Buyout fund managers just finding their footing in the higher-for-longer interest rate environment have to deal with a backlog of portfolio companies investors are eager to exit.

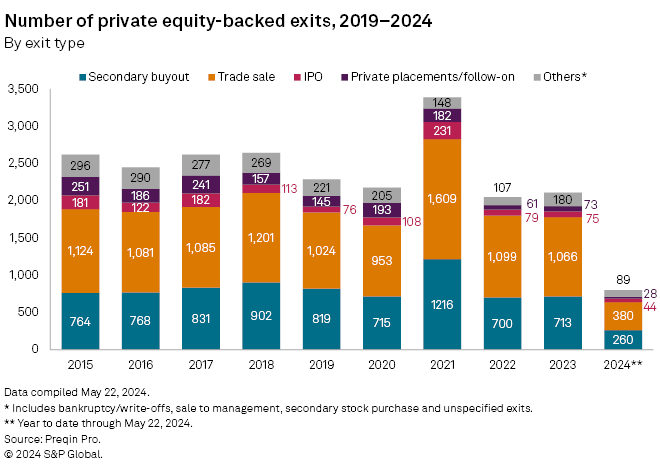

The rate-hiking cycle that kicked off in March 2022 dented corporate valuations, dampened M&A activity and stifled IPOs, prompting private equity general partners (GPs) to put off exits until conditions improved. The number of private equity exits fell 40% between 2021 and 2022 and remained essentially flat in 2023, according to Preqin data.

Exit pathways remain open for top-performing assets, but a glut of portfolio companies nearing the end of the typical investment period is raising urgent questions for limited partners (LPs) — the private equity investors like college endowments and public pension funds, which have seen flows of distributions from funds slow in recent years.

Boosting distributions is critical for reversing a two-year decline in private equity fundraising since LPs recycle distributions into new fund commitments, said Claudine Cohen, a managing principal at CohnReznick who advises private equity dealmakers.

“Private equity are there to buy and sell companies. You can sit on the sidelines for however long, but at some point you’ve got to get back into the market,” Cohen said.

‘Long in the tooth’

Bain & Co. estimates about half of the roughly 28,000 companies in global buyout fund portfolios have been held for four years or more, “getting quite long in the tooth,” said Brenda Rainey, executive vice president of the firm’s global private equity practice.

“Oftentimes it is just a business that, for any number of reasons, might be struggling, and it is simply not in a place to put into the market and generate a successful exit. And that is a lot of what is still in the portfolio today,” Rainey said.

As the average holding period for a private equity portfolio company spiked to 5.8 years in 2023, the highest since 2015 according to Preqin data, interest rates and elevated inflation took a toll on private equity portfolios. Portfolio company bankruptcies filed for bankruptcy protection a record 103 times in 2023, and as of mid-May were on pace to nearly match that total again in 2024.

“Fundamentally good businesses are still doing pretty well,” Cohen said, as much of the global economy glides to a soft landing, avoiding recession despite the shocks from interest rates and inflation. Companies already struggling two years ago may be in an even tougher spot as higher interest rates throttle cash flow.

“[GPs] just don’t like to talk about it, honestly,” Cohen said.

Shifting outlook

With portfolio company valuations under scrutiny, GPs got creative in their efforts to produce exits in 2023. Private equity took a larger share of M&A deals with earnout provisions, which make an exited company’s sale price contingent on reaching specific performance goals.

Goodwin partner Liam Timoney, a member of the firm’s private equity group, said earnouts are less prominent in private equity deals in 2024 as sales processes become more competitive.

“We’re seeing the dynamic shift again towards more seller-favorable than what it was five months ago,” Timoney said.

The economy appears to be on track for a soft landing, helping to close what had been a stubborn divide between buyers and sellers in the M&A marketplace, said Pete Witte, global private equity lead analyst for EY.

While purchase price multiples have fallen since 2021, their decline has stabilized in recent quarters.

“There’s a lot of evidence out there that the reset is in its later stages,” Witte said.

On the horizon

Declining private equity exit activity may have found a bottom, Bain’s Rainey said, but a rebound remains a bit out of reach. When Bain surveyed 1,400 GPs in March, nearly 40% predicted it would be 2025 or later before deal markets “bounce back,” while another 30% predicted higher activity no sooner than the fourth quarter of 2024.

It could be longer before GPs flip a key metric watched by their LPs: distributed to paid-in capital (DPI). Slumping exits dragged down DPI as less cash flowed back to investors.

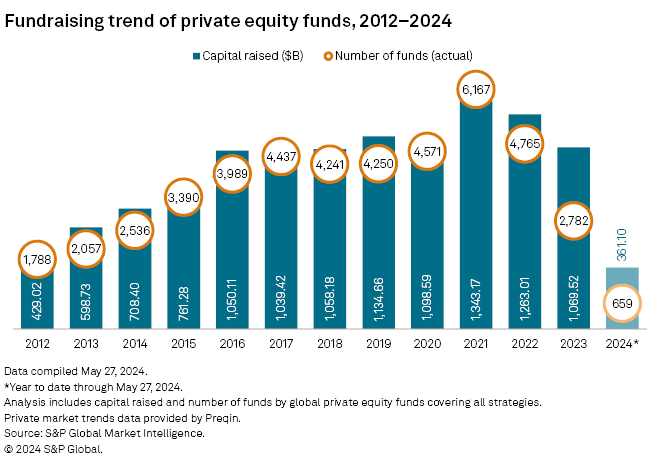

“LPs have been cashflow negative now for four of the last five years, in aggregate,” Rainey said, adding that it is having a measurable impact on fundraising.

Global private equity fundraising was on track to decline for a third consecutive year, with 659 funds in the market raising an announced total of $361.10 billion as of May 27, according to S&P Global Market Intelligence and Preqin data.

Nearly five full months into 2024, private equity firms had secured fund commitments equal to about one-third of the $1.069 trillion total raked in last year.

“Getting distributions back to their investors so that they can be recycled into new fund commitments is absolutely critical,” Rainey said.