Justin Ishbia may not be as well known (or as rich) as his younger brother Mat. But with a $7 billion portfolio of veterinary clinics, autism treatment centers and bakeries, he’s made a fortune for himself and his investors.

By Matt Durot and Amy Feldman, Forbes Staff

“Italk fast,” says Justin Ishbia with a smile during a recent tour of Shore Capital Partners, his Chicago-based private equity firm. Wearing Nikes with a blazer and jeans, the 46-year-old billionaire moves fast, too, racing through a jam-packed schedule—courtside seats at the Bulls game the night before with his younger brother, Mat, the Phoenix Suns’ controlling owner and also a billionaire; a quick catered lunch with Forbes and four of his top lieutenants followed by a portfolio company board meeting; then a private flight to Oregon to watch U of O’s football team play USC with his law school buddies. He answers texts and emails within minutes, regardless of the hour. “I don’t sleep very much,” he says.

Shore Capital moves just as quickly as its founder. The health care–focused microcap investment firm sealed 801 deals from 2020 to 2023, making it one of the world’s busiest buyout shops. Its assets under management soared sevenfold to $7 billion during that period, as stellar returns convinced early investors like the University of Notre Dame and Sequoia Capital’s wealth management arm to steadily boost their commitments. But with its 15th anniversary this year, Shore remains a minnow in the ocean of private equity—where the largest fish, such as Apollo, Blackstone and KKR, oversee more than $500 billion apiece. That’s by design. “We’ve turned away billions of dollars,” Ishbia says. “In private equity, when you’re good at your job, you raise a bigger fund. My thesis was, ‘Who stays in microcap?’ The answer is basically nobody.”

STAYING SMALL is working out big time: Shore’s average internal rate of return on its 14 exits, all in health care, is 53%, net of fees. That’s nearly triple the average net IRR of U.S. buyout funds raised since 2009, according to data from Cambridge Associates. After Shore took its 20% to 30% cut of profits, its exits multiplied investors’ money by 5.5 times on average, also nearly triple the average total value to paid-in capital multiple of U.S. buyout funds raised during that period. Shore has never unloaded a company for less than three times cost before fees, nor, it says, has it ever suffered a loss. “Those are top 1% returns in private equity,” marvels one investor who asked not to be identified, citing his organization’s press policy. “That’s rarefied air, right? That’s more like venture capital than a traditional buyout firm.”

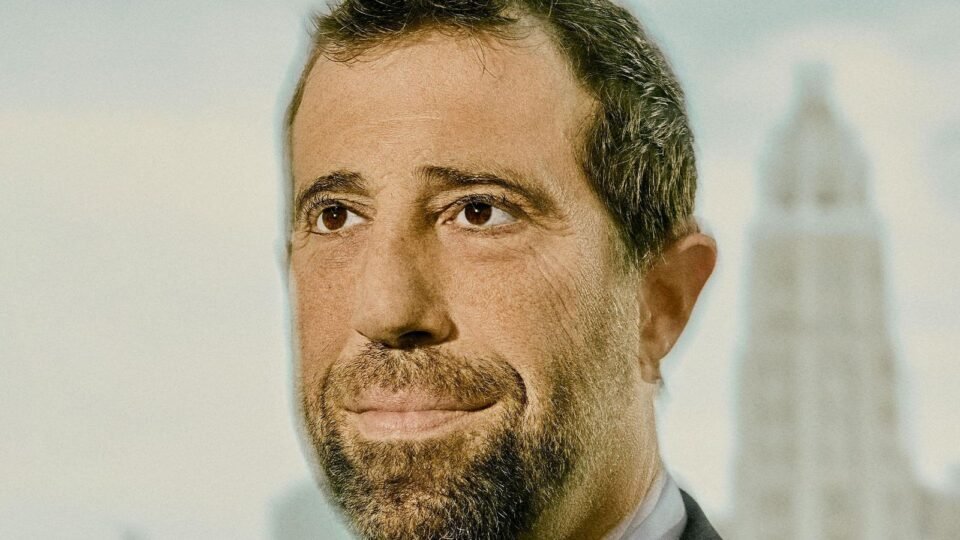

Shore Capital’s Justin Ishbia: “We’re investing in Main Street, not Wall Street.”

Guerin Blask for Forbes

Ishbia and his team have acquired more than 1,000 mom-and-pop shops across the country (average cost: $15 million) since Shore’s 2009 founding and rolled them up into 61 larger chains of things including autism treatment clinics, bakeries and exterminators. “We’re buying businesses in Akron, Ohio, and Pittsburgh, and Birmingham, Alabama,” Ishbia says. “There’s more low-hanging fruit for me. It’s Joe Schmo on Main Street.”

Shore then invests in computer systems and equipment, stacks the businesses’ boards with industry veterans and hunts for complementary companies in adjacent markets. “We’re just buying and buying and buying,” says Ishbia, who insists Shore doesn’t take on as much debt as other private equity firms and doesn’t cut services or head count. “The private equity world gets a bad rap for ‘buy this, slash that.’ We are growth—we have almost 35,000 employees and hire thousands per year.”

Even with all his success, Ishbia doesn’t get the same attention as Mat, his younger, richer brother, who is CEO of the nation’s largest home lender, United Wholesale Mortgage (UWM). But Shore’s portfolio companies employ five times as many people and have arguably had a similar impact on America’s economy, helping build up small businesses nationwide. While critics say private equity hurts consumers by reducing competition and quality and raising prices, Ishbia dismisses the idea. “It’s not like there’s just one PE-owned company in veterinary or dental or urgent care.”

He first learned about private equity as a teenager from his best friend’s father, who worked in the industry. “I just knew my buddy had a big house,” he recalls. “At the end of the summer, I asked him, ‘How do I pursue that career?’ ”

After college at Michigan State and law school at Vanderbilt, Ishbia did stints at a Chicago law firm and private equity shop. His father, who founded UWM’s predecessor in 1986, pitched him hard on coming to work with him in 2009. Mat had joined six years earlier. “I love Mat . . . but we’re both alphas,” Ishbia says. “I said, ‘Dad, if Mat and I work together every day, we’re going to end up fighting all the time, and that won’t be good for either of us.’ My dream was to start my own thing.” That same year, at age 31, he founded Shore with buddies Ryan Kelley, John Hennegan and Mike Cooper.

The economy was in recession, and it might not have seemed the best time to start something new. But Ishbia trusted his friend’s father, who told him a difficult time to raise capital is a good time to invest. To build a track record, he raised $10 million for his first deal from his father, his brother, his friend’s dad and other individuals, mostly partners in private equity and law firms. “We were young, and we knew no one would give us money to buy 10 companies, but they might give us money to buy one,” Kelley says. “Justin was like, ‘Let’s just prove we can actually buy these companies, add value and sell ’em.’ ” He did that. Four more times. In each instance, Shore raised between $5 million and $15 million to buy one business, then sold it at a profit. By 2014, the cofounders were ready to expand and raised $113 million for their first institutional fund.

THAT WAS AROUND the time veterinarian Jay Price first heard of Justin Ishbia. Price was running three Alabama clinics when a college friend called with a proposition: Talk to my law school friend, who owns a private equity firm and is looking to buy. “I didn’t really know what private equity was,” Price says. “I was like, ‘You guys can come down, but I’m not really interested.’ ” At the time, the veterinary industry—traditionally fragmented and dominated by small-scale operations—was starting to consolidate. Not long after the meeting, Price read about how National Veterinary Associates was selling to private equity giant Ares Management, and he agreed to sell a majority stake in his outfit, Southern Veterinary Partners, to Shore in a $6 million (enterprise value) deal.

Today, Southern Vet competes not only with National Veterinary Associates (now owned by JAB) but with VCA (owned by candy maker Mars) and Oak Hill Capital–backed VetCor in the lucrative market of taking care of America’s pets. Price is CEO and runs an operation with more than 400 locations and $1.3 billion in annual revenue. That makes Southern Vet one of Shore’s most successful acquisitions. Though Price no longer has time to practice, he still personally oversees the health of Ishbia’s two yellow Labrador retrievers remotely.

Another success is BrightView, a chain of addiction treatment centers. The Cincinnati-based company was founded in 2015 by Chad Smith, an attorney; Shawn Ryan, an ER doc who had seen too many patients caught up in the nation’s opioid epidemic; and a third cofounder who has since left. Smith, who is CEO, discovered Shore a year later through a business broker when the operation had two locations. “In outpatient health care services, it takes a decent amount of capital to get off the ground. Try explaining to your spouse what ‘personal guarantees’ mean on loans that exceed all your assets,” he says.

He first spoke with Ishbia and his team at 5 a.m. one Saturday while vacationing in Austin, Texas, and sold a majority stake to Shore the next year in a $20 million (enterprise value) deal. To celebrate, Ishbia threw a deep-dish pizza party. “When Justin came out, eating a meat-only pizza and wearing a hoodie, it gave the team a sense of calm: The Shore folks “are normal people, and it’s going to be fine,” Smith recalls. Shore figures BrightView, now with over $200 million in annual revenue from 80-plus locations, is worth more than $450 million.

The CEOs of 11 of Shore’s portfolio companies shared similar stories. The firm starts by spending hundreds of thousands (or millions) upfront, getting the house in order. That causes an initial decline in profitability. But the dip is quickly offset as they begin to buy competitors and expand rapidly. “People think a veterinary rollup is different than a rollup in the bakery space. I say it’s the same,” Ishbia says. Concurring is Boris Groysberg, a Harvard Business School professor who is writing a case study on Shore, noting that it has done exceptionally well putting in place repeatable processes that it can use to scale up quickly. “They are very systematic, which is so unusual for their type of firm,” says Groysberg, who has consulted for Shore. “It’s a group of people that’s like the special forces. They come in, and they do exactly what needs to be done.”

SOME THINK THE private equity party is over and won’t be so much fun going forward. Ishbia argues that many of Shore’s businesses are recession-resistant, because people will get cataract surgery and care for their sick dogs regardless of the economy. Plus, Shore’s relatively modest use of debt has somewhat insulated it from higher interest rates. “The world corrected on price, and I think businesses are worth 10% to 20% less than they were in April 2022,” Ishbia says. But as he learned when he started the business, a downturn is a good time to invest. “I’m a buyer right now,” he says. “And some people say that’s crazy.”

He can afford to be crazy. Forbes estimates that just two-fifths of Ishbia’s $5.1 billion net worth, or roughly $2 billion, is from Shore. Most of the rest comes from his 22% stake in UWM, on whose board he sits, and 13% stake in the NBA’s Suns, both controlled by his brother. (After publication of this story in the print edition of April/May 2024, a report was published claiming that UWM pressured brokers to steer deals its way, costing borrowers heavily. UWM responded that the report was “riddled with inaccuracies and incorrect information.” The stock is down 4% from the beginning of that day.)

Ishbia’s understanding of entrepreneurs began with his father, Jeff, whose own father, a Turkish immigrant, died when Jeff was a teen. To help out, he bought ice cream bikes and rented them to other kids. The first in his family to go to college, Jeff bought ice cream trucks, restaurants, apartment buildings, hotels, a potato chip maker and an alarm company—all while maintaining a law practice in the Detroit suburb of Birmingham. In 1986, when Justin was 8 and Mat 6, Jeff founded Shore Mortgage, UWM’s predecessor. “We grew up very comfortable, but we weren’t wealthy by any means,” Justin recalls.

Justin Ishbia (left) at age 4, with his younger brother, Mat, in their preschool class photo in Southfield, Michigan. “We’d pretend to be stars and pretend to be the guy taking the shot at the buzzer,” Justin says.

Courtesy Justin Ishbia

The family was tight-knit, and the brothers were best friends but also highly competitive. When they weren’t playing one-on-one and pretending to be NBA legends Magic Johnson and Isiah Thomas (the latter is now a UWM director), they were wrangling over the Sega Genesis. “If I was winning with a few seconds left, Mat would just turn off the console so the game wouldn’t count toward the standings,” Ishbia says. “We were both guilty of that.” Inspired by Detroit’s Pistons, Tigers and Red Wings, who won five championships combined during the ’80s and ’90s, the brothers took athletics seriously, encouraging each other in their sports. Justin was into baseball; Mat excelled in basketball. “We’d push each other to get better,” Mat recalls. “I think extreme competitiveness, which we both have, has driven our work ethic.”

While Justin’s sporting career ended when he went to Michigan State, Mat—who followed him to East Lansing—joined the university’s basketball team and became a popular benchwarmer. The brothers roomed together, but Mat became a campus celebrity after the team won the NCAA championship in 2000, his freshman year. “[Justin] used to always joke that his first couple of years on campus, he was Justin Ishbia,” says Shore cofounder Hennegan. And then he was Mat’s brother. “I think that stuck with him.”

Adds Kelley with a laugh, “His little brother’s got three times his net worth or whatever it is. So yeah, I think there’s part of that driving Justin.” (The discrepancy is actually closer to two times.)

Justin Ishbia (right) and his younger brother Mat: The two, who own the Phoenix Suns together, are very close — and extremely competitive.

Michael Reaves/Getty Images

The sibling rivalry seemingly never ends. Both brothers are currently building over-the-top trophy homes. In Winnetka, Illinois, Justin is building a megamansion that will reportedly have a price tag of nearly $80 million (an area record) and have both indoor and outdoor pools. “It looks like a bomb got dropped on Lake Michigan,” says future neighbor Kelley of the construction. Not to be outdone, Mat’s home in Bloomfield Township, Michigan, will boast a trampoline park, an enchanted forest and a lazy river.

Justin insists he couldn’t be prouder of his younger brother. His office across the Chicago River from Trump Tower is cluttered with family photos and sports memorabilia: a Phoenix Suns jersey, a photo of Mat and Jeff ringing the NYSE’s opening bell when UWM went public in 2021 and a poster of Mat’s Michigan State national championship team.

But maybe there is a more important trophy. Just outside his office is the “Shore Cup.” Inspired by the NHL’s Stanley Cup and produced by the same manufacturer, the massive silver goblet is engraved with the names of all Shore’s portfolio companies. In the early days, Ishbia and his team would take it out on the town. “They’d fill the thing up with champagne,” says Shore chairman Jim Forrest, “and go bar to bar to bar to bar to bar to bar drinking out of the Shore Cup.”