To print this article, all you need is to be registered or login on Mondaq.com.

Companies in the Facility Services sector — such as

janitorial, HVAC, alarm security, fire protection and window

washing companies, among others — represent a highly

attractive target for private equity (PE) investors for several

reasons. These companies usually have recurring revenue streams

with long contract terms and contracts that renew automatically.

Some services also provide a relatively recession-resistant

investment since they are considered essential or mandated services

for compliance and other reasons.

The sector is a highly fragmented one, with businesses that

offer a wide range of services providing easy consolidation

opportunities for investors with an eye toward gaining market share

geographically. Combining different services under one roof can

expand business as customers prefer one point of contact for all

their outsourced service needs.

Investors can see the opportunities to drive value through

economies of scale, especially by offering volume-based vendor

discounts.

The size of the Facilities Services industry, which includes

both soft services like janitorial work as well as hard services

like HVAC and fire safety, is estimated to be $1.33 trillion in

2024 and reach $1.66 trillion by 2029, indicating a compound annual

growth rate of about 4.66 percent.1

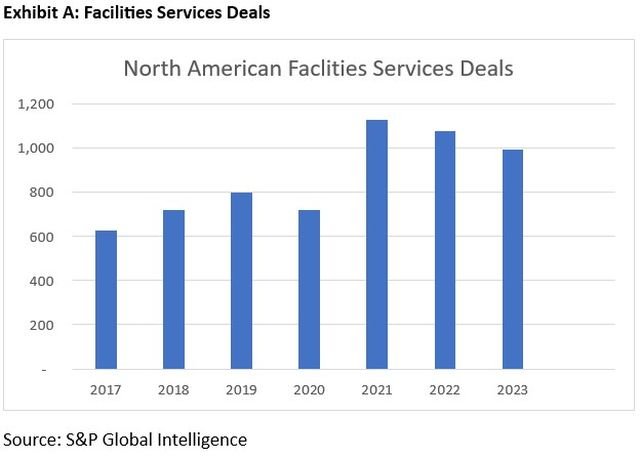

Transactions across the industry have been trending upward over

the past several years, reflecting the attractiveness of

value-driven opportunities and growth through roll ups and

synergies to PE firms.

Growth in Facilities Services Dealmaking

PE investors are finding they can infuse further value into

consolidated businesses by employing technology to predict

maintenance demand, monitor energy consumption, track assets and

optimize other areas of the portfolio company. Small improvements

in technology can significantly enhance the overall delivery and

performance of the business, especially as some PEs expand their

investments from commercial to residential services.

Finally, the ability to buy and grow the business in a short

window of time, depending on the level of integration, can make a

big difference when it’s time to consider exiting the

business.

The Three Main Areas to Evaluate a Deal in This Sector

While PE investors must consider many factors when conducting

due diligence, these three areas can indicate the attractiveness of

the acquisition target and highlight the best opportunities to

drive value after a deal is completed.

Financial

- Customer wins versus losses run rate: Evaluate

the stickiness of customer relationships. The characterization of

the typical Facilities Services business is a recurring and

automatically renewing revenue base, so significant wins or losses

in customer retention during recent periods can result in

meaningful differences between historical and future earnings.

Run-rate considerations for material wins and losses should be

weighed when assessing the value of the business. - Margin analysis: Differences in how a business

classifies certain costs can drive wide disparities in how gross

margin is evaluated or compared to peers. For example, whether a

business locates supervisory managers within the cost of sales or

under operating expenses can impact gross margin. When adding on a

target to an existing portfolio company, buyers should ensure that

a detailed analysis of the cost structure and the classification of

those costs is performed so that there are no surprises in gross

margin pre- versus post-acquisition. - Revenue recognition: In services businesses

where revenue is recognized over time based on percentage of

completion, a full historic analysis should be performed using

cost-to-cost comparisons, expended efforts evaluations or

units-of-delivery methodology. Depending on the level of accuracy

in management’s estimation methods, there could be material

differences in revenue recognized. - Risks of poor financial controls and quality of

information: Smaller, founder-owned businesses tend to be

less sophisticated and have looser financial controls in place. In

order to fully understand the target’s cash inflows and

outflows, a cash proof or reconciliation exercise is typically

called for during the due diligence process. Focus a higher level

of scrutiny around the balance sheet to confirm proper recognition

and reconciliation.

Human Resources

- Employee retention: Within the industry,

certain sub-sector populations such as janitorial services have

turnover rates of more than 100 percent. Workers are often

performing second shift work with limited ability for measurement

or recognition. Buyers should ensure that the business can sustain

its current headcount and growth trajectory without incurring

material additional costs. - Unionization: Building services, janitorial

work, security services and other sub-sector industries are

commonly unionized outside of right-to-work states. Union

populations are often party to union-sponsored benefit plans, which

can be more generous than non-union programs or multiemployer

pension plans (MEPs.) MEP participation carries the risk of

significant financial burden due to withdrawal liabilities in the

case of a union exit. Buyers should quantify these contingent risks

and determine any impact on overall valuation. - Employment classification: Facility service

employees are commonly operating at the direction of their

employer, utilizing company equipment and uniforms. In situations

where employees are misclassified as contractors and source their

own teams for staffing, compliance issues can arise. - Wage and Hour laws: Employers with large

hourly populations can often run afoul of complex and changing wage

and hour laws when expanding into new states. These can include

overtime or spread hours rules, meal and wage breaks and changes to

minimum wages. We recommend an investor complete a comprehensive

diligence exercise to ensure no past risks or high costs to correct

procedures.

Tax

- Sales Tax: States have disparate treatment

regarding the taxability of different facility and environmental

services. For smaller targets, they often do not have a dedicated

team or deep knowledge on taxability across multiple jurisdictions.

Rapid growth across state lines may also result in errors. While

sales tax is collected by the vendor, it would ultimately be paid

by the customer prospectively. However, this creates a risk of lost

revenue if a customer refuses to pay tax or procure services due to

additional cost, which generally can be 7 to 8 percent higher with

sales tax. The vendor may also be liable for any amount that it had

an obligation to collect and report but did not. - Payroll Tax: The nature of this work often

lends itself to large work crews that may travel across state lines

and have significant per diems or expense reimbursements.

Additional work focuses on nonresident state withholding and

controls for traveling employees as well as documentation and

support for per diems and expense reimbursements. - Transfer Tax: For small targets, the

transaction is often structured as a true asset acquisition. Asset

acquisitions are generally subject to sales tax — including

motor vehicle sales and excise tax and real property transfer tax

— unless a separate exemption applies. For many facility

service businesses, there are significant vehicles that will be

transferred as part of the acquisition and transfer taxes may be a

significant expense of the transaction. Buyers should focus on

evaluating and quantifying any transfer tax that may apply. - Tax Opportunities: Work Opportunity Tax

Credits often apply to large labor workforces and may provide tax

savings or benefits for hiring and retention. These tax savings may

result in meaningful value to a buyer and help pay for growth.

Consolidation in Facilities Services Will Continue to Grow

The opportunities for PE investors within the Facilities

Services sector are abundant, and there’s still extensive room

for consolidation and good valuation in some subsectors —

like janitorial, security, roofing, electrical and plumbing —

according to investment banking advisors TM

Capital.2

Some subsectors have had very little PE deal activity while some

are at very favorable valuation multiples compared to others.

Thorough evaluation of the target acquisition’s unique business

environment, recurring revenue streams and geographic contexts are

needed to select the right company to add to a portfolio

company’s mix.

PE investors with knowledge of the sector and a nose for adding

value through efficiencies, technology and leveraging different

services under one brand will be rewarded.

Footnotes

1.

https://www.mordorintelligence.com/industry-reports/facility-management-market.

2. 2023 Facility Services Report, TM Capital.

Originally published by 02 April, 2024

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

POPULAR ARTICLES ON: Corporate/Commercial Law from United States