Shopping for an investment property or a second home? The residential property market continues to be a hot favourite for plum returns. Indeed, according to the Knight Frank Wealth Report 2024, 21 per cent of Australasia’s UHNWIs are planning to invest in a residential property this year. We pick the top five cities and luxury developments to put on your property portfolio radar.

5 top cities and luxury developments to add to your property portfolio

Dubai: Sizzling Sands

Luxury home prices in Dubai have increased by more than 100 per cent in the past two years. To say the scene is hot is accurate in more ways than one. Among the contributing factors is a fast-growing expatriate population, driven by the emirate’s focus on becoming a business hub and launchpad into the rest of the Middle East. Desert climes aside, Dubai has worked hard to position itself as cosmopolitan, with a lively, year-round calendar of events.

Rising from the sands is the first ever Bugatti Residences, developed by the luxury supercar manufacturer with Dubai-based property developer Binghatti. Standing at 42 storeys, its sinuous form is wrapped in balconies on every floor. There are 171 apartments and 11 penthouses, with the latter equipped with a private terrace pool to enable a dip with views of Downtown Dubai. Occupants will revel in the building’s French Riviera vibe and incorporated heritage of the carmaker. A car lift will transport the resident’s vehicle to his or her floor, where the car can serve as a piece of art.

London: Green Appeal

London inevitably comes up in discussions of overseas property investment. Among the key reasons are the city’s financial stability, rental income and capital appreciation. Last year, prices dropped by approximately two per cent, presenting further opportunities.

Of course, high returns tend to apply to projects in central London. Ticking all the boxes is Bankside Yards by Native Land, on the South Bank of the River Thames, master-planned by PLP Architecture. Positioned as the UK’s first fossil fuel-free, mixed-use development, it encompasses eight new buildings, including 14 Victorian-era railway arches.

Residential options are Opus, which will be launched later this year, and the Mandarin Oriental branded residences. Occupants will live easy knowing they are being served by a fifth-generation energy network, which produces zero emissions across the entire site. Additionally, landmarks like the Tate Modern and the financial district are well within walking distance.

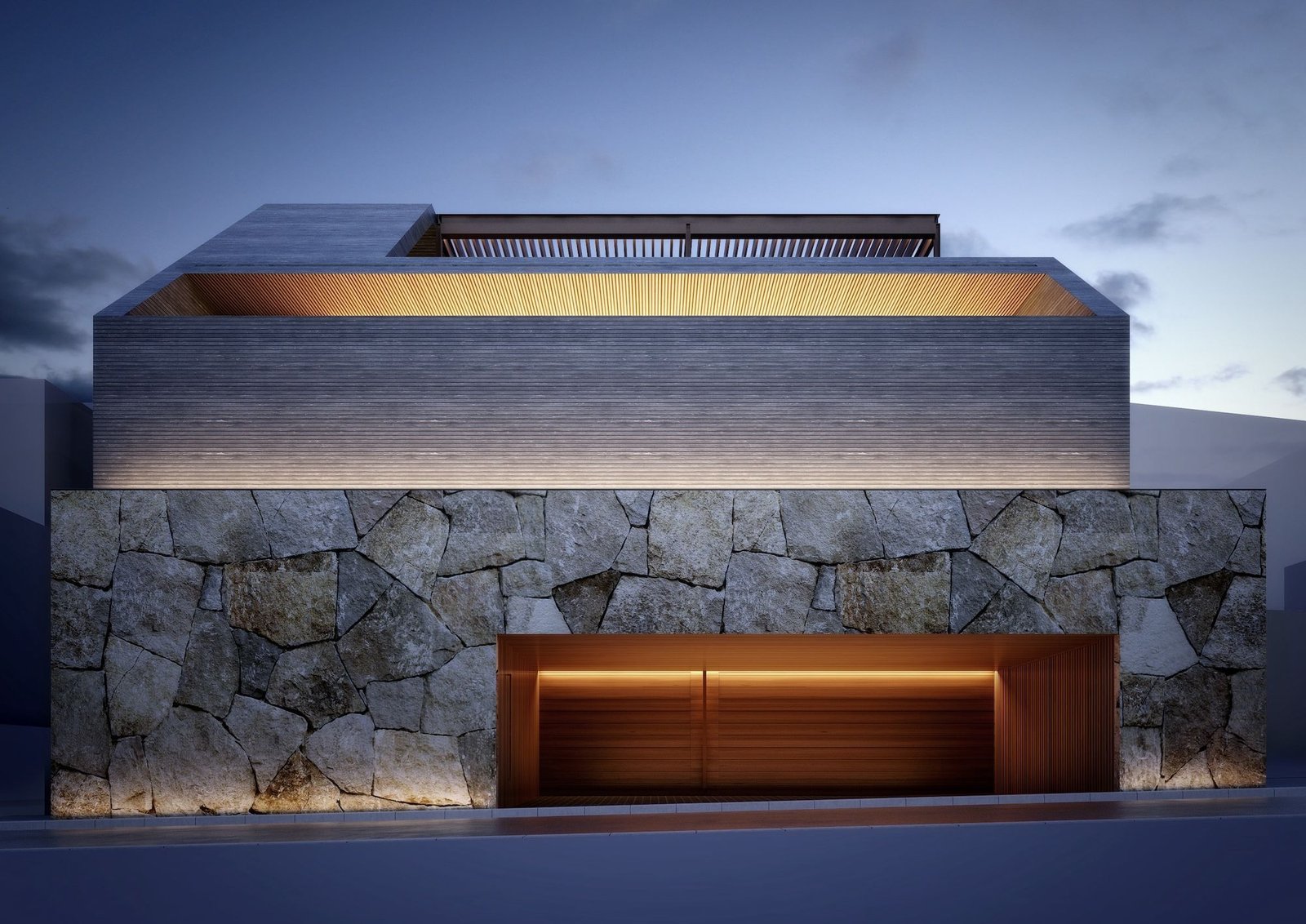

Tokyo: Castle on a Hill

With a weak yen, stable investment climate and low interest rates, Japan continues to remain attractive to investors, especially in Asia. Other inducements include a compelling way of life, where one can be fully immersed in nature a short train ride away, and a culture of excellence that permeates everything that the locals do.

The same can be said of the homes they design and build, including the recently launched Poltrona Frau Suites Motoazabu in Tokyo’s Minato Ward, conceptualised by Satoshi Kurosaki of Apollo Architects & Associates. The branded residence’s formidable facade, composed of high-grade Aji stone, takes reference from Japanese castles. What prying eyes cannot see is the view of Tokyo that residents get to enjoy from the family lounge, while reclining on Poltrona Frau furniture, some of which are made from the furniture company’s renowned, buttery-soft Pelle Frau leather.

Sydney: Desirable Down Under

The Australian residential market has been making headlines in recent years, driven by sustained demand, insufficient new housing projects and high immigration rates. Knight Frank’s Wealth Report ranked Sydney as the frontrunner in its rental forecast this year. With the city’s vacancy rate well below the national baseline, it spells good news for investors. Projects like Aura, developed by Aqualand, therefore, become all the more appealing.

Located in North Sydney and a stone’s throw from the harbour, Aura already stands out for being part of a mixed-use precinct that promises to inject new life into the neighbourhood. The curvaceous architecture by renowned firm Woods Bagot belies 371 luxury residences in one- to four-bedroom configurations. For those looking to settle in, the two penthouses are still available. They are inspired by the top-floor apartments of a classic Parisian building and have the same feeling of volume and elegance.

Bangkok: Retire in Nature

Most well-known as a holiday destination, Thailand is increasingly holding its own from a property investment standpoint. According to Savills Research, the country’s capital ranked number three among the cities in the world with the highest price growth in the residential sector in 2023. It also noted that demand outstripped supply – no surprise considering how there are many factors working in Bangkok’s favour, including a wide array of culinary and lifestyle options, its renowned wellness and private healthcare industry as well as excellent air connectivity, including with Singapore, which is only two and a half hours away.

Foreigners are allowed to own condominium units and of note is The Aspen Tree by MQDC. Targeted at those who desire an active retirement, it is part of The Forestias, a 64ha lifestyle development where more than half the land is dedicated to landscaping. Within The Aspen Tree, residents can choose from one of the 290 units designed in association with Baycrest Centre, a Canada-headquartered, leading geriatric healthcare provider. The development has residences for multigenerational families.

This article was first published in Prestige Malaysia

The information in this article is accurate as of the date of publication.