It’s a seller’s market for infrastructure asset managers. Conventional and alternative investment firms are falling over themselves to expand in this lucrative area, and M&A is the easiest way for them to leapfrog the competition. Don’t expect high deal prices to act as a break. Consolidation into scale players just creates more pressure on smaller infrastructure managers to bulk up.

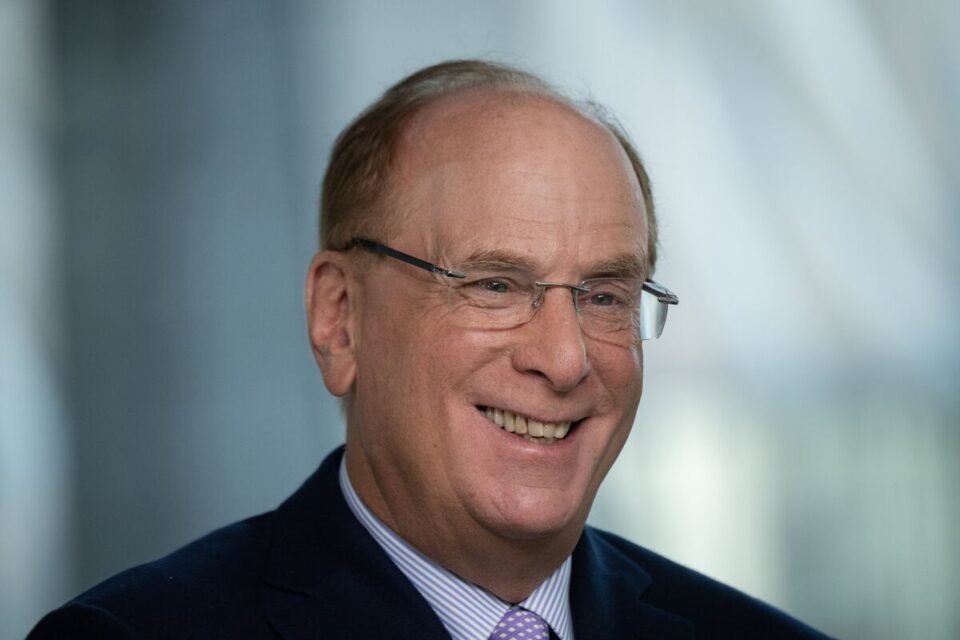

BlackRock Inc.’s agreement to buy Global Infrastructure Partners (GIP) for $12.5 billion earlier this month is the latest and most eye-catching transaction in the sector and follows recent smaller deals by CVC Capital Partners and others.