This is gonna be long and there’s no TLDR. Get over it.

As mentioned in this week’s news brief, the Institute of Chartered Accountants in England and Wales (ICAEW) put together a snazzy little report on the state of mid-tier firms based on a survey of managing partners. Keeping in mind that these are specifically mid-tier firms across the pond but the Brits are basically us with funny accents, bland food, and an unnecessary vowel littered throughout their words ending in -or. The biggest difference between our firms and theirs is that their advisory practices seem to be struggling even harder to secure work if frequent layoffs at large firms are any indication.

Without further blabbering, let’s get into the report.

Mergers & Acquisitions

As we predicted two years ago, firms of this size and under are merging — and acquiring — like crazy. We tend not to cover these stories because they’re not relevant to our predominantly US and Big 4-focused audience but I definitely see tons of them in my news feeds on a weekly basis. Says the ICAEW report:

While some accountancy firms favour lower-risk organic growth, the mid-tier has been active in using M&A for growth to meet client demand. The majority of respondents (64%) confirmed that their firm had acquired another in the past and 17% had been part of a merger. Of firms that had experienced fee growth in the past year, 21% was attributed to M&A.

And:

Whatever the approach, growth is an important item on firms’ agendas, with 29% of firms describing the culture of their firm as ‘growth led’. Looking ahead, using M&A to achieve rapid growth and build capacity appears set to continue in the mid-tier. More than one-fifth (21%) of respondents stated that their firm would look to merge with another in the next three years, and more than half (55%) are looking to make an acquisition. This propensity towards M&A was reinforced by respondents when asked for the key opportunities for their firm’s future, with 19% listing it among their top three.

Let’s add in here that now is a great time to absorb a practice or five because so many boomers who think succession planning is for bitches or who just assumed they’d get a ton of buyers at inflated prices are desperate to cash out. See also: The Old Guys Want to Cash Out. According to the most recent Rosenberg survey, 25 percent of all partners are over the age of 60, and 60 percent are over 50. It is, without a doubt, a buyer’s market and the mid-tiers are buying.

Private Equity

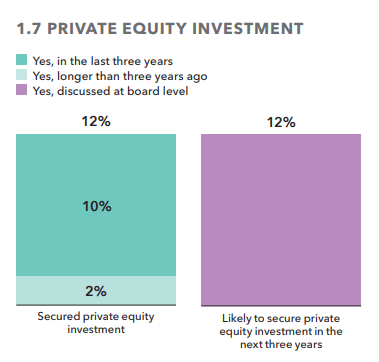

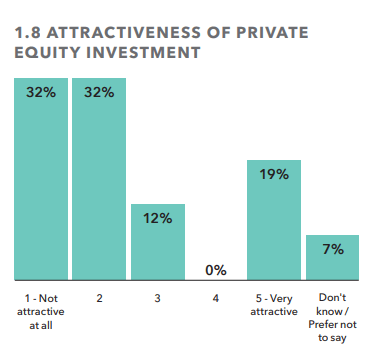

Move over talent, private equity is the profession’s hottest topic of 2024. Although the ICAEW’s research shows that only 12 percent of respondents had secured private equity investment, and 80 percent of those in the preceding three years, 57 percent of respondents ranked PE investment as a top three macro trend impacting the profession. 19 percent of firms said PE is attractive to them and 12 percent said it’s a top three opportunity (versus 7 percent who ranked it a top three challenge).

When discussing the opportunities around PE investment, respondents cited the ability to invest in technology, particularly artificial intelligence (AI) and automation, and the opportunity for growth. With 93% of firms surveyed looking to make further

investments in technology, capital injections from PE investors could be a great enabler and allow firms to get ahead of the curve.

As we’ve seen on our side of the pond, firms have said outright that private equity opens the door for them to make acquisitions. We saw this just the other week with Baker Tilly buying Seiler to gain a strong foothold in the tech-rich Bay Area within a few months of their private equity deal — that deal is rumored to be 50 percent of the firm and worth a billion dollars. Expect many more acquisitions to come.

So private equity is a hot topic and some mid-tier firms are interested but…

Close to two-thirds of respondents (62%) said that PE was “not [or] not at all attractive” to their firm. Furthermore, 17% of respondents saw remaining independent as an opportunity.

This is a valid concern. While firms appear to be getting around independence requirements by creative restructuring of their firms and quarantining off their audit practices, it’s certainly something to be cognizant of. SEC Chief Accountant Paul Munter directly flagged independence concerns related to PE deals in a recent statement:

Audit firms have also sought investments from third parties, such as private equity firms, that have not been subject to the same independence and ethical responsibilities as auditors. Depending on how those investments are structured, they could lead the firm’s professionals to question the firm’s commitment to both independence and high-quality audits. Firm leaders need to be sensitive to the message such arrangements could send and stand ready to correct any such misimpressions.

Calling it now, at least one of these PE’d-up firms is going to catch a fat independence violation within the next two or three years because they got sloppy about their post-PE restructuring.

Some visuals from the ICAEW because we love pictures:

We predict that chart will look very different two years from now as the “not attractive at all” crowd watches their competitors grow their practices in ways that wouldn’t be possible on billable hours alone. The “Not attractive at all” column will shrink but that won’t necessarily mean large numbers of firms start jumping into PE. They’re comprised of risk-averse accountants after all.

That said, many firms in the ICAEW survey are understandably concerned that PE will do a Red Lobster on their firm. It’s rumored — rather, people with eyes and brains are postulating — that Grant Thornton’s recent layoff of 350 people is due to PE-related housekeeping. No doubt more PE-aligned firms will be trimming fat as their investors seek ways to streamline the business. Firms that are already a hot mess will be gutted and sold off in parts.

And there’s another concern: the personal touch. It’s the family-owned grocer versus Wal-Mart.

Conversely, maintaining independence may support firms in upholding their unique identity, values and client approach, which some firms believe could be jeopardised under external ownership. More than one-fifth of respondents (21%) described the culture of their firm as ‘family-like’, and a further 17% as ‘traditional’, which may not be seen as a natural fit for PE investment. One respondent suggested that there were already “disgruntled clients” unhappy with accountancy firms taking on PE investment, and that remaining independent was an opportunity for their firm.

So this is interesting. When news of EY splitting its audit and consulting practices hit the news, we saw their competitors championing their “multidisciplinary private partnership model” as superior to the chopped up service lines EY was debating. See: Deloitte Global CEO Joe Ucuzoglu Just Mic Dropped EY’s Messy Split Drama and PwC Plans to Poach Unhappy Senior Managers From EY. In both of the linked examples, EY’s direct competition was quick to plant a seed in clients’ minds that their way of doing business was superior to what EY would have going after the split. We should expect to see similar behavior with non-PE firms versus PE-funded ones.

Brace yourselves for a bunch of corny “wE’rE a FaMiLy” marketing from firms that are morally opposed to private equity investment.

OK, but there’s another concern at these firms. While private equity is touted as a band-aid solution to the talent shortage (theoretically, private equity cash can help fund better salaries and efficient technology), some firms think it is more con than pro.

Comments from those looking to remain independent highlighted a sentiment that a PE model did not value people in the same way as traditional partnership structures. One respondent stated that staying away from PE was an “opportunity to recruit good staff that PE-backed firms underappreciate”. Another cited their firm’s desire to: “…retain a ‘traditional’ people-focused practice model which, in the light of increased private equity involvement in other practices, may make us more attractive.”

We have no doubt this will be the case. The public accounting model is shitty enough already without adding another layer of profit bloodletting to it.

A third respondent said: “We remain a privately owned network of businesses. [We see an] opportunity to attract other like-minded firms who wish to avoid PE funding and all that goes with that.”

Again, can totally see that. Aspiring retirees with their practices on the market may prioritize a culture match over a quick sale. Depends on how desperate they are to cash out I suppose.

Choice quote from this section:

Oh fuck off, firms can afford outsourcing without PE. That’s the whole point of doing it, you scrub.

This article is already long enough so we’ll stop here and hit part two on talent and technology tomorrow.