Private equity backers of Moonpig have cashed in significant stakes in the greetings card retailer at a double-digit discount.

Their decision prompted investors to send a clear message of their own, sending the shares down sharply on what became Moonpig’s worst day of trading in three years as a listed company.

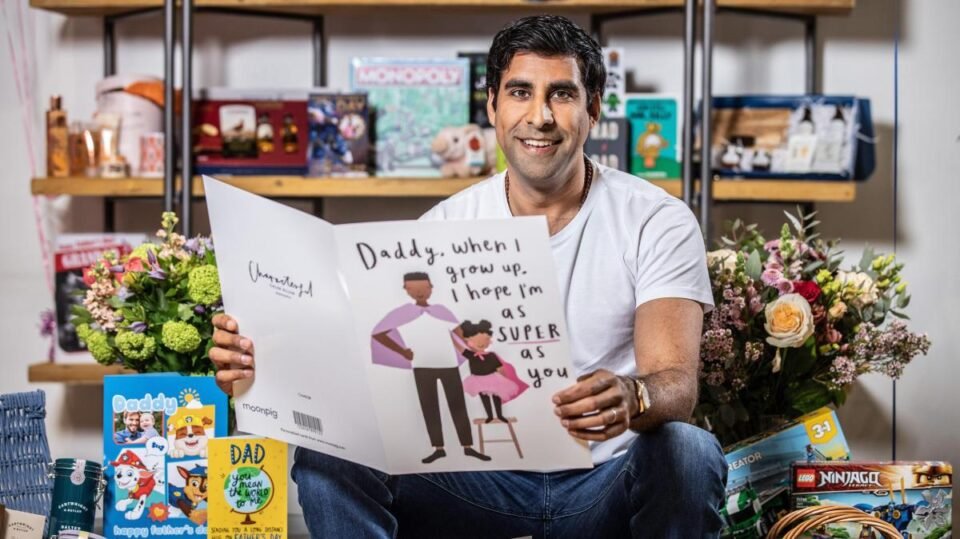

Investors led by Exponent, the private equity firm, sold 25 million shares in the FTSE 250 online cards and gifts seller at 160p apiece, more than 10 per cent below Wednesday’s closing price of 178p. The sale will cut Exponent’s stake in the business by about a third to 8.2 per cent and will raise £40 million in proceeds. Strategic Value Partners, LGT Capital Partners, GoldPoint and Abrdn also joined the secondary placing, with