The sale of a “dilapidated” property for $1.32 million is the latest example of the dire situation home buyers find themselves in, with the housing market upswing showing no signs of slowing.

The two-bedroom semi-detached property in Annandale in Sydney’s inner west was initially valued at $850,000, and 18 people registered interest. However, over the weekend, only two deemed the property worthy of a price tag in the millions and battled it out in an auction.

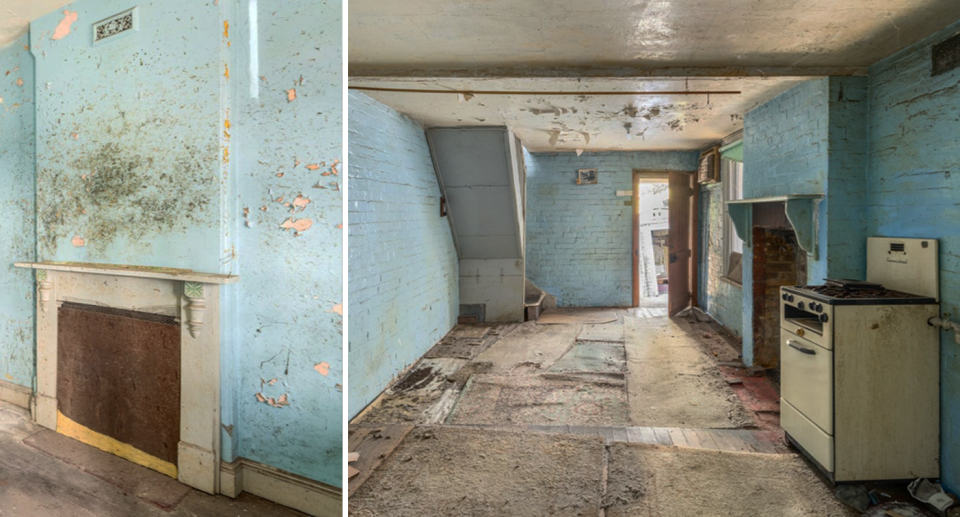

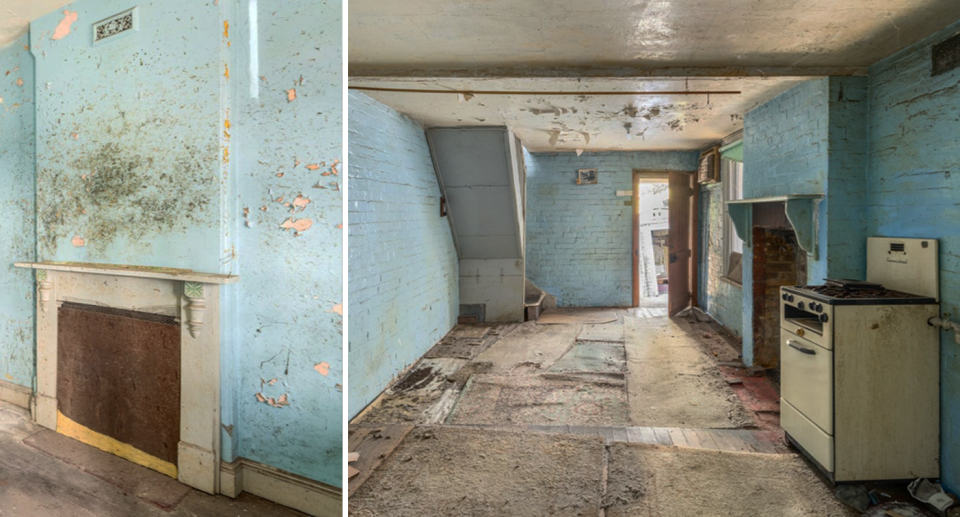

The real estate listing acknowledges the property is “in dilapidated condition” but it’s being advertised as an “exciting renovation project” requiring restoration from “the ground up”.

Images show the space has broken flooring and paint peeling from the walls and ceiling. There is no kitchen installed and no bathroom, although the “original outdoor loo” is in the backyard.

‘Emotion behind purchase’ increased price

The sought-after location is believed to be the major selling point of the property. Belle Property real estate agent Rebecca Duncan told Yahoo Finance the buyer’s intentions with the house ultimately meant they were willing to pay more to secure it.

“The purchaser plans to move into it after he’s done a build, and that tends to have a little bit more emotion behind a purchase, as opposed to an investor who’s just crunching numbers on a build and resale,” she said.

RELATED

It is the first time in almost 125 years the property has been available, with the house being owned by the same family since it was built. It is believed its condition “deteriorated” after the last occupant “wasn’t fit to do a renovation”.

House prices keep climbing

The housing market has extended its growth into 2024 as Australia faces an ongoing undersupply of new homes, hiking up the prices of available properties.

CoreLogic released data on home prices at the start of the month, which showed a 0.4 per cent lift in values in January, marking a 12th consecutive monthly increase in the index.

Perth recorded a 1.6 per cent lift in January, while Sydney edged up 0.2 per cent. Melbourne produced a 0.1 per cent decline and Adelaide, Brisbane and Perth returned increases of 1 per cent or above.

“Despite ongoing cost-of-living pressures, high interest rates, low consumer sentiment and affordability constraints, homes are still selling,” CoreLogic research director Tim Lawless said.

Follow Yahoo Finance on Facebook, LinkedIn, Instagram and Twitter, and subscribe to our free daily newsletter.