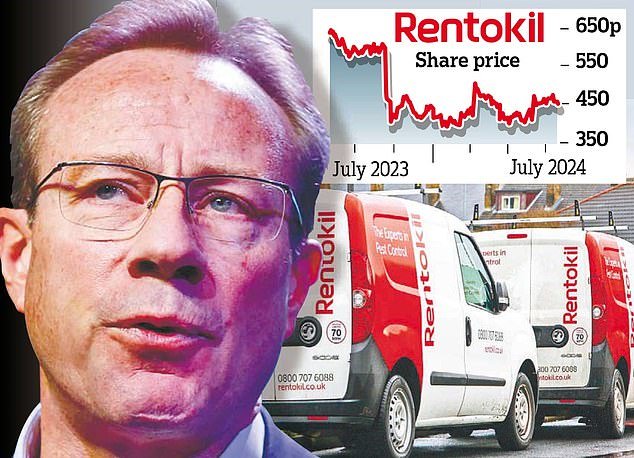

Rentokil shares will be in focus when the stock market opens today amid reports it has become the City’s latest takeover target.

The FTSE 100 pest controller is at the centre of a £15billion swoop by the former boss of BT.

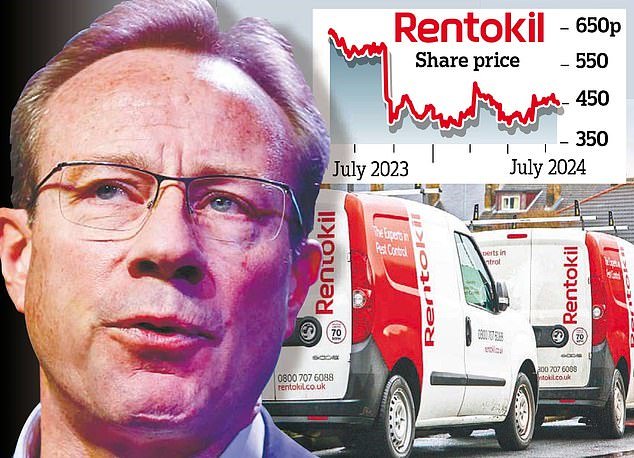

Philip Jansen, who left at the start of this year, is seeking private equity funding for a deal that would see him become executive chairman.

Swoop: Philip Jansen is seeking private equity funding for a deal that would see him become executive chairman at Rentokil

Rentokil has struggled since it took over US rival Terminix in 2022, failing to win new customers in North America.

Jansen, 57, is keen to improve the company’s performance across the Atlantic. Possible bidders include CVC and Bain Capital.

Analysts at Jefferies said that ‘broader private equity interest is unlikely to be much of a surprise’.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

eToro

eToro

Share investing: 30+ million community

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.