- Firm backed a 620p per share offer from US private equity group Thoma Bravo

- Proposed sale will deepen ‘existential crisis’ facing London stock market

- Exodus of listed companies being taken over or moving overseas

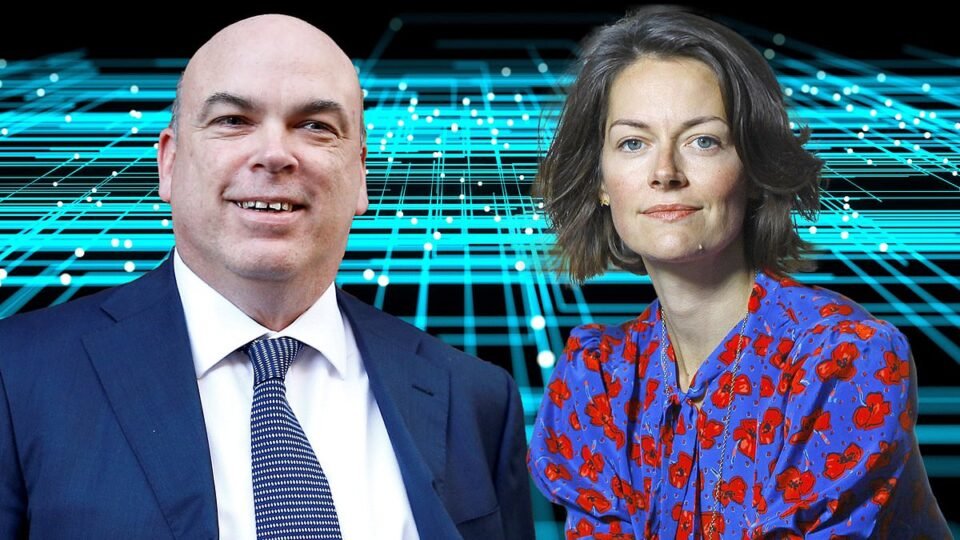

Tech entrepreneur Mike Lynch is set for a near-£300m pay day after Darktrace became the latest UK business to be targeted by foreign predators.

The FTSE 250 cybersecurity firm backed a 620p per share offer – valuing it at £4.25billion – from US private equity group Thoma Bravo.

The proposed sale will deepen the ‘existential crisis’ facing the London stock market amid an exodus of listed companies being taken over or moving overseas.

Lynch, the company’s founding investor, is on trial in the US on fraud charges relating to his former company Autonomy, which he denies.

He and his wife Angela Bacares between them own just under 7 per cent of Darktrace – a holding worth £290m under the terms of the deal with Thoma Bravo.

A spokesman for Lynch, 58, declined to comment yesterday on whether he backed the deal.

Darktrace chief executive Poppy Gustafsson will collect £24m for her stake.

Charles Hall, head of research at Peel Hunt, said UK-listed companies with a combined value of more than £100billion were now subject to bid processes or switching to other listing venues such as New York or Frankfurt. He said: ‘The UK market has an existential crisis and needs urgent action to ensure it remains a leading listing venue.’

And in a letter to MPs published yesterday, City minister Bim Afolami said he was working ‘every day’ to speed through reforms designed to help revive the sector.

Related Articles

HOW THIS IS MONEY CAN HELP

Among companies being eyed up for takeovers are mining giant Anglo American, which yesterday rejected a £31billion approach by Australian-listed BHP.

High Street retailer Currys and insurer Direct Line have rebuffed foreign takeover offers.

But others including haulier Wincanton and packaging giant DS Smith have been snapped up by overseas bidders.

At the same time, companies including gambling group Flutter and travel firm Tui are relocating their main listings to the likes of New York and Frankfurt.

Darktrace’s announcement yesterday echoed a common complaint among such companies that they are not valued highly enough by the London market. It said: ‘Darktrace’s operating and financial achievements have not been reflected commensurately in its valuation with shares trading at a significant discount to its global peer group.’

Darktrace shares jumped 16.4 per cent, or 85p, to 602p.

Chicago-based Thoma Bravo, led by Puerto Rican billionaire Orlando Bravo, 54, has more than £110billion assets under management with investments in over 75 companies. Thoma Bravo said it intended to keep Darktrace’s headquarters in Cambridge and that it would remain a ‘British tech champion’.

Darktrace, founded in 2013, employs around 2,300 people and operates across over 110 counties, boasting more than 9,400 customers.

Gustafsson, 41, said yesterday: ‘Our technology has never been more relevant in a world increasingly threatened by AI-powered cyberattacks.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.