Property values are always contingent upon the location. Whether it be a home in a desirable neighborhood or a commercial retail space near a sizeable population, as the old adage goes, “Location, location, location.” However, neighborhood data provided by data platforms like ATTOM has taken the application of geospatial data to a whole new level. Unfortunately, not every real estate professional or commercial property investor understands what location data is or how to use it effectively.

Here’s eight ways points of interest data can and should influence the price of property and investment decisions.

- The Starbucks Effect

You’re probably aware of the Starbucks Effect. A Harvard study from 2018 found that homes located within close proximity to a Starbucks had a half percent higher value than homes that were not near a Starbucks.

Of course, it’s not accessible to a good cold brew that has such an effect. Any desirable point of interest will make a property more appealing to a certain buyer. Proximity to public transportation is particularly influential where house values are concerned as are grocery stores.

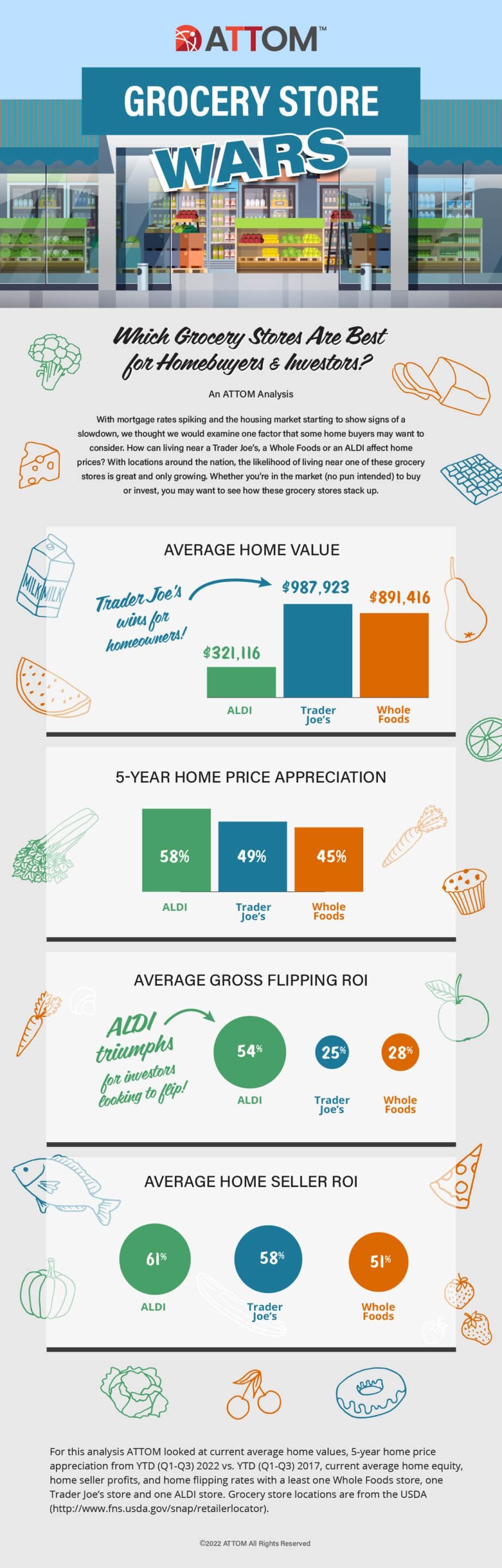

In 2022, ATTOM released a special report on grocery store locations and found that homes near a Trader Joe’s realized an average 5-year home price appreciation of 49 percent, and homes near a Whole Foods saw an average appreciation of 45 percent, ALDI had a slight advantage at 58 percent.

Geospatial data can be displayed on a point map showing relevant points of interest. These are critical data points for investors and flippers and show how locational data can and should influence investor decisions.

- Be School District Savvy

School district data is another critical factor in home-buying decisions. What school district a home is located in and the schools assigned to a particular area are obvious criteria that determine a home’s value. A realtor.com study shows that many buyers are willing to pay up to 10 percent over their budget for a home if its school district has higher test scores and desirable teacher-to-student ratios.

- Community Data for Developers and Educational Institutions

Neighborhood data serves many groups in addition to investors. Educational institutions, developers, and urban planners all use neighborhood data. Economic data or data that show changes in local business density or consumer trends can aid in planning new development or marketing initiatives. For example, ATTOM provides neighborhood data on transit access, walkability, and amenities. These datasets show the effects of government programs and the impact of community development initiatives on property pricing,

In the case of educational institutions, the data can help in the creation of targeted marketing lists to boost enrollment and identify locations for new college campuses. In the case of property developers, the information can inform stakeholders of the rentability and potential income of units.

- Proximity to Points of Interest

It’s not just retirees in Florida who will pay more for a house or condo that backs onto a beautifully manicured golf course. Families and singles might pay 8 to 20 percent more for a property that’s within walking or biking distance from a park or recreation area.

Sports stadiums are big attractions. According to researchers at the University of Illinois at Urbana-Champaign and the University of Alberta, a new pro sports stadium can raise property values in a 2.5-mile radius by an average of $2,214.

- Transportation and Commuting Data

Commuting distances, times, and accessible public transportation are key data points that homebuyers and property investors need to assess the demand and value of properties they may be considering purchasing.

According to the California Department of Housing and Community Development, homes close to public transportation are in high demand, and these property values are up to 20 percent higher on average than similar properties further from public transportation.

- The Beyonce Effect

Locational data can offer up some interesting facts, such as what celebrities live, or have lived, where. Although it’s not always the case, these homes garner attention and are often sold for higher values.

Part of the allure is the lifestyle that A-list celebrities lead and the idea that the homes will feature high-end design elements. In the case of Beyonce and Jay-Z, it’s a home with bullet-proof glass, and in the case of Kim Kardashian, it’s a vineyard.

According to Luxury Portfolio International quoting Susan Smith, global real estate advisor for Hilton & Hyland in Beverley Hills, California, “There’s definitely an increase in the value of [celebrity} homes, not only because of its intrinsic value, but you do get a much greater pool of buyers …Often, more buyers are interested in viewing that type of home,” she said.

- The Points of Non-Interest Effect

As much as points of interest data show the highlights of a property’s location, investors should know the less desirable aspects of a location. Having a Starbucks within a mile or a luxury gym three blocks away is all very well. However, whether there is a trash dump in the opposite direction, a high-crime pocket, or an area saturated by a certain type of business that would be a problem for the investor are also data to note. POI data offer a bird’s-eye-view of a neighborhood, both the good and the bad, to aid buyers in their decisions.

- Building Footprints for Insurance

For insurers, geometric data like building footprints offer precise building attribute details, capturing the exact shape and perimeter of a building using advanced proprietary AI algorithms to detect buildings.

Precise building locations can be key to identifying hazard risks. Without building footprint data, underpriced policies would expose insurance carriers to higher unforeseen flood claims.

The Arrival of Trader Joe’s or the Departure of Timberlake? – Which Is the Better Option?

Neighborhood data is a must-have for anyone considering property values. They offer context at the ground level and a bird’s eye view of a location at the ten-thousand-foot level. Let’s say an investor has two properties in mind, both similarly priced and with similar characteristics and features. How can they decide which one to buy?

Perhaps the better choice is the building half a mile from a planned Trader Joe’s where foot traffic is increasing or the luxury hi-rise condo building next-door where Justin lived in 2023? Whatever the ultimate deciding factor, neighborhood data provides context to wise investment decisions.

ATTOM’s neighborhood data are inputs critical to your real estate business. Neighborhood data allows you to accurately assess a property’s potential. Tap into the layout of a community to find the best places to invest. Marketers can build targeted products for clients, and real estate agents and brokers can streamline the process of finding just the right home for just the right family.

Visit www.ATTOMData.com today and talk with an expert.