The Bank of England this week flagged concerns about the financial stability risks posed by private equity in light of higher interest rates and the resulting pressure on valuations. While the announcement has been widely covered in the financial media, no concrete actions were announced. The BoE’s Financial Policy Committee plans to report back on its analysis at a June meeting.

Global M&A deal value jumped 30% to $690 billion in Q1 according to London Stock Exchange Group data cited in the Financial Times. We have previously suggested that the recent easing in financial conditions could support improvement in investment, exit, and distribution trends in private markets. Dealmaking activity during the quarter, however, skewed to larger transactions, and the recovery in Europe outpaced the improvement in the U.S.

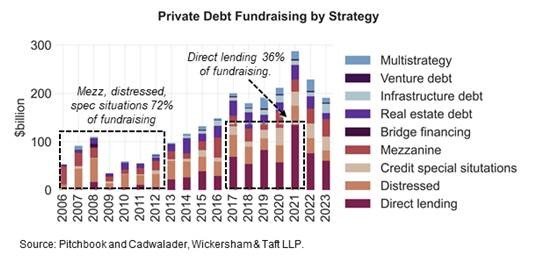

The direct lending share of global private debt fundraising declined again 2023 after reaching an all-time record of 47% in 2021, according to data from Pitchbook. Until the 2012, distressed, special situations, and mezz strategy funds dominated private debt fundraising, accounting for as much as 90% of dollars raised in 2006, and reflecting interest and returns in difficult-to-access, non-commoditized fixed income. That interest appears to be making a return.

Meanwhile, Bloomberg reports that private credit funds are giving up fees to attract capital as competition between closed-end funds, BDCs, and banks intensify. Illustrating the point, Apollo recently waived the first year of fees on its Middle Market Apollo Institutional Private Lending BDC for its anchor investor Mubadala Investment Co.