Schroders has launched its first private markets engagement blueprint which looks to the same engagement priority themes of climate change, natural capital and biodiversity, human capital management, human rights, diversity and inclusion, and governance as in public markets.

Paul Lamacraft, head of sustainability & impact – private equity at Schroders, told Markets Media: “We launched the blueprint to be consistent with what we have done across the broader group.”

Schroders Capital, the private assets investment division of Schroders Group, encompasses private equity, private debt and credit alternatives, real estate and infrastructure. The blueprint said Schroders Capital has more than 300 investment professionals in 26 locations around the world and $94bn in assets under management.

“There is a slightly different dynamic in the private markets as we are looking to be pretty active and heavily engaged with the businesses where we are investing,” added Lamacraft.

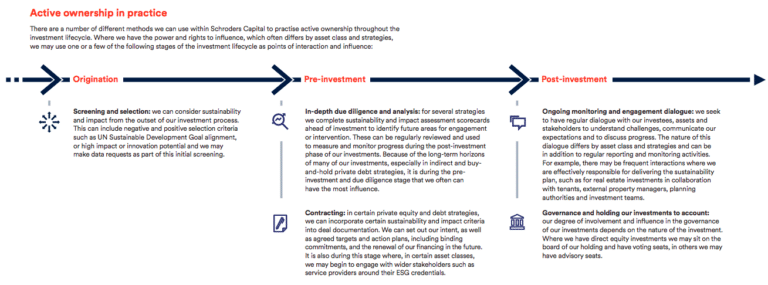

In private markets Schroders is often a majority owner or owns a very significant proportion of ownership alongside a general partner (GP). Lamacraft said the Schroders is investing in businesses for four, or five or six years and need to make sure that everyone is fully aligned pre-investment to drive them in the right direction during that holding period, so ESG is a fully integrated part of the investment process.

“We have a proprietary approach based on scorecards and there is a real consistency across the private markets group,” he added. “That upfront analysis, digging into the ESG risks and opportunities is where we spend a huge amount of time shaping whether we actually want to go into the deal.”

As in public markets, ESG data is one of the biggest challenges. If the data is not available at the time of the investment, Schroders tries to get the company to commit to providing that data over the coming years. At the same time, Schroders is working with industry bodies to try and encourage more consistent data provision.

Contracts will include identified key performance indicators (KPIs) that need to be reported on a regular basis, and Schroders will look to develop the KPIs over time. The contract could also set out the consequences of not meeting the KPIs, such as limiting any further investment during fund raising.

“We have engaged with around 25% of our assets under management over the last 18 months,” he added. “We are pushing on an open door.”

Lamacraft said Schroders is seeing more interest from investors wanting to put capital to work in private markets.

“We think there is a great opportunity in terms of democratisation, and we have opened a number of new structures and products that should open private markets to a wider audience,” he added.