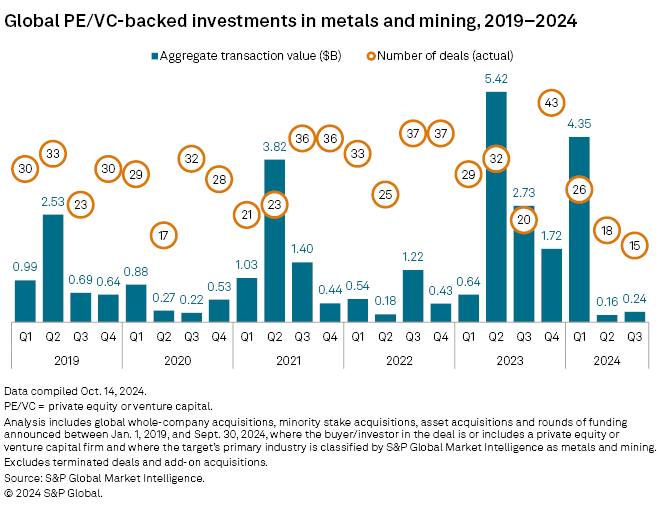

Private equity and venture capital transactions in the global metals and mining industry are trending lower in 2024 after reaching a five-year record in 2023.

As of Sept. 30, transaction value reached $4.76 billion, down more than 50% compared to the $10.52 billion total in the full year 2023, according to S&P Global Market Intelligence data.

The number of announced deals in the first three quarters was only 59, putting the year on track for the fewest deals in five years.

Higher acquisition debt financing rates and reduced venture capital deployments contribute to lower totals, said Antti Gronlund, managing director of private equity at UK-based Appian Capital Advisory LLP, which invests in metals, mining, and related companies globally.

Transactions in 2023 may have benefited from large deals and nonsector-focused investors attracted by upbeat headlines focused on electric vehicles, which require significant amounts of lithium, nickel, cobalt and a long list of other metals. Those headlines are now more subdued, affecting deal appetite, Gronlund said.

In the third quarter, deal value plunged 80% year over year to $240 million from $1.22 billion and deal count fell 59% to 15 from 37.

– Download a spreadsheet with data featured in this story.

– Read about Blackstone’s transactions outlook.

– Explore more trends in global private equity deal-making.

Sector opportunities and challenges

“We are seeing metal scarcity in a number of subsegments, particularly related to net-zero efforts,” Gronlund said.

The energy transition and upgrading aging electricity infrastructure are expected to increase demand for metals such as copper.

“The power networks represent over 25% of the copper demand this year. By 2030, the world will likely need almost 30% more copper year-on-year versus now,” Gronlund said, adding that no significant large-scale copper exploration successes have been announced recently.

Demand for zinc is rising due to its use in galvanized structures for renewable power infrastructure. But zinc from existing mines is decreasing, he added.

Near-term challenges for mining companies include rising capital requirements, operating costs and longer project timelines due to extended permitting schedules. It now takes nearly 18 years to bring a mine into production compared to roughly 15 years two decades ago, Gronlund said.

Private equity and cash requirements

Private equity investing is challenging because the sector is “working capital intensive,” said Kyle Mumford, partner at KPS Capital Partners LP, which invests across the metals and mining value chain.

“There are no small capital requests in a metals business. There’s only really big ones,” Mumford said. “Unlike other businesses, in metals and mining, change in profitability and manufacturing to meet the demand that may be out there takes a long time and is really hard. It can mean a new equipment or a new mill or a new recycling capacity. Those are expensive and don’t often meet typical private equity return profiles.”

Yet opportunity exists. The metals and mining industry is expected to require about $2.1 trillion by 2050 to support global net-zero goals, Gronlund said, citing BloombergNEF. A significant portion of that will need to come from private capital sources.

Most investors are optimistic about the natural resources asset class, with only 11% expecting worse performance in the next 12 months compared to the previous year, said Victoria Chernykh, Preqin associate vice president of research insights, citing a July 2024 investor survey.

Top deals

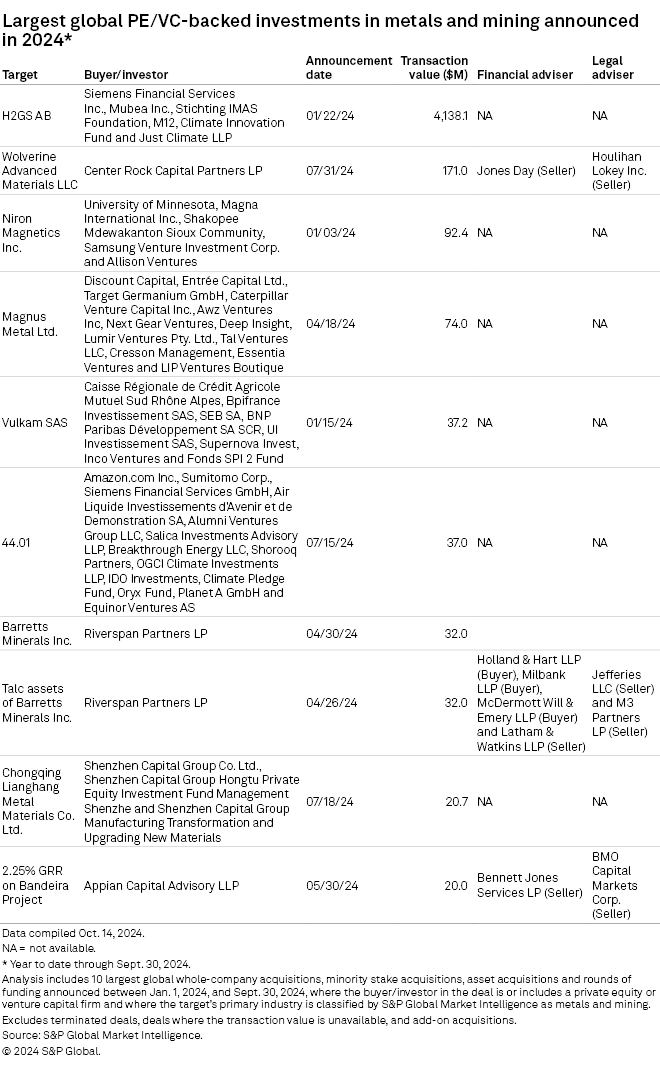

Steel producer H2GS AB’s $4.14 billion funding round in January led private equity and venture capital deals in the metals and mining sector from Jan. 1 to Sept. 30. Investors included M12 and Just Climate LLP. The round accounted for most of the deal value through the third quarter.

Largest funds

Among funds with exposure to metals and mining currently seeking capital, KKR & Co. Inc.’s KKR Global Climate Fund, focused on Europe, has set the highest target at $7 billion. The ten largest funds aim to raise a combined $18.37 billion, according to Preqin.