Starting 1 July, the Reserve Bank of New Zealand’s new

debt-to-income (DTI) ratios will change the game for

property buyers, capping borrowing at six times household

income (for owner occupiers) to curb excessive debt and

enhance financial stability. For property investors,

borrowing is capped at seven times your income. However,

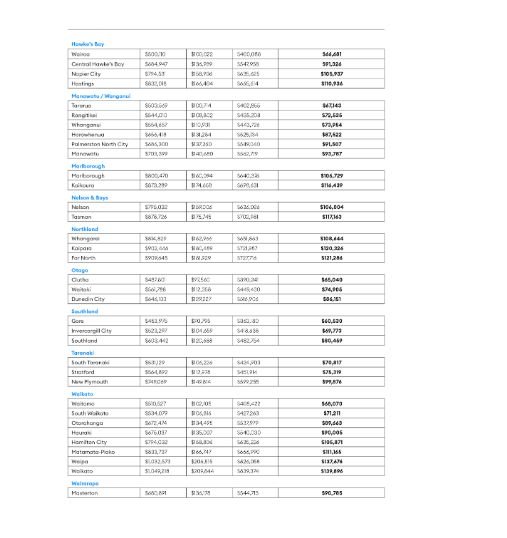

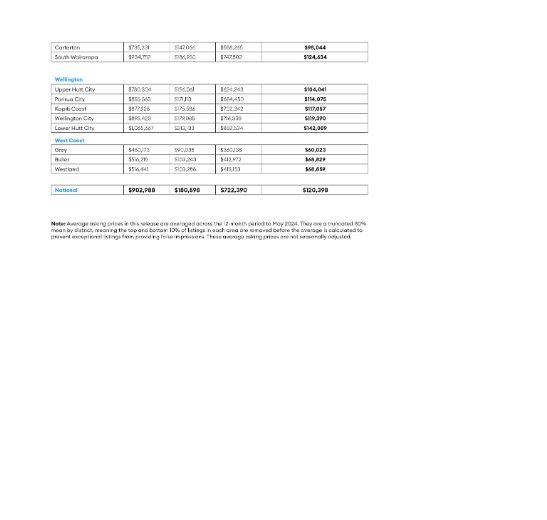

analysis of average asking prices over the last 12 months

reveals significant variations in the household income

required to buy a home across the motu.

Based on

our 12-month national average asking price of $902,988,

property seekers will need a household income of $120,398.

Assuming a 20% deposit, this is calculated by dividing the

total loan amount of $722,390 by six, per the new DTI

regulations. This $120,398 is just $6,0411 less than the average

annual household gross income of

$126,411.

However, in many regions of New Zealand, the

significant gap between household incomes and what will be

required under the new DTI regulations is likely to be

challenging.

How will these new DTI ratios

impact Kiwis across the country? Which districts will be

hardest hit, and will any be immune to the

changes?

Location, location,

location

Queenstown was the most expensive

district in which to buy property, with a 12-month average

asking price of $1,953,091. Under new DTI requirements,

property seekers wanting to borrow the full 80% on property

in this region would need a minimum household income of

$260,412. Waiheke Island followed with an average price tag

of $1,901,507, requiring an income of $253,534. Wanaka,

Rodney and North Shore City rounded out the top five,

needing incomes between $175,544 and $245,381.

Advertisement – scroll to continue reading

Vanessa

Williams, spokesperson for realestate.co.nz, attributes the

high prices to lifestyle appeal:

“These

districts offer a blend of urban and rural lifestyle options

and, in most cases, are an easy boat ride, flight, or drive

to our main commercial hub of

Auckland.”

City of sails…and

sky-high property prices?

It’s not

just Waiheke Island, Rodney and North Shore City where

households need high incomes. Auckland City and Hauraki Gulf

Islands were just shy of the top five most expensive

regions, requiring minimum incomes of $171,447 and $167,076,

respectively, “With beautiful golden sand beaches,

inner-city living, and café culture, lifestyle is a

significant drawcard. Ultimately, buying a property is not

about choosing a home; it’s about choosing the life you

want to lead.”

Papakura, Waitakere City,

Manukau City & Franklin are the only four of nine

Auckland districts where the minimum required income fits

within Auckland’s annual gross income. Based on having a

20% deposit, property seekers will need a minimum household

income of $108,796 in Papakura, $119,841 in Waitakere City,

$132,111 in Manukau City, and $139,480 in Franklin. These

all sit below the Statistics

New Zealand reported annual gross income of $153,159 for

Auckland for the year ending June 2023.

Vanessa

notes that individual circumstances will vary:

“Opportunities can be found in every market. Property

seekers need to be patient, consider their expectations, and

seek advice from their local real estate agent.”

She

also notes that these regulations apply to household income;

therefore, purchasing via a syndicate or as a couple could

offer more opportunities.

New

Zealand’s lowest-cost regions

Prices vary

significantly across regions due to factors such as local

economic conditions, population density, and demand for

housing. At the affordable end of the spectrum, Bay of

Plenty’s Kawerau was the lowest-cost district, with a

12-month average asking price of $432,604. To meet DTI ratio

requirements and borrow 80%, an income of $57,681 per annum

is required. With average asking prices around $450,000,

Grey on the West Coast and Southland’s Gore came in a

close second and third, requiring household incomes of

around $60,000.

Otago’s Clutha and

Canterbury’s Waimate rounded out the bottom five,

requiring incomes of around $65,000 to secure a property

based on average asking prices in the

districts.

“According to Statistics New Zealand,

the average household income in the Otago region is $109,943

and in Canterbury it is $114,961. Buyers in these regions

may have more flexibility to go up a price

bracket.”

“Like the rest of the country, average

asking prices in both regions have remained fairly flat for

the last 18 months,” explains

Vanessa.

Should we expect a

slowdown from 1 July?

The new

regulations may reduce the number of buyers by limiting

their options. However, with high interest rates, Vanessa

doesn’t expect DTI ratios to start biting

immediately.

“Some Kiwis are unable to enter the

market currently due to high interest rates, and that will

likely continue to be the case.”

“The idea

of DTI ratios is to slow down the market and, ultimately,

help prevent people from getting into unmanageable debt,

which isn’t necessarily a bad thing. We will have to wait

and see what impact this has

overall.”

Curious if

your income stacks up against average asking prices in your

region? Check out the table below:

Note:

Average asking prices in this release are averaged across

the 12-month period to May 2024. They are a truncated 80%

mean by district, meaning the top and bottom 10% of listings

in each area are removed before the average is calculated to

prevent exceptional listings from providing false

impressions. These average asking prices are not seasonally

adjusted.

Glossary of

terms:

Average asking price

(AAP) is neither a valuation nor the sale

price. It is an indication of current market sentiment.

Statistically, asking prices tend to correlate

closely with the sales prices recorded in future months

when those properties are sold. As it looks at different

data, average asking prices may differ from recorded sales

data released simultaneously.

New

listings are a record of all the new

residential dwellings listed for sale on realestate.co.nz

for the relevant calendar month. The site reflects 97% of

all properties listed through licensed real estate agents

and major developers in New Zealand. This description gives

a representative view of the New Zealand property

market.

Stock is the total

number of residential dwellings that are for sale on

realestate.co.nz on the penultimate day of the

month.

Inventory is a measure

of how long it would take, theoretically, to sell the

current stock at current average rates of sale if no new

properties were to be listed for sale. It provides a measure

of the rate of turnover in the

market.

Seasonal

adjustment is a method realestate.co.nz uses

to represent better the core underlying trend of the

property market in New Zealand. This is done using

methodology from the New Zealand Institute of Economic

Research.

Truncated mean is the

method realestate.co.nz uses to supply statistically

relevant asking prices. The top and bottom 10% of listings

in each area are removed before the average is calculated to

prevent exceptional listings from providing false

impressions.

Advertisement – scroll to continue reading