Braff. “It’s extraordinarily rare—less than 10 percent of the time—that the earnings margin of the buyer is greater than the earnings margin of the seller, which is proof positive that there are not synergies or economies of scale,” he says.

Carlson, who now works for a small provider, agrees. “We’re taking on clients thoughtfully,” he says “We work really hard to retain our staff, so we don’t have to spend a lot of money retraining and hiring new staff. We just operate better.”

To date, private equity-backed providers account for the industry’s biggest failures. CARD’s bankruptcy was followed by the closure of 23 clinics operated by Invo Healthcare, another 30-year-old veteran provider bought up by San Francisco-based Golden Gate Capital in 2019. It announced the loss of 1,000 staff in June 2023, carrying as much debt as CARD. Two other private equity-backed chains, 360 Behavioral Health and Elemy, announced mass layoffs and clinic closures in 2022.

The applied behavior analysis industry, like the practice itself, remains in its infancy, and CARD’s bankruptcy may prove just a blip to investors in the long term. There are still millions of Americans living with autism who need care and laws that mandate coverage. Valuations are down from the heady heights of 2017, but “buyers still want in on this space,” says Braff, “and they still see opportunity in the stumblings at some of the larger companies.” Some have begun to consider school-based care as a more promising way to provide therapy, and less costly than opening clinics.

Many Oregonians still feel the loss of CARD and the committed and caring people who worked there. Some nights, the Merritt’s youngest still asks if he can go back to CARD tomorrow, Jasmine says. “‘No, I’m sorry buddy, CARD closed.’ And it breaks my heart every time my son asks for that.”

Debbie Hiatt now knows that by the time she heard about CARD’s complaints over Medicaid rates, it was too late. She accepts that the tip-off came with the best intentions from a staffer who clung onto hope that services could be saved. But her search for answers opened her eyes to the wider picture. It wasn’t until CARD’s bankruptcy that Hiatt came to perceive how the disappearance of the small clinic she had visited so many times, the one beloved by Zachary, was connected to economic turmoil, financial forces, and decisions made in boardrooms far away from Oregon and the rolling hills of Medford.

Following CARD’s bankruptcy, Hiatt says she no longer blames Oregon, having reconsidered where the problems lay when Zachary continued to receive care through the family’s Medicaid insurer.

When he pops up on a Zoom call, Zachary, now nine years old, is bouncing around in a Spiderman T-shirt, quiet but stress-free, checking out his hair, which he’s twisted into a makeshift quiff. There are always ups and downs. Still, Zachary and his family are doing better, Debbie says. After all the noise she made about Medicaid, Zachary was appointed a personal care supervisor by her public insurance provider, something he should’ve had since diagnosis. He’s also been enrolled in Oregon’s K Plan, a program that provides a support worker when the family needs to run errands.

After nearly a year without care, Hiatt’s son joined a new nonprofit clinic in the spring of 2023.