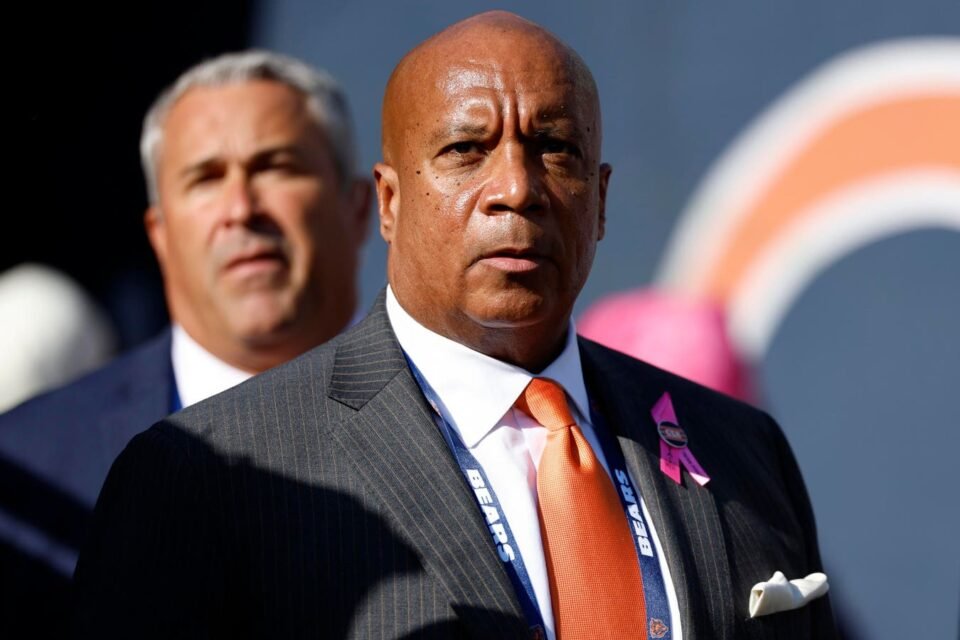

Chicago Bears president and chief executive officer Kevin Warren stands on the sidelines during the … [+]

A 4-2 start provides immediate hope for the Bears in the Caleb Williams era. Meanwhile ownership continues trying to unravel how to finance a showplace stadium in downtown Chicago, alongside Lake Michigan.

“It would be a crown jewel for the NFL,” team president Kevin Warren said. “I am looking forward to being able to host major events, not only being able to bid for a Super Bowl but Final Four college football (and basketball) games, concerts, all those different things.”

Warren provided an update on the stadium situation while the Bears were in London last week.

While Soldier Field is one of the NFL’s historic stadiums, it lacks a roof to make it a year-round facility and seats only 61,500, the smallest capacity in the league. The team believes it has become obsolete even though it was renovated at taxpayer’s expense in 2002-03.

The Bears purchased land in suburban Arlington Heights as a potential stadium site. But Warren, who was hired away from a job as Big Ten commissioner in 2023, is intent on building adjacent to Soldier Field.

The franchise has the support of Chicago mayor Brandon Johnson but Illinois governor J.P. Pritzker hasn’t budged from his position that public financing is “a non-starter” for the state. The Bear tried unsuccessfully to get a funding bill introduced into last spring’s session of the legislature.

While the Bears and the NFL have pledged $2.3 billion toward construction, the project is expected to cost more than $5 billion, including upgrades to infrastructure.

Before joining the Big Ten, Warren headed the Minnesota Vikings’ efforts that led to the construction of U.S. Bank Stadium, the team’s home since 2016. He’s determined to duplicate that success and insists he’s not discouraged by the lack of progress.

“Me, worn down?” Warren said. “Never. These stadium projects … that’s why you do them once every 30, 40, 50 years. I’m actually energized by it because anything that is great in life, anything that lasts 50 years, takes a lot of energy and effort.’’

The Bears are positioned to take advantage of an NFL policy change approved by owners in August. Teams can sell limited shares of ownership to private equity firms, up to 10 percent.

That may be one way the Bears can bridge the gap needed to fund their lakefront stadium project. Warren confirmed he is studying the possibility but said it’s not something the franchise is currently exploring.

“I say that to say, these next couple of months my focus will be to make sure I truly understand how the private equity system would work in the NFL,” he said. “We started (awhile) ago, the second it was actually announced, and I will spend the next couple of months digging into it — not only how it operates but the financial implications, what happens down the road. I want to make sure any decisions we make do not create any unintended consequences.”

The Bears were founded by George Halas in 1920 and have remained in his family. His daughter, Virginia McCaskey, has been the primary owner since Halas’ death in 1983, with her son George McCaskey as the team chairman.

The McCaskey family sold a 20 percent share of the team to businessmen Pat Ryan and Andy McKenna in 2021.

Forbes currently values the franchise at $6.4 billion, making a 10 percent investment from private equity worth $640 million. That infusion of cash could help Warren get closer to achieving his dream stadium but even with it there would be more work to do.