So EisnerAmper announced they bought themselves a smallish firm in Los Angeles this week. Whoop-de-doo. But because they were the first large accounting firm to blow up the Hoover Dam of capital and invite private equity to the professional accounting services sector, that story got me thinking about how much has changed since EisnerAmper did their deal with TowerBrook Capital in late 2021.

Thus I went digging around in our archive and revisited the story I wrote about their getting in bed with private equity on September 14, 2021: Private Equity Is Now Dipping Its Toes In Public Accounting Firms

What I found there made me cringe into another dimension.

You see, I’ve written 3,792 posts on this website over the last 15 years. I’m old so my memory isn’t what it used to be and what it used to be already sucked so I can’t possibly remember everything I’ve written. Regular readers of Going Concern will know my approach to anything accounting firms say is usually cynical, perhaps overly negative, and dotted with profanity.

For some reason, I threw skepticism out of the window for the EisnerAmper private equity deal and like an absolute fool I naively believed the PR line at the time which was that private equity investment would give accounting firms necessary funding to make big investments in talent and technology. And unlike bad takes of years past, I can’t say I was drunk when I wrote it because I no longer drink. Excerpt of the old article in italics:

TowerBrook’s significant capital infusion will help drive EisnerAmper’s long-term growth initiatives, which include accelerating the evolution of service offerings, investing considerably in talent and technology, and strategically expanding via organic growth and targeted mergers and acquisitions—all directed at exponentially enhancing client service.

We can safely extrapolate from this bit that Eisner understands it will take more than squeezing clients for every dime billable hours to compete in the ongoing (and escalating) talent war.

Fucking idiot. Naive nitwit. What was I thinking? Why did I, for once in my life, blindly believe an accounting firm’s flowery press release? This was right about the time ‘The Great Resignation’ was well underway and Wall Street Journal jumped on the accountant shortage train, pushing out article after article about how dire the situation was becoming and would be in the near future. I suppose I believed firms were panicking about the talent thing and would take appropriate measures to recruit and retain talent. YOU ABSOLUTE FOOL.

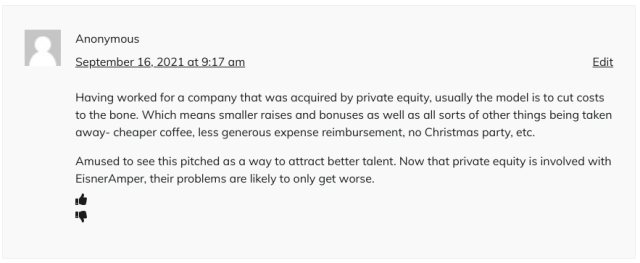

Someone even called it out in the comments at which point I should have deleted the post in shame but we don’t do that so it forever remains a reminder of how naive I can be despite my deeply embedded cynicism toward the motives of accounting firms.

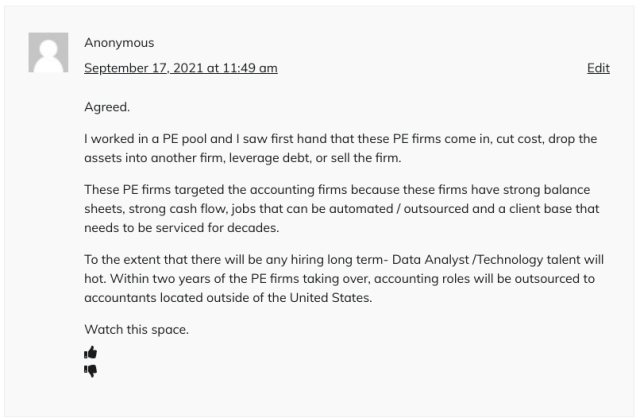

And another one.

Sigh. Look at Miss Cleo up here knowing what’s up. It shouldn’t have been difficult for me to foresee either, firms had been headed that direction for more than a decade by that point and I’ve been observing them for long enough to know all too well how they operate (that’s where the cynicism comes from, after all). At least now they’re being honest about what they’re using private equity for.

Boomer Partners Selling Out To Private Equity And Riding Off Into The Sunset

byu/ConcentrateMedical61 inAccounting

I can admit when I’m wrong and in this case, I was embarrassingly wrong. Wrong. More wrong than I’ve been on anything else.

I promise to be more skeptical of obvious bullshit in the future.