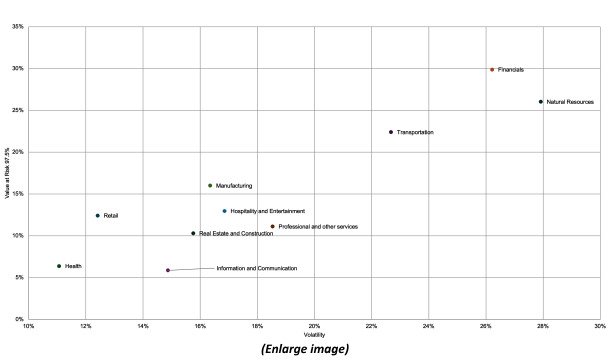

Private equity investments offer high returns in exchange for taking a certain level of risk. These risks result first and foremost in considerable return dispersion and sometimes, despite the long-term investment horizon, in exits in less favourable conditions than anticipated by investors. Private companies can also go bankrupt, but they are more likely to do so in certain segments of the private market. Stratifying the PE universe using the PECCS taxonomy, a range of risk/return profiles appears that suggest a wide range of risk-taking and return-seeking strategies (figure 1).

Figure 1: Dispersion of 10-year Volatility and Value at Risk (confidence interval 97.5%) of PECCS Activities in Europe

Source: privateMetrics PECCS benchmarks (EW, USD) as of 31/08/2024

This week we look at the Manufacturing and Natural Resources market segments (table 1). Natural Resource companies have had more volatile revenues and profitability over the past 10 years, leading to more volatile valuations and returns as compared to Manufacturing companies across all historical time periods.

Table 1: Comparing Volatility and Value at Risk (confidence interval 97.5%) of Europe Manufacturing and Natural Resources sectors

| Volatility | VaR 97.5% | |||||

| 3 Years | 5 Years | 10 Years | 3 Years | 5 Years | 10 Years | |

| Europe Manufacturing | 12.00% | 14.74% | 16.35% | 17.79% | 15.64% | 16.00% |

| Europe Natural Resources | 18.24% | 23.06% | 27.92% | 21.86% | 20.86% | 26.03% |

|

Source: privateMetrics PECCS benchmarks (EW, USD) as of 31/08/2024

|

||||||

Proper private asset risk measurement requires different data that genuinely takes account of the evolution in the risk premia to which the investments are exposed, and doing this requires indices and benchmarks that reflect these risks. privateMetrics market indices and benchmarks are asset-level private equity indices that reflect the dynamics of private markets with a beta of 1. They are built by repricing thousands of private companies each month using the latest private market transactions to calibrate an asset pricing model. This approach achieves a high degree of pricing precision at the market segment level, ensuring that indices and benchmarks built with this data accurately reflect the level of market prices and of the risk of each segment over time.

To find out more: