For EQT, the interest ran high up its hierarchy. Senior adviser, David Gonski, got on the phone to Perpetual chair Tony D’Aloisio to hammer home the private equity firm’s interest in the business. For TA, Ed Sippel, its Hong Kong-based head of Asian operations, led negotiations for the other half of the consortium, according to people involved who requested anonymity to speak freely.

KKR, meanwhile, took its discussions to New York, where its committees run the ruler over acquisitions. Locally, Australia and New Zealand co-head David Lang and Anna Kilmartin, a principal who worked on both the Arnott’s and Colonial First State buys, were marshalling proceedings for KKR.

Bankers, too, had nestled in on the buy side. Barrenjoey and Morgan Stanley were working with EQT and TA, The Australian Financial Review’s Street Talk column reported in April, while Jefferies’ Michael Stock was advising KKR, alongside Gilbert & Tobin’s Alex Kauye, a partner in its corporate advisory group.

By April, Project Constantine had whittled down to either KKR or the EQT-TA consortium. KKR wanted the two businesses, EQT set sights on the corporate trust unit and TA was drawn to the wealth management arm.

What’s in a name?

Perpetual sign being taken down from on Thursday May 9 in Sydney. Louie Douvis

The cash offers from both suitors were tight, but EQT and TA’s tie-up had complications. Perpetual’s storied, 137-year-old name was a critical component of the negotiations for all interested bidders, and it was imperative that whichever firm won, it gained the right to own the businesses and the Perpetual brand.

Boston-headquartered TA did not want to share Perpetual’s naming rights with a rival buyout firm like EQT, putting a dampener on negotiations, people familiar with the talks said.

KKR’s offer as a sole owner of Perpetual’s trust and wealth businesses also negated the need to split up the units across two private equity firms, and determine which firm would pay for certain separation costs.

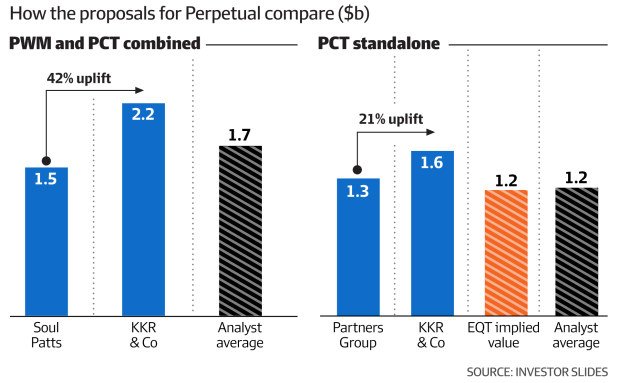

As the two bidders crafted their final bids, bankers and lawyers pondered whether Soul Patts – now a near 15 per cent shareholder in Perpetual – would return with a revised offer for the businesses.

No doubt, the investment conglomerate’s initial $3 billion bid provided an ample structure – separate corporate trust and wealth from asset management – that private equity firms could mirror in their bids, but ultimately, it was higher cash offers, from deep-pocketed buyout firms that would inevitably win over Perpetual.

KKR, meanwhile, gained an upper hand when it scored exclusive negotiations with the asset manager last month. It not only tempered rival bids, but enabled Perpetual to hone in on one potential deal, that ultimately became the winning offer.

That offer splits Perpetual into two. Shareholders will get a share in the existing company and eventually a dividend from the sale to KKR. Importantly, Perpetual structured this deal so its shareholders can vote on the transaction, something they could not do when the company bought Pendal for $2 billion in 2022.

Adams, Perpetual’s outgoing chief executive, believes the break-up and rebrand of the company as a stand-alone asset manager requires fresh eyes. While the public market has been unforgiving of the decision to pursue growth through acquisitions, Adams is confident the strategic review and sale to KKR unlocks value that shareholders have long craved.

“I honestly believe this needs a minimum four-to-five-year commitment, and I, hand on heart, cannot give that time commitment with a combination of fundamental changes in the role,” Adams told AFR Weekend.

“Post completion, the company will go from being a diversified, complex business to a monoline asset manager. So this is a very different role … it is a good time to pass the chalice.”