Canada’s Fighting Against Forced Labour and Child Labour in Supply Chains Act (the Act) came into force on January 1, 2024. The Act requires certain “entities” (including corporations, trusts, partnerships and other unincorporated organizations) to prepare a report on, among other things, the actions they have taken to reduce or eliminate forced labour and child labour in their supply chains, their structures and activities, and their policies and due diligence procedures on forced labour and child labour.

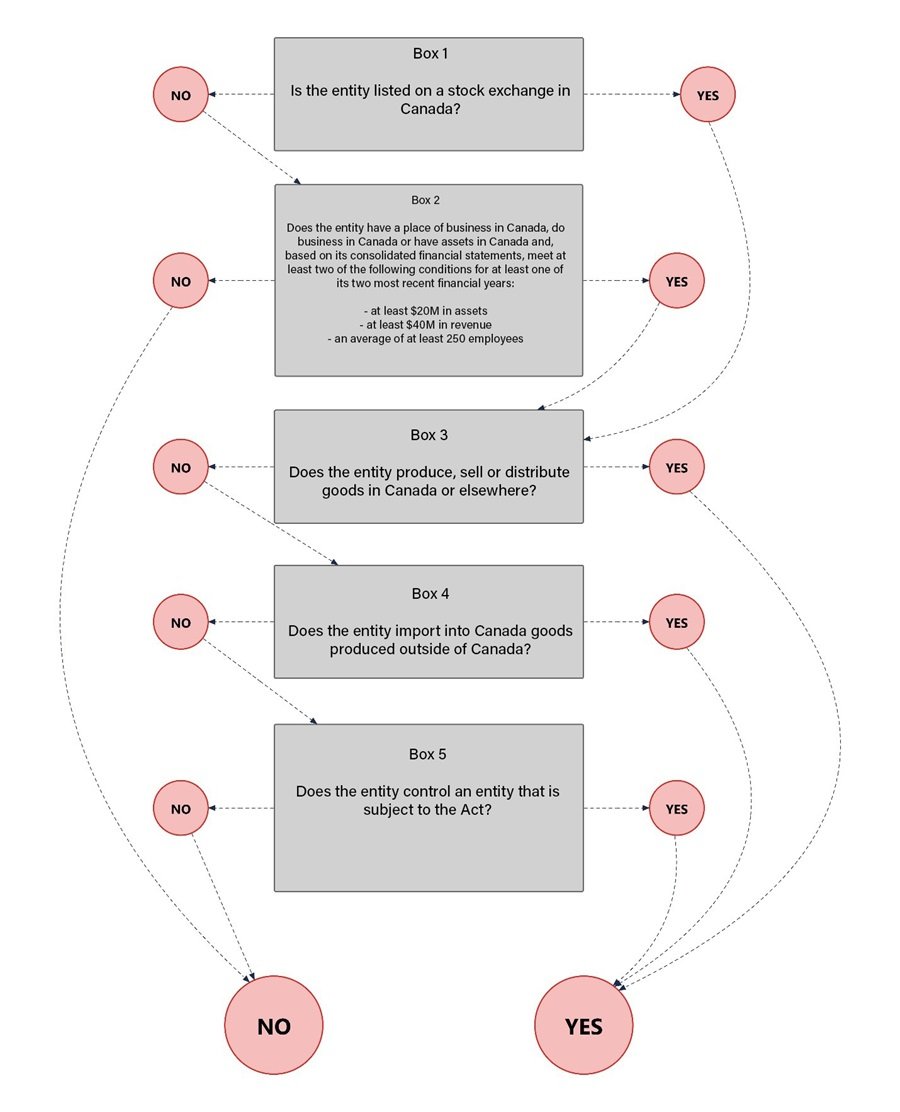

To be subject to the Act, an entity must (1) either be listed on a stock exchange in Canada or meet certain connection to Canada and financial threshold tests (see Box 2 of the decision tree below) and (2) be engaged in the production, sale, or distribution of goods in Canada or the import of goods into Canada. We refer to entities that meet these requirements as “reporting entities” under the Act. We note that recent guidance issued by the federal government calls into question whether entities that are only engaged in distribution are subject to the Act if they are not also engaged in production or importation (see our recent client legal update here).

At first glance, private equity (PE) and venture capital (VC) firms may not appear to be subject to the Act, as they are not typically engaged in the sale, production, distribution or importation of goods. However, the Act also applies to entities that control reporting entities and requires those controlling entities to file their own reports. Many PE and VC firms that meet the connection to Canada and financial threshold tests control portfolio companies that are reporting entities under the Act. Those controlling PE and VC firms are likely to themselves have a reporting obligation under the Act.

The term “control” is not defined in the Act, but it likely includes the ability to appoint the majority of the board and any control that may be exercised pursuant to an agreement. Control includes direct and indirect control. The federal government has noted in published guidance that “control” should be applied broadly and may include situations in which an entity exercises joint control of an operation.

Entities required to prepare a report must do so on or before May 31 of each year and must include information on their structures, activities, supply chains, policies, due diligence processes, risk assessment and management, remediation measures, training, and effectiveness in ensuring forced and child labour are not being used. The report must be posted on the entity’s website and will also be made publicly available by the minister.

Failure to comply with the Act can result in a fine of up to $250,000.

Are you or a portfolio company subject to the Act?