Afcons Infrastructure IPO Day 3 Live Updates: The initial public offering (IPO) for Afcons Infrastructure, the leading infrastructure engineering and construction company of the Shapoorji Pallonji Group, faced challenges during the first two days of bidding. On the second day of the share sale, Afcons Infrastructure IPO subscription stood at 36%. The segment for non-institutional investors achieved a 72% subscription, while the retail individual investors (RIIs) category saw a 36% subscription rate. The qualified institutional buyers (QIBs) portion garnered an 8% subscription, and the employee segment was oversubscribed at 1.01 times.

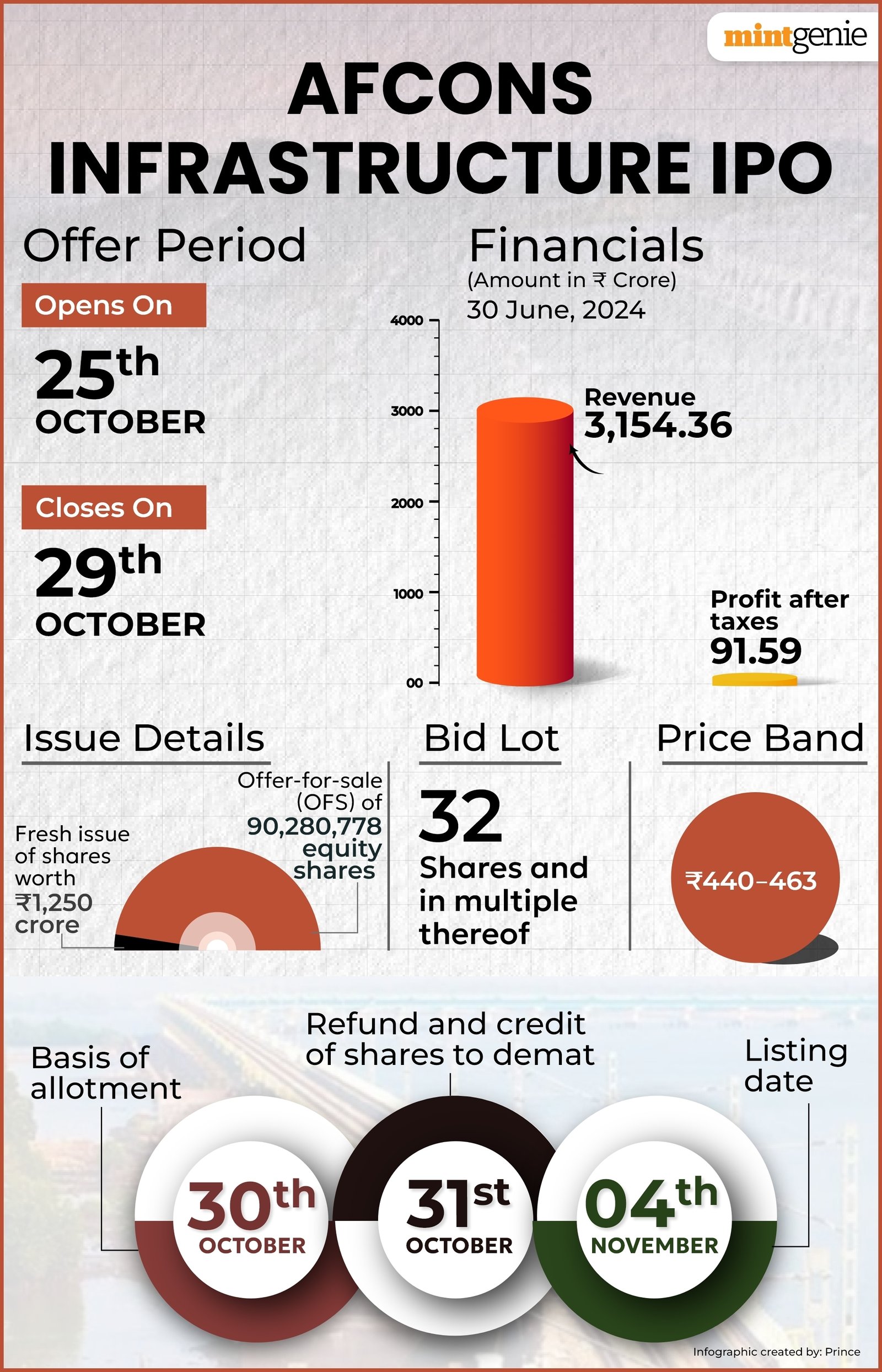

On the first bidding day, Afcons Infrastructure IPO was booked 10%. Afcons Infrastructure revealed on Thursday that it has secured ₹1,621 crore from anchor investors. The IPO, valued at ₹5,430 crore, is set to remain open until today (Tuesday, 29 October). The price range for the shares has been established between ₹440 and ₹463. This IPO includes a fresh issuance of shares worth ₹1,250 crore and an offer for sale (OFS) totalling up to ₹4,180 crore by the promoter, Goswami Infratech Pvt Ltd. Currently, the promoter and associated entities possess a 99 percent ownership in Afcons Infrastructure, based in Maharashtra.

Stay tuned for more updates

Afcons Infrastructure IPO Day 3 Live Updates: Check Afcons Infrastructure IPO GMP

Afcons Infrastructure IPO GMP today is +40. This indicates Afcons Infrastructure share price was trading at a premium of ₹40 in the grey market, according to investorgain.com.

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Afcons Infrastructure share price is indicated at ₹503 apiece, which is 8.64% higher than the IPO price of ₹463.

Afcons Infrastructure IPO Day 3 Live Updates: The issue is a good long term investment, says SMIFS Ltd

The brokerage indicated that Afcons continued to deliver strong returns, achieving a ROE of 13.28% and a ROCE of 20.18% in FY24, reflecting solid profitability and effective use of capital. The brokerage advises subscribing to the issue as a favourable long-term investment, given the distinctive range of projects the company has engaged in, along with a robust order book and sensible valuations.

Afcons Infrastructure IPO Day 3 Live Updates: Arihant Capital Markets has a ‘Subscribe’ tag on the issue

“The company focuses on delivering high-quality services in road and marine projects while leveraging its market position in new geographies. It bring attention to sustainability and profitability by managing a recurring order book of high-margin specialized projects.

Company is also dedicated to optimizing costs while also enhancing its project delivery capabilities and capacity. At the upper band of ₹463, the issue is valued at a P/E ratio of 46.48x, based on a FY24 EPS of ₹9.96x . We are recommending a “Subscribe” for this issue,” the brokerage said.

Afcons Infrastructure IPO Day 3 Live Updates: Issue subscribed 60% on third bidding day so far

The initial public offer of Afcons Infrastructure IPO has been subscribed 60% on the third day of subscription today, at 10:18 IST, as per BSE data.

The initial share sale received bid for 5,18,63,520 shares against 8,66,19,950 shares on offer, at 10:18 IST, according to BSE.

The portion for retail investors received 42% subscription while the quota for non-institutional investors got subscribed 1.30 times. The qualified institutional buyers (QIBs) part is booked 37%. The employee portion has been subscribed 1.11 times.

Afcons Infrastructure IPO Day 3 Live Updates: The firm has expertise in complex infrastructure and strategic growth

The firm has a solid history of successfully managing intricate infrastructure initiatives across five key sectors: Marine & Industrial (8%), Surface Transport (10%), Urban Infrastructure (50%), Hydro & Underground (26%), and Oil & Gas (6%). Their capability to finish substantial projects punctually frequently leads to receiving performance bonuses.

Afcons Infrastructure IPO Day 3 Live Updates: Here’s all you need to know about the objectives of the issue

The company plans to allocate ₹80 crore from the net fresh issue proceeds for the purchase of construction equipment and ₹320 crore for long-term working capital requirements.

The company plans to allocate ₹600 crore for debt repayment, with the remaining IPO funds earmarked for general corporate purposes.

Afcons Infrastructure IPO Day 3 Live Updates: GEPL Capital recommends ‘subscribe’ to the issue

The brokerage indicates that the company boasts a strong order book surpassing ₹40,000 crore as of September 2024, mainly in the underground metro and rail industries. This provides solid earnings visibility for the next two to three quarters. The company’s strong relationships with clients, including long-term partnerships with Arcelor Mittal and Reliance Industries, bolster its competitive advantage.

Although capital-intensive operations and significant depreciation affect profit margins, the company has demonstrated substantial financial growth from FY22 to FY24, with revenues, EBITDA, and PAT experiencing CAGRs of 9.7%, 20.8%, and 12.1%, respectively. Consequently, the brokerage advises a “Subscribe” rating for the issue.

Afcons Infrastructure IPO Day 3 Live Updates: Key dates to know

Tentatively, Afcons Infrastructure IPO basis of allotment of shares will be finalised on Wednesday, October 30, and the company will initiate refunds on Thursday, October 31, while the shares will be credited to the demat account of allottees on the same day following refund. Afcons Infrastructure share price is likely to be listed on BSE and NSE on Monday, November 4.

View Full Image

Afcons Infrastructure IPO Day 3 Live Updates: Check out the IPO reservation details

Afcons Infrastructure IPO has reserved not more than 50% of the shares in the public issue for qualified institutional buyers (QIB), not less than 15% for non-institutional Institutional Investors (NII), and not less than 35% of the offer is reserved for retail investors. A discount of ₹44 per equity share is being offered to eligible employees.

Afcons Infrastructure IPO Day 3 Live Updates: Nirmal Bang has a ‘Neutral’ tag on the issue

The brokerage notes that while Afcons excels at managing large, complex projects, it has lagged behind its competitors in revenue growth, achieving a 10% CAGR from FY22 to FY24. In contrast, L&T, which is significantly larger than Afcons, has experienced much faster growth. Afcons maintains higher asset turnover than its rivals, leading to a better ROCE.

Although Afcons has a strong order book-to-sales ratio of 2.4x, the orders will take several years to complete. Afcons is currently priced at a 15% premium compared to the average of its peers based on P/E, which seems unjustified given Afcons’ slower growth. As a result, the brokerage has assigned a ‘NEUTRAL’ rating to the IPO.

Afcons Infrastructure IPO Day 3 Live Updates: Here’s what GMP indicates on third day of bidding

Afcons Infrastructure IPO GMP today is +40. This indicates Afcons Infrastructure share price was trading at a premium of ₹40 in the grey market, according to investorgain.com.

Considering the upper end of the IPO price band and the current premium in the grey market, the estimated listing price of Afcons Infrastructure share price is indicated at ₹503 apiece, which is 8.64% higher than the IPO price of ₹463.

According to the grey market activities observed over the last 31 sessions, the present GMP ( ₹40) indicates a downward trend. The lowest recorded GMP is ₹0, while the peak GMP is ₹225, as per the insights from investorgain.com experts.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decision.